Rational Decision Making in ICOs

I've noticed an uptick in Twitter personalities criticizing ICOs and ICO investors lately. It's easy to empathize: bitcoin and ethereum went from being niche technology (an "underground nerd thing" according to u/EvoFume on r/ethtrader) to THE NEXT BIG WAY TO GET RICH!

While nobody is complaining about their capital accumulation after 2017's historic bull run, the crowd in this space has certainly changed. This is only natural: if you want to get people-normal ones at that-interested in using the tech, you're going to have to deal with the "newbies". And the noobs are going to make a lot of racket and change the game.

Such is life.

So, what I see on Twitter is a lot of "get off my lawn" earlier adopters who mock ICOs and seem to throw shade on those who invest in them.

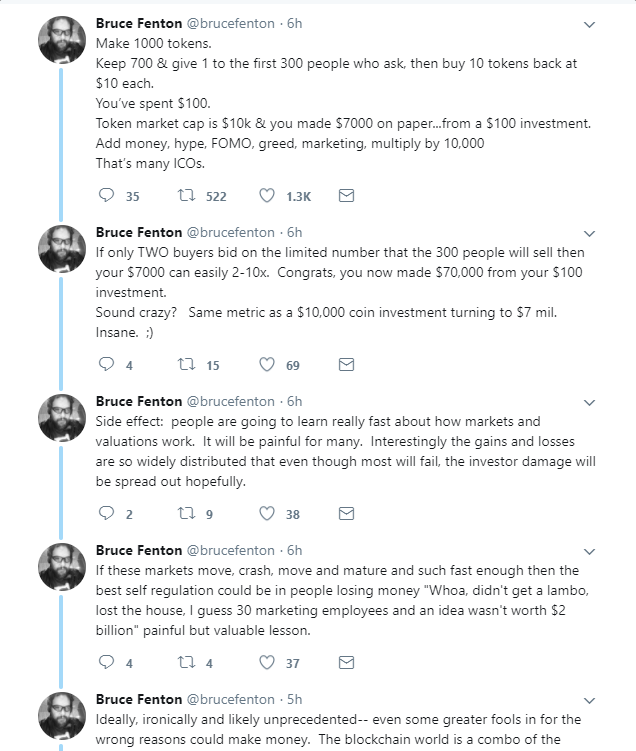

This is a good thread, and Bruce is worth following, but he's only partially right.

Insane ICO Investing is Rational

Sometimes, in cases of short term flipping, fundamentals don't matter. Here's the problem: a good number of ICOs in the past year made over 100x returns. Some, like ETH, returned over 1000x. You could turn $100 into $100,000 by just holding ETH since late 2015.

Furthermore, the penny stock mentality has made coins with very little active development rocket upwards as people seem to prefer holding whole tokens more than fractions.

It's irrational with regards to fundamentals, but human psychology creates situations where "dumb decisions" make money.

Why the Poker Book?

I got into poker in the late 90's, and the first book I bought was the bible for any "serious" player: Hold 'Em Poker for Advanced Players by Sklansky and Malmuth. This book was painstakingly researched, with odds calculations, acceptable starting hands, positional strategy, and so much more information. You bought this book, memorized it, then cruised on down to the local card room ready to play according to the rules you learned from the Masters.

Here's the problem I found: my local card players at the $2-$4 tables weren't playing the same sort of game that S&M described. They were playing loose, wild games where 7-2 offsuit was just as commonly seen as pocket Aces (AA..get it now?).

Lee Jones understood this and wrote the great How to Win at Low Limit Hold 'Em for these games. This book helped aspiring players learn how to change their approach to a game with consistently high numbers of players after the flop...something often seen in low limit games.

What in the World Does This Have to do with Crypto???

We're in the "Winning at Low Limit Crypto" phase of this game. Tons of new players are in the crypto game. Many of these ICOs are junk coins. And yet, it is rational to buy into them when the historical record is insane returns. The market is not irrational; the market is reflecting hundreds of thousands (millions) of individuals who have realized that $100 can turn into five or six figures fairly easily. The vast majority know this is a game that is going to last only a short time, and that smart capital allocation can change their lives.

(Incidentally, I have yet to see one ICO I think is worth investing in this year. I may or may not buy into some, although I feel like the best returns are behind us. As I said in my last post, I intend to only buy what I can afford from my delegated steem income, rather than touch my ETH stack this year. Taxes stink, and I'd rather not give Uncle Sam a free ride on my sweat and risk.)

So, rather than look down disdainfully upon the "noobs" and their reckless ICO buying, let's welcome them into the community and try to share best practices, and not be too judgmental when some of them buy into what turns out to be a real garbage coin. Personally, I put all of my ETH into The DAO a couple years ago...so who am I to judge[1]?

-Jeff

[1] This is meant for entertainment and maybe education, but certainly NOT investment advice. Thanks for reading.

Texas HODLem

Oh man, I wish I had thought of that!

For next time :)

Followed.

I see what your saying, but with dozens of ICO's each week and all of them touting themselves as The Next Bitcoin, I tend to dismiss them especially when they can only be traded on secondary or tertiary markets. So hard to trust a flooded market.

Absolutely agree. But one can still make money by ignoring the "rules" sometimes.

It's knowing when to ignore them that is important.

Agreed, what bothers me though is when I try to warn people about a scam ICO ad in Facebook they laugh you off even when you provide them with evidence. Thankfully Facebook has started to regulate ICO related ads.

Yes, but I think they are regulating ALL crypto related ads, which is hurting my book sales!

really nice article thanks for share