Bitcoin Core Fees Fall to Their Lowest in Years

Lower Fees, Lower Usage

It is no secret that the number of on-chain bitcoin core transactions, along with those of other blockchains, has dropped significantly since late 2017. This mirrors the decline in the valuation of bitcoin and most other digital assets during this timeframe. On December 14, almost half a million BTC transactions were recorded in a single day. By February, this figure was averaging below 200,000 a day. On April 24, the number peaked at 254,000, but has since declined, reaching a low of 158,000 on May 26, according to Bitinfocharts.com.

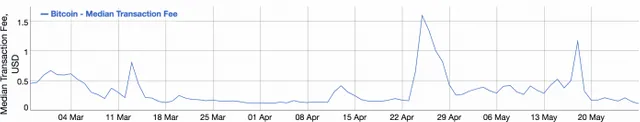

In early April, the median BTC transaction fee dropped to under 10 satoshis per byte before rising to almost 40 sats by the end of the month. As of yesterday, May 26, the median fee was back below 10 sats/byte once more. Median fees are taken as being a more useful metric than looking at average fees, for as Coinmetrics.io explains, “Median figures are generally much more informative for data like fees or transaction value since the data is normally extremely (positively) skewed”.

Bitcoin Core Fees Fall to Their Lowest in Years

The number of daily BTC transactions has been dropping

BCH Is Still 3x Cheaper Than BTC to Send

On May 24, the number of BTC transactions utilizing Segwit reached an all-time high of 38%. This will have contributed to reducing median fees, although many believe that Segwit’s role in doing so has been overstated, with one assessment pointing out the role that transaction batching has played in fee reduction.

Bitcoin Core Fees Fall to Their Lowest in Years

Median BTC fees are at their lowest in years

On the bitcoin cash network, fees reached their three-month low on April 2, hitting a median of $0.0018. They now stand at $0.0038 per transaction, a significant increase in the space of a month but still three times cheaper than bitcoin core, at $0.113. When fees are unusually low, shrewd BTC holders use the opportunity to consolidate their unspent transaction outputs (UTXOs). This is done by sending all of the dust in their wallet to a BTC address they control. That way, when bitcoin core fees inevitably rise again, they’ll be able to save money on fees because each transaction will contain less UTXOs, making it smaller and thus cheaper.

Do you think BTC fees will stay low, or is this just a temporary dip? Let us know in the comments section below.

Images courtesy of Shutterstock, Bitinfocharts.com, and Transactionfee.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Not smart my friend. Flagged for plagiarism @steemflagrewards

Source: https://cryptotelegraph.co/bitcoin-news/bitcoin-core-fees-fall-to-their-lowest-in-years/

Steem Flag Rewards mention comment has been approved! Thank you for reporting this abuse,@enforcer48 categorized as plagiarism. This post was submitted via our Discord Community channel. Check us out on the following link!

SFR Discord