Bitcoin Price Analysis: Long Time Trend, Fibonacci Retracements, and Price Expectation

Bitcoin's total market cap currently accounts for 40% of the crypto market's total value. However, the price movements in Bitcoin have an impact on the market beyond what this ratio indicates. The ten percent drop in Bitcoin on September 7 was an unpleasant surprise for the crypto market. Nowadays, confidence in the market is slowly coming back.

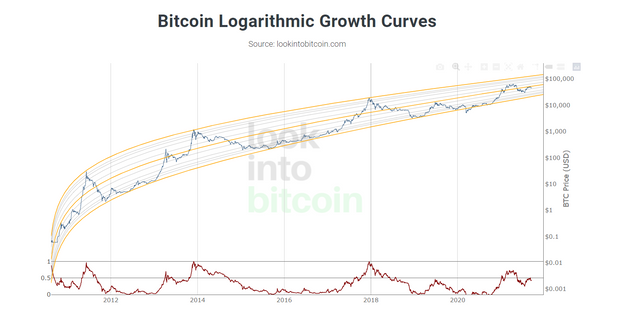

Numerous charts represent Bitcoin's long-term price action. My favorite model is shown below.

If we take the middle line of the trend channel as a base, the areas above and below the Bitcoin price chart do not become equal. That's why I prefer the line below the middle line for Bitcoin's fair value. If we take a closer look at the chart available at https://www.lookintobitcoin.com/charts, we see that we are slightly above fair value as of today.

So, where can the fluctuations that are shown in the chart take us? I did a Fibonacci retracement analysis for this. Fibonacci retracements are used to measure how far the price will retrace after a trend. Prices usually retrieve 50% or 61.8% of the level at which they rose or fell. 61.8% is also known as the golden ratio.

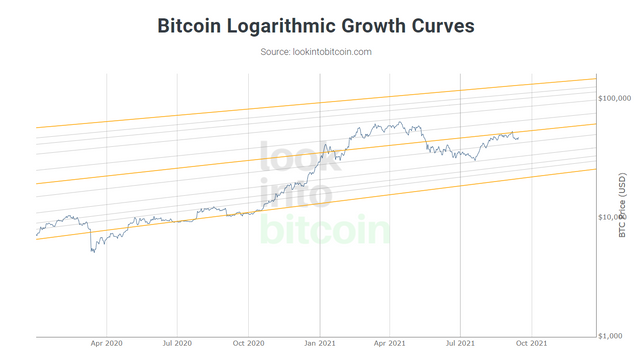

Bitcoin entered an upward trend when it was at the level of 10 thousand in October 2020 and reached 63 thousand levels on April 14, 2021. This uptrend resulted in a 61.8% pullback as seen in the chart below.

As a result of the downward trend between April 14, 2021, and July 20, 2021, the price of Bitcoin decreased to 29 thousand levels. The price rose again, this time with a 61.8% correction, to 53,000.

We have been in a consolidation period since September 7 and we wonder how much the correction can be. If the price corrections by 61.8% continue the Bitcoin price regress to the level of 38,500. However, after the two Fibonacci corrections, a third major correction may not be needed as the prices approached the fair value.

After assessing the historical movements of the price, let us try to predict future prices.

When we look at the weekly charts on Trandingview, we see a positive outlook on all technical indicators: https://www.tradingview.com/symbols/BTCUSD/technicals/

On the daily charts, the MACD is giving a sell signal, the RSI is just on the edge of 50 and the volume is not sufficient to confirm a new upward trend.

On the 4-hour charts, on the other hand, it is seen that the momentum and trading volume have turned positive with the effect of yesterday's price increase.

As technical indicators suggest, the picture is not clear. But as technicals for weekly charts are bright, I think these levels are suitable for medium and long-term investment.

The above-mentioned ideas are not investment advice. Likewise, although I am a former banker, I am not an investment advisor.

Thank you for reading.

Cover Image Source: https://unsplash.com/photos/W_K6j6OQBDg

!sbi status

Hi @muratkbesiroglu!

Structure of your total SBI vote value:

Take Control! Include

#sbi-skipin your text to have us skip any post or comment.