Bitcoin Price Continues Downward Trend, Dips Below $6,600 - Trend News

Bitcoin Price Continues Downward Trend, Dips Below $6,600 - Trend News

After a meteoric rise in value in the past 30 days, the bitcoin price has endured a major correction as it dropped from $7,500 to $6,550.

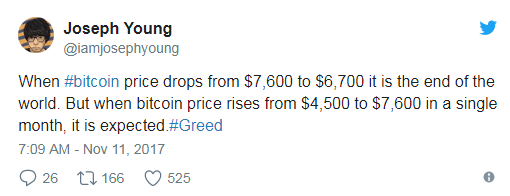

Before delving into the analysis of the downward trend and the recent decline in the price of bitcoin, it is important to acknowledge that the price of bitcoin has increased from around $4,500 to $7,500 within a single month.

Even with the recent major correction, the bitcoin price has recorded a 29.2 percent monthly increase and investors are overly concerned with the short-term price trend of bitcoin. Many analysts have predicted the price of bitcoin to plunge either after the cancellation or execution of SegWit2x, as B2X dividend expecting investors reallocate their funds from bitcoin to other cryptocurrencies.

Such trend has been evident in the decline in the bitcoin dominance index, which dropped from over 62 percent to 55.1 percent. Hence, a major correction on bitcoin has been long over due, considering the rapid increase in its price in a relatively short period and the SegWit2x hard fork.

Is Frustration of High Fees Pushing Users to Bitcoin Cash?

Several experts and investors have claimed that the high fees of bitcoin and the cancellation of SegWit2x are pushing existing bitcoin users to migrate to Bitcoin Cash, which has a flexible block size limit and therefore, larger on-chain capacity than bitcoin.

The price of Bitcoin Cash did breach the $1,000 mark earlier today, but the increase in the value of Bitcoin Cash also seems slightly inorganic, given its 20 percent increase in value for three days straight. More importantly, the Bitcoin Cash market is heavily concentrated in South Korea, with three major South Korean trading platforms accounting for around 53 percent of Bitcoin Cash trading.

The rest of the trading volumes are composed of Bitcoin Cash-to-USD trades, not Bitcoin-to-Bitcoin Cash trades. Thus, it is too early to claim that bitcoin users frustrated with high fees are moving to Bitcoin Cash.

While the abovementinoed claim is far fetched, it is notable that the mempool size of bitcoin has risen to 100 million bytes for the first time since June. With the mempool, the holding area for unconfirmed transactions, overloaded with bitcoin transactions, users are likely to be recommended to attach higher fees than usual by wallet platforms.

Peter Todd, a Bitcoin Core developer, further emphasized that it is crucial not to oversell bitcoin, as fees will likely remain high in the long-term, after the adoption of SegWit.

https://twitter.com/petertoddbtc/status/928908080296816640

Positive Indicators to Expect

At this point, it is too early to justify the recent correction of the bitcoin price as the movement of users from bitcoin to Bitcoin Cash, given that Bitcoin Cash will also very likely suffer a correction after its exponential increase in value in the past few days.

The drop from $7,500 to $6,600 could have been caused by two major factors: sell-off of SegWit2x expecting investors and the market’s correction after bitcoin’s strong short-term price rally.

If it is the latter, then the bitcoin price will be able to recover in the upcoming weeks. With CME Group and other major institutions planning the integration of bitcoin and launch of bitcoin futures exchanges, a “herd of institutional investors,” as billionaire Mike Novogratz explained, could soon enter the bitcoin space.

Featured image from Shutterstock.

Nice Post... Follow Me And Upvote My Post

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptocurrencywatchgroup.com/press-release-2/bitcoin-price-continues/