Tsunami Conditions for Bitcoin: Preparing to Ride the Wave

As we watch the price of bitcoin and the other cryptocurrencies appear to plummet it's good to appreciate the opportunity for greater growth that is at hand. This could be called a tsunami condition for which, if we are properly prepared, great profits lie ahead.

Said profits would be the secondary benefit when large mass quantities of people migrate into this pace and adopt the new decentralized system as their standard value conveyance instrument.

While uncertainty prevails in advance of the UASF/BIP148 event on August 1, which can be causing some people to sell their positions (profit taking) as prices slide, it should be noted that the benefit that bitcoin provides and will provide, remains unchanged.

If anything, bitcoin will get even better, handling higher volumes and quicker confirmations, while providing the same protections that made it worth huge investment and caused its price to rise in the first place.

The usefulness of bitcoin has not changed: it will improve. As such, this is a great time to profit, even when the price is, at the moment, going down. Such profit is possible through cryptocurrency trading, if the organization is real.

Unfortunately, that may not be the case.

Solid Footing Among the Quicksand in Cryptoland

Since I entered the "cryptospace" I have been fascinated, attracted, and duped by a multitude of leveraging platforms that promise to multiply the value of your bitcoin investment in a set period of time, through a combination of trading and networking. Naive me and thousands of others were easy pickings as site after site raked in bitcoins, made early adopters a LOT, and then suddenly collapsed, which I call implosion. Whether intentional or not, these platforms, as configured and operated, were unsustainable.

It's not that trading doesn't produce profits. It does, even when the price is sliding. The decline that we're witnessing right now is great if you're involved with a real trading company.

It's also not that networking isn't profitable. While "network marketing" is a pejorative term in some circles, a system of referral commissions is used by a growing number businesses that are distributing their profits to a larger base: i.e., the people who are actually bringing them business.

So fortunately, I kept looking for investment leveraging platforms, seeking those that would provide better than conventional yields (not hard to do when "conventional" high-yield investments are 2.5% or so annually), and were not subject to sudden collapse syndrome, or implosion proof.

After I started doing videos about bitcoin and its significance on my YouTube channel earlier this year, a long-time subscriber, Mark, called to asked me about an accrual platform that I found and, as far as I could see, was promising, Wallet Pllus. He also told me of a platform that he was in, Trade Coin Club. It did not publish the same "guaranteed" returns as Wallet Pllus (3.3% daily, doubling in 60 days or less), but it had produced consistently and substantially enough for him and his friend to not need "jobs" and were free to travel the country, present to interested individuals and groups, and help them get started in this nascent economic culture.

A financial analyst, Mark eventually invested in Wallet Pllus as he had invested in Gladiacoin, and several others. However, he questioned their sustainability for several reasons. The lack of transparency (owners never revealing their names, where their operations were based, or even whether they actually traded), the promise of fixed daily percentages, and other factors, suggested that the chances were high they might not be around.

Trade Coin Club was a different animal; affiliated with the world's first licensed cryptocurrency trading company. Distributions are based on actual profits made, which vary from day to day. By Mark's calculations, daily profits generated in his 5 months in TCC have ranged from 0.7% to 3.2%. The overall average has been just under 1.5%.

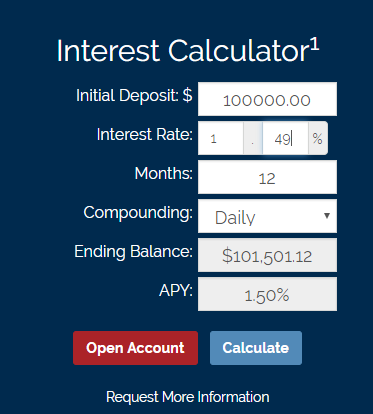

Using that average number into an indicator of potential net performance just from trading, we compare what would happen to $100,000 if invested in a conventional bank program, or placed in TCC's cryptocurrency trading program.

$100,000 at 1.5% APY

This calculation was taken from www.bankofinternet.com.

