As Max Keiser continues pumping Bitcoin, is he forgetting about the competition?

I bought some Bitcoin the other day. By the time I was done, I’d been murdered for transaction fees amounting to 12% of what I’d bought. I didn’t have much choice with how I did it all because I was in a rush, but this really got me thinking about how BTC can never really be used at scale, for business-to-business transactions in participial, because it’s just too expensive.

The other thing that’s caught my attention since the “bubble” in the BTC price made it to five-figures is the speed of verification: the Visa payments network can process over 50,000 transactions a second, orders of magnitude more than what BTC can handle. It’s been said by on one the IOTA founders that IOTA can run over 5,000.

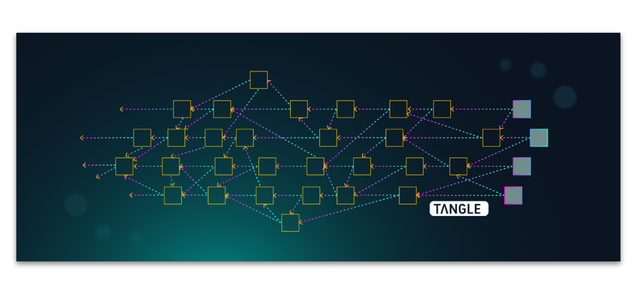

While I’ve not made my mind up about buying into IOTA in terms of investing in it, it sure has got my attention from a technological point of view. The whole concept of the The Tangle and the ledger being driven by a participatroy archietcture that gets better and mreo effieicent as it’s used is brilliant as it is, but the fact that this will then effectively eliminate transactions costs, and allow for minute payments to be sent too, is just a game changer in my view.

I know it’s early days, but if this new crypto-tech gets off the ground, BTC has a serious competitor on its hands. The scalability problems in the blockchain revolve around how the system runs peer to peer transactions. This relies on a lot of miners and nodes to verify the transactions. Decentralization of nodes and the number of transactions input into a block of transactions, mined every 10 minutes, is limited and this of course a good thing because there’s no single verifier with monopoly here. The main issue is that this just doesn’t scale in business sense.

The IOTA Tangle ledger solves all three of the scalability problems that exist with blockchain, namely:

- There’s are no third party miners to pay

- Maintaining the Directed Acyclic Graph (DAG) is not compute intensive so there is little capital or operating cost

- It’s dead fast!

There’s also some other very important features of The Tangle that make it very suitable for business transactions and being scalable. There’s no real cap on transaction size and transactions can be connected to each other arbitrarily. With blockchains being limited in the number of transactions that can be fit into a block (Bitcoin's blockchain can only handle about 5-6 transactions per second ) The Tangle is by nature a parallel processing system, making it as a minimum, theoretically superior to blockchain.

So while good old Max Keiser keeps telling everyone that BTC is on its way to 100 grand a coin as the dollar continues its hyper inflationary collapse against his favourite cryptocurrency, it’s probably worth keeping in mind that once IOTA is well understood in terms of its implementation and how it can eliminate parts of the cost of doing business, I would expect to see a pretty big flow of fiat, BTC and Ether into IOTA.

Let me know what you guys out there think?