Fractional Reserve Banking in Cryptocurrencies

Fractional Reserve Banking is the single biggest cause for global poverty in the world. There is nothing that is more destructive for the economy than to print up money out of thin air and to lend it at high interest. What has been eroding the fiat currencies since the Bretton-Woods system and even before, could come to Cryptocurrencies as well.

What is Fractional Reserve Banking

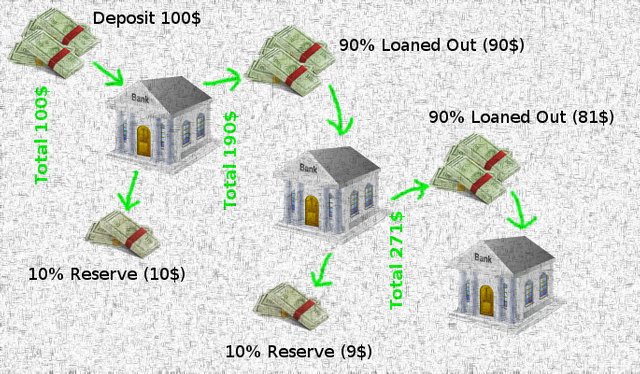

Fractional Reserve Banking is a financial practice to keep only a fraction of the assets in a bank, while lending out the rest. This way the money is double-accounted, and it's both lent out, and both inside the checking account of the bank client. Normally this would work, but it breaks down when the user tries to withdraw his money, banks have to scramble to the central bank to lend them emergency money, sort of called "liquidity injection" , this is the sort of liquidity crisis the banks are talking about.

While also the lent out money, can be deposited again in another bank, and lent out again, this creates an avalanche effect, and banks keep piling up more and more debt, while the risk of bank run, grows. Essentially with a 10% reserve rate, the bank can only pay out 10% of their clients, while their debt keeps growing.

I suggest you Mike Maloney's video for a more easy and visual explanation, but in short this is what happens, commercial banks print up more money via fractional reserve lending than a central bank, and it's all visible in the M1/M2 statistics:

It's a giant Ponzi Scheme technically, but it's backstopped by endless money injection, liquidity injection, by central banks. So it won't go bust, and will probably end in hyperinflation: Venezuela.

So when you see on TV "economists" talking about banks need liquidity injection, they are actually referring to what I told you above.

Should we worry about FRB in Cryptocurrencies?

Short answer: NO. In fact it's a little bit more complicated, and we have to rely on people to be educated, so if people were to read for example this article, then it might be impossible to create a systematic FRB for Cryptocurrencies, but it might happen locally, in smaller scale, but those instances would be isolated?

What's stopping FRB?

We should use Bitcoin for example, I am pretty sure Bitcoin is very defended against it.

- There is no Central Bank in Bitcoin

- It's public & digital and transaction can be verified

- Most coins are held in private wallets

These are the 3 reasons why FRB is unlikely or next to impossible in Cryptocurrencies. Now exchanges might still run on FRB, and some people allegedly say MTGOX did it, in fact there are multiple allegations against existing exchange giants that they might be dishonest with their accounting. It's totally possible, unless they go under a strict audit and they publicly show their reserves, both on their accounting statements & their Bitcoin wallets, then this could be a risk.

But even then the event is isolated, if an exchange runs on fractional reserves, and they implode, they will take the funds of their clients with it, but not the entire network. And people will have to learn the hard way to be more careful with their money. This is how risk works.

In fact Bitfinex allegedly could have been on fractional reserves, and the whole hacker thing could have allegedly been an inside job to balance the books. We shall never know until an investigation takes place, but nontheless, the risk is always there.

The point is that, without a central bank, printing money and injecting it into the Ponzi Scheme, the Ponzi Scheme implodes very quickly. The only reason FRB exists for 100 years, is that the central banks devalue the currency. Since Bitcoin's supply growth is not 0, but it's strictly enforced by the coin halving protocol, FRB is next to impossible to be systematic.

It could be local though, many scam exchanges, wallet providers could do it, but the lesson is for people to keep their money in their own wallets, not at 3rd parties, or atleast demand strict public audit from your custodian.

The solution

Apart from educating people about the risk of holding money in different forms and at different places, people should strive towards decentralization, and elimination of the middlemen. The middleman is not just an inconvenience, but also a big risk.

- Exchange models like: @shapeshiftio are very good, since they don't store your coins longterm

- Completely decentralized exchanges http://bitsquare.io could be the next step too

- For wallets, just make sure that you control the coins, the private keys, and you are the sole owner of it.

Remember a secret is only a secret if 1 person knows about it, if you share your wallet with others, it's not yours anymore!

This is a brilliant post. Upvoted and deserving of a share on twitter. Thanks. Stephen

https://twitter.com/StephenPKendal/status/795398139603800067

Disclaimer: I am just a bot trying to be helpful.

Thanks Stephen, thanks for reading, you are a very active reader of my articles.

You are very welcome. You write some great articles. I am interested in reading anything to do with: Blockchain, Social Media, Economics, Markets, Currencies, Bitcoin, CryptoCurrencies, Debt, Global Trade, Democracy, Stock Markets, Economies, Technical Analysis, Gold, Silver, Steemit, Trends, Stats, Finance, News, Beyond Bitcoin. Keep up the great work. Cheers. Stephen

Here is another interesting one:

https://steemit.com/money/@profitgenerator/how-much-inflation-is-there-really-100-sp

Nice post. Thanks to @ramta for resteeming. upvoted, followed, reseeemed.

Greetings from the cold and rainy town of Munich.

This post has been linked to from another place on Steem.

Advanced Steem Metrics Report for 6th November 2016 by @ontofractal

The Daily Tribune: Most Undervalued Posts of Nov 07 - Part I by @screenname

Faucet #1 - ReSteem & Earn 0.1 STEEM! by @earnsteem

This post has also been linked to from Reddit.

Learn more about and upvote to support linkback bot v0.5. Flag this comment if you don't want the bot to continue posting linkbacks for your posts.

Built by @ontofractal

Hei Hei @ramta hvordan gar det ?? Nice post could not agree with you more on this subject !! Currency held in a privately owned decentralised manner with a community watching over it is by far the best solution to value based currencies of any nature. Why the success of Bitcoin as people do see it as a secure and personally controllable asset ! Upvoted and resteemed ! ps I am in Frederikstad finally would be nice if you had time to meet up ) let me know if that could be possible !! )