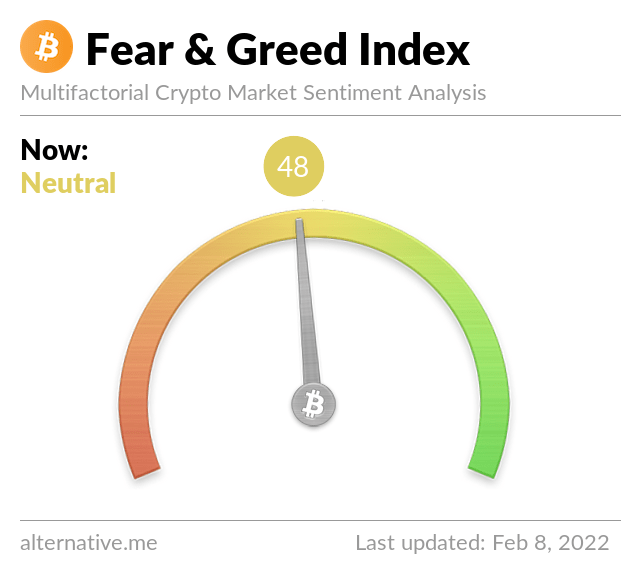

BITCOIN'S FEAR - GREED index at highest rate since november 2021

Bitcoin broke a 21-week downtrend after a newfound bullishness. At 48, the Bitcoin Fear and Greed Index is highest in three months depicting a significant shift in terms of market participants’ outlook.

After a choppy month that involved whales cashing out and taking profits, the cryptocurrency market rose to a collective valuation above $2 trillion. The market leader – Bitcoin, for one, tested the coveted $45k-level but failed to reclaim it.

The Bitcoin Fear and Greed Index essentially demonstrates overall market sentiment towards BTC by taking factors such as volatility, surveys, social media activity, dominance, and others into consideration.

On February 8th, the index climbed to 48 – a state of “neutral” after a period of almost three months when it was in a state of fear or extreme fear, according to Alternative.me.

The Fear and Greed Index had hit 45 on December 22nd, which was followed by Bitcoin noting a mild uptrend from $46k to $52k before taking multiple tumbles.

Since then, the index had mostly oscillated within the confines of “Fear” and “Extreme Fear.” The latest shift marks a reset in terms of sentiment, but the week’s bullishness, however, does not invalidate the possibility of a return to red.

The score does depict a sentiment of optimism among crypto traders and investors.

Bitcoin faced significant resistance in the $45k area. CryptoPotato had reported millions of shorts being liquidated as a result. The average funding rates remained low, meaning traders are cautious to avoid significant liquidations in the near term. The rally also comes with low volatility in the BTC options market.

In a recent Twitter thread, QCP Capital said that the prices of cryptocurrencies have surged despite NASDAQ trading lower towards the end of last week. However, it also asserted that this phenomenon does not necessarily mean that crypto has necessarily decoupled from NASDAQ, instead, it demonstrated the “tangible and targeted crypto demand right now.” The digital asset trading firm believes that the uptrend may continue:

“Given the absence of any significant macro events before the 17 February FOMC Minutes, we expect this upward momentum to continue.”

In the past few hours, however, the market has been correcting as BTC now hovers slightly above $43K.