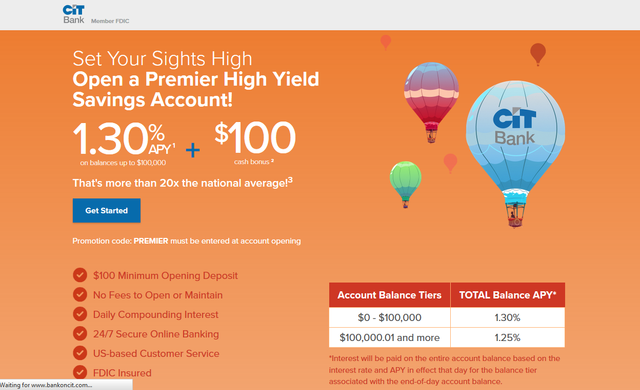

Here's an actual program offered by a bank. Over $100,000, the rate is actually lowered.

And this is 20x the national average?!

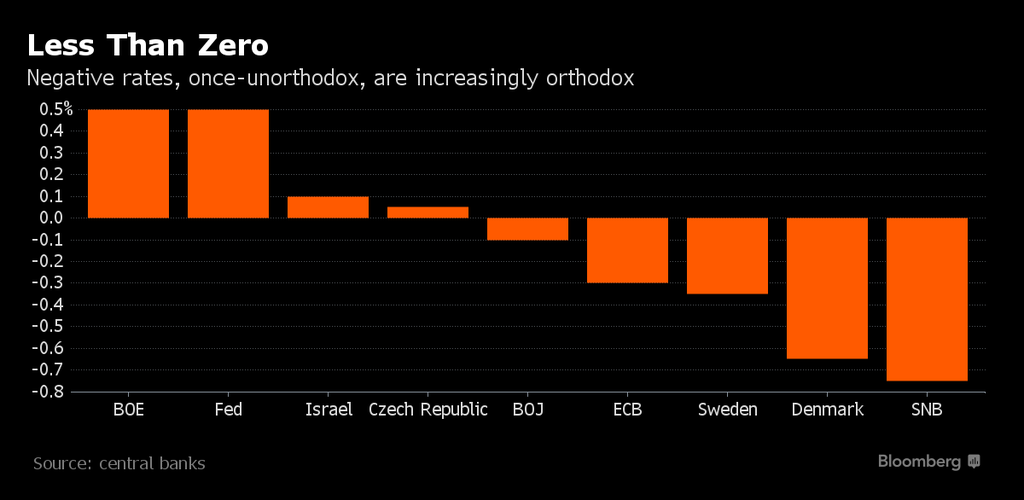

The reasons for the low yields (don't you love how they call these anemic yields high?) become more evident when you look at the prevailing interest rates at various banks around the world.

$100,000 at 1.5% daily (not compounded)

At 1.5% net daily profits from trading, $100,000 grows very nicely, to $491,500. However, when you take no cash withdrawals and roll your profits back into your principle ~ i.e., compounding ~ things get spectacular.

This calculation is taken from www.compoundaily.com.

In one year's time, $100,000 becomes $4,871,213.60, based on 5 trading days / week and a 1.5% average profit daily.

I wanted to experience this. I still do.

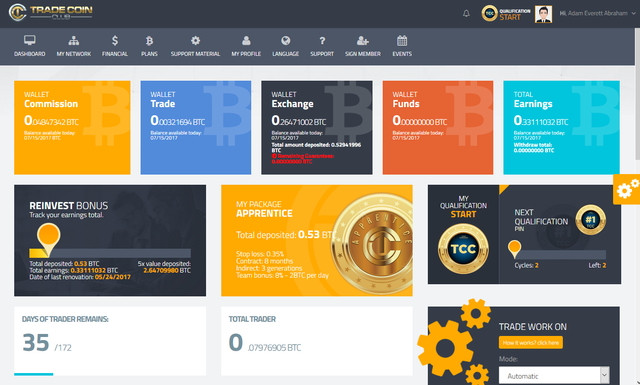

Mark did join me in Wallet Pllus. It imploded not too long thereafter. However, Mark's experience with, and comments about Trade Coin Club made sense too. I joined even before Wallet Pllus went down, starting at the Apprentice (less than 1 BTC). After 52 days in I'm happy to report that the "walking on eggshells" feeling has gone away. I spend time managing my assets, compounding my commissions and like my partners Mark and Dave, sharing about the bitcoin opportunity, and this platform that can one can use, in conjunction with networking, to substantially build what I now term, a PRIVATE RESERVE.

