1/13/2017 The Market View and Trading Outlook

Today will be quick. As stated yesterday, we are trending up for the short term future likely to the $16,000 range before we will either break down there and back to the bottom of the triangle around $13,800. Alternatively we could break through the upper triangle boundary nullifying its existence to around $18,000 indicative of this being a bear flag, which should then be followed by an extremely severe correction that could see sub $9,000 prices as it will then use downward momentum to break decisively through the $13,000 and lower.

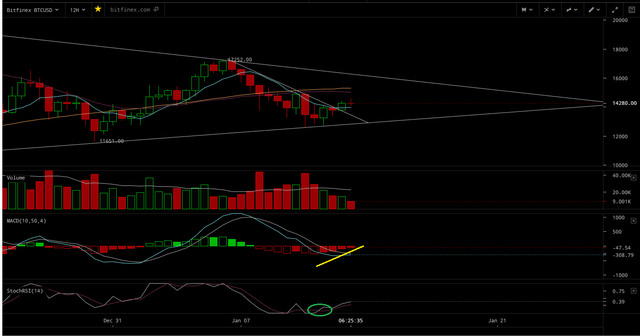

On the 12 the MACD histogram is still trending towards a buying period and we do have a somewhat solid RSI crossover from oversold territory. It looks as though the MACD/Signal line may cross as well but as of yet has not. I do not expect to get moving average confirmation from this time frame until it is headed back down from the top of the triangle due to the delay in moving averages. $15,000 will again be a key point of resistance as will the longer term 77. Quite honestly the moving averages and the fact that we may enter a buying period midway through the range of a potential triangle scare me as they may provide enough fuel to bring about an upper boundary break through and the manifestation of the bearish flag.

The six hour is looking considerably more bullish in the form of a positive MACD histogram, an RSI cross and MACD/Signal line cross. Although volume is not over the top, this is actually a good thing as one aspect of a bullish triangle is for volume to decrease to a near trickle as we reach the intersection. So in a perfect world I would like volume to drop to near nill as we get closer and closer to the intersection on January 28th. We are below MACD 0 but far enough below that we should gain a decent amount of upwards momentum in order to test the 0 line and hopefully fail just as we are reaching the upper boundaries of the potential bullish triangle.

The four hour is looking good as I stated yesterday when I suggested a buy. There is really little difference between this time period and the six. Both histograms are positive, however this one may be drawing to a close which I do not suspect will have a great affect on the price. We have three buy indicators thus far an RSI cross, MACD/Signal line cross and a 7/21 upside cross under the 77. That said expect resistance at the longer term 77 or $14,800.

The longer term two hour frame is looking mehh at the moment. I entered long shortly after the 7/21 upside cross at 1 p.m. on 1/12/18; nothing major 20 percent of capital on BTC and 30% on LTC at $222. I will slowly add or subtract as necessary, currently I am selling off a bit, dropped some at $14,440 and $249 based on what I think the two hour may do. That said and I may be wrong, I think the 2 hour will face resistance at the 77 just as the 1 hour did yesterday. The MACD histogram has this buying period potentially coming to an end and I think it will suffer a small rejection and push price to $14,000-ish and $242-$243-ish (maybe slightly lower on LTC but not below $239.50 I do not believe). The reason I am going with these numbers is that 2 hour price is trending below the longer term 77 ($14,490) but above the 21 at ($13,900) which will likely create a squeeze of price between the two as the range narrows. As momentum on the longer charts is to the upside price should pop above the 77 as these two get closer and closer together. My theory anyway and as I have already bought and sold, locked in some profit I can afford to take the gamble on it playing out and worst case, and either sell my remaining position if it heads down or buy in under my previous sell price if it plays out.

Also the charts and diagrams come from here: https://cryptowat.ch/bitfinex/btcusd/2h

I use these as they are free and you can use them to match my setting or create your own.

My Previous Analysis:

https://steemit.com/bitcoin/@pawsdog/1-12-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-11-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-10-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-9-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-8-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-5-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-4-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-3-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-2-2017-the-market-view-and-trading-outlook

waoooww !! what a great information you shared for bitcoin lovers <3 i think crypto is future <3 whats your opinion ?? by the way thank you for you hardwork on this post i appreciate you man :) keep in touch i am following you

Thank you for the comment I appreciate it..

I recently learn about cryptocurrency and from what I seem and read about it, it will continue to increase and decrease, but at a slow increasing state. Soon bitcoin will raise at higher expectations. continue the good work your doing!!

It may but markets are not cyclic they move in waves.... :)