BTC Bitcoin - Feb 5 - 3AM Update - Elliot Wave Arguments, Deduction, Targets, Bull and BEAR Scenario

Short Term Target. The Rest is Unknown

We find Support at $7,800 regions where it is constantly rejected at the trend line support

EXTREMELY IN-DEPTH ANALYSIS

Long Term Bias (6+ months) - Bullish

Medium Term Bias (Weeks) - Bullish

Short Term Bias (Today) - Neutral (Maybe Neutral to Bullish

Long Term Target Prediction - $30,000+ by 2019

Short Term Bear View - $7000-$7500

Short Term Bull View - $8500-$9500

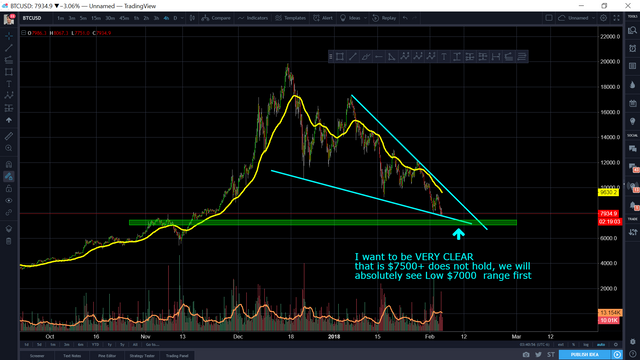

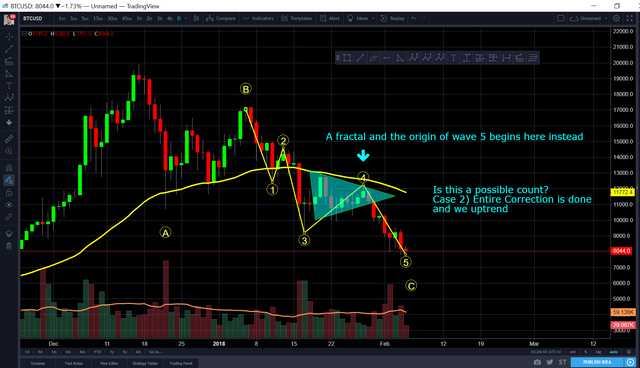

On the big picture, we notice a massive wedge, where the bulls and bears eventually reach a critical apex and one ends up giving up.

I want to be VERY CLEAR that if my support Near $7500 range does not hold, we will without certainty trend to lower $7,000 ranges first.

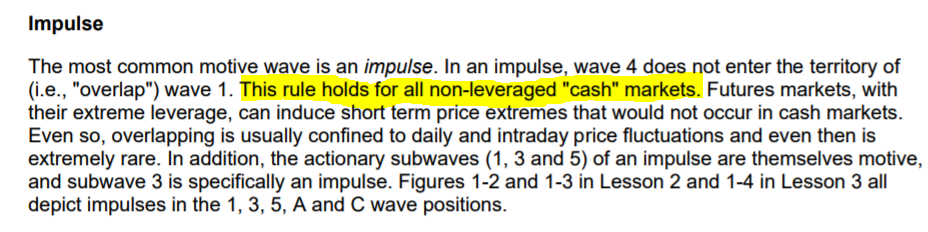

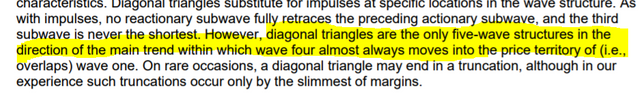

I'd also like to state formally about, "wave 4 cannot overlap wave 1 territory," has many sub rules that must be followed and is important to consider. Here are a few shown and there are dozens more.

This is the my main count which seems clean in price action and magnitude.

Case two is not as likely to me as I would consider above the correct count for the origin of the final wave. Though I must state it regardless.

Therefore, based on the defense constantly of the bulls @ $7,800 range, and the mentions in the video, also assuming $7,500 holds, I'm led to believe that $8,500 is our first target at the trend line resistance. The rest is unknown and to be determined

Always be cautious, take high probability trades, plan entries and exits, stick to high reward low risk R:R setups. Good luck traders

Tutorial Series

Lesson 1 - Bitfinex Tutorial - How to Customize and Set Up Bitfinex

Lesson 2 - How to Analyze Candlesticks Charts with Strategy

Lesson 3 - Moving Averages

Lesson 4 - Relative Strength Index RSI with Advanced Strategy

Lesson 5 - MACD and Histogram

Lesson 6 - Margin Trading Long, Short, Leveraging

Lesson 7 - Basic Risk Management

Lesson 8 - Fibonacci Retracement Part 1

Lesson 9 - Fibonacci Extension Part 2

Lesson 10 - Laddering

Lesson 11 - How To Interpret Time Frames

Lesson 12 - Swing Trading Advanced 55 EMA Strategy

Lesson 13 - Introduction To Elliot Wave Theory

Lesson 14 - Using a Basic Excel Tracker for Risk Management

Lesson 15 - Automatic Stop Sell/Buy Executions

Lesson 16 - Advanced 55 EMA Strategy with Time Frames and MACD Part 2

Lesson 17 - 6 Hours Live Trade Scalping. Growing $2,000 Account into $3,500

Twitter - https://twitter.com/PhilakoneCrypto

Youtube - https://www.youtube.com/user/philakone1

If I've helped you, consider buying Luna and myself a beer

BTC address: 1PruhmsYXU2gPkNw574xZSMyBG4YW5Wnq9

Ethereum: 0x2538b728f9682fc1dc2e7db8129730f661753850

LTC: LPeaZpGiF3XdCw5XPN7LXztDagTEZAMgYd

Bitcoin Cash: 1AY2FPANCe5URB71Nvy6tkCgoTS8iHgmZD

The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization.

DISCLAIMER:

Legal stuff here. I'm not financial advisor. This is just my opinion that I'm sharing with the community. All information is for yours to process how you wish.

Hey philakonecrypto, where do you get the short/long positions chart. Ive looked on tradingview and nothing. I found one chart on bxdata but its 2 weeks behind??

Great vidz by the way, it fills me with hope when even bears like you are seeing a bottom is near :)

No reply? :((((((((((

Learning a whole bunch from you. All your posts, tweets, and videos help tremendously. To be a trader we must learn to think like one.

Really appreciate this and it’s amazing to see how you decipher these graphs

glad you're enjoying it! :) :)

Thanks for the fast updates!

Had to get it. Stuck in my head on replay until it's solved.

Love your enthusiasm. Appreciate your analysis

I'm tired in this video :( My pleasure my friend.

Just in case you weren't joking . Here is Bitcoin address 1Q6HakEhBuDZ8dEZ8RUEdGU1x9hnZVuoJT

<3

Giggle

Great work.. Thanks

great work, you made me smile

wish I'd followed you before I lost most of my money :)))

People should stop looking at the BTC/dollar value. You bought coins (BTC or alts) and you still have those coins. Rigth now you shouldnt look too much and wait until this bear market is over and that can take long! Longer then you want it to take and longer then you expect it to take.

Eventually we will go up again and you can start looking at the BTC/dollar value again in case you want to sell and make profit.

What is happening now ....happens in all markets and people with patience will be the winners!

Good luck!

Just love your TA videos. Highly detailed and with proper reasons for your thoughts rather than difficult rhetoric. Very leased I stumbled across your channel on YouTube and can't wait to get stuck into your tutorials. With the market the way it is it's very easy to think we should be selling but things like this help me keep on track. Thanks.