My referral link.

Contact me directly.

A look at my TCC back office. Gradually growing.

It was then that I then began to appreciate how TCC 's transparency and organizational differences made implosion unlikely. In addition to profits from trading, TCC members benefit by sharing the Club with others. Commissions and bonuses are disbursed in several ways that build substantial, sustainable active and passive income.

Sustainability of a platform is as important, if not more so, than yield. I have invested in accrual platforms that produced very high yields, but quickly imploded. We can say that I should have known, but with 95% of the population still unaware of what a bitcoin wallet is, much less how to navigate in the cryptosphere, there's no way to stop a person from getting their own experience of what is true.

Tsunami Time

With prices going down at the moment, more people are going to learn about bitcoin. More will be watching, particularly as the August 1 event comes and goes. Barring geopolitical craziness on other fronts, bitcoin will surely be around after August 1. As the dust settles, whatever value that is lost during that time will be regained, and a faster, more efficient, and just as secure bitcoin will break the price point that it flirted with several weeks ago, leaving it in the dust.

We have been given a hint of the future. We are now in tsunami watch conditions, where the tide is momentarily receding. But when it comes in, it's best we be prepared, because people will rush in too, driving the price/value to heights long projected, often dismissed.

While I will continue to evaluate other leverage platforms, Trade Coin Club is one that is built to help members build their PRIVATE RESERVE in the tsunami that is brewing.

TODAY I will host a Zoomcast webinar to discuss BUILDING a PRIVATE RESERVE. My guest will be John Reilly, who joined Trade Coin Club when it began operations around the same time as Gladiacoin. He has profited significantly through his membership, so much that he has become a member of the company's Board of Directors.

Please join us!

Topic: Building (or Re-building) Your PRIVATE RESERVE with John Reilly and Trade Coin Club

Time: Jul 15, 2017 3:30 PM Pacific Time (US and Canada)

DESCRIPTION

The bind and "rat race" that tens of millions of people find themselves in can be traced directly to the effective way our society has separated the individual from their sense of self-worth or value, and transferred it to an instrument of exchange called "money".

The objectification of money as an instrument for conveying exchanges of value between people, has made it subject to manipulation by its controllers and owners, so that the value associated with it progressively diminishes, leaving many chronically SHORT of available RESERVES to meet their obligations or needs, or to implement projects or initiatives. This leads to people going to lending institutions, part of the organization that controls "money", to apply for loans.

Because money is controlled and no other options are available, the bulk of society has been tightly constrained. That is, until the introduction and maturation of BITCOIN.

The encrypted and decentralized nature of bitcoin is such that it facilitates exchanges of value between people, while protecting the RECORD from intrusion or alteration. The value of these qualities, demonstrated over the years, have translated into added value for each "bitcoin" or fraction thereof, which actually have no physical basis.

In this Zoomcast, part of an ongoing series, we will introduce the concept of building a PRIVATE RESERVE, why it is important to individuals and their families. Our special guest is John Reilly, a leading earner in Trade Coin Club, and newly appointed to the company's Board of Directors. He will share his experience building his PRIVATE RESERVE with TCC, and answer questions regarding the company's sustainability, given so many other platforms that have come and gone with investors' funds.

Join from PC, Mac, Linux, iOS or Android: https://zoom.us/j/861854717

Or iPhone one-tap (US Toll): +16465588656,,861854717# or +14086380968,,861854717#

Or Telephone:

Dial: +1 646 558 8656 (US Toll) or +1 408 638 0968 (US Toll)

Meeting ID: 861 854 717

International numbers available: https://zoom.us/zoomconference?m=eP9H0_3aUj_Hh8GGEBQgecIzzoX2CHGZ

Growth since beginning of the year was above all expectations and a correction after this several 100% run is more then healthy. Bitcoin will be fine in a bit and it´s a good chance to get some more for a good price, now or in a bit. Especially ETH is promising a solid technical base for further blockchain innovations to come.. Hold, buy more and be patient!

Well said!