LEARN "ICHIMOKU" STEP BY STEP WITH BEST EXPLANATION AND GRAPH

The Ichimoku Cloud indicator is an all-in-one indicator that presents statistics about support/ resistance, trend route and momentum all at the equal time. The Ichimoku indicator is a powerful buying and selling tool, but many merchants sense overwhelmed when looking at all the strains and information that the indicator offers them and then regularly misread the Ichimoku signals. In this article, we will dissect the tool and show you step by step how to use the Ichimoku indicator to make trading decisions.

First step: taking the indicator apart

The Ichimoku indicator is made up of 2 distinct components:

The Conversion and Base lines: Those seem to be like transferring averages on your charts, however they are no longer as we will see

The Ichimoku Cloud: The Cloud is the most famous element of the indicator due to the fact it stands out the most.

Please word that I am focusing on the momentum and trend-following components of the Ichimoku indicator for this article. The lagging span of the Ichimoku is left out by using preference considering the fact that it does now not add a whole lot value.

We will now take a look at every thing in my view and then put it all together to help you find higher alternate signals.

Conversion and Base Lines

As I stated earlier, that the Conversion and Base traces appear like moving averages on your charts, however they do some thing different. The Conversion and the Base traces show the center of the 9 and the 26 duration high and low. This skill that they look returned 9 and 26 periods (candles), take the easiest and the lowest price tiers at some stage in that length and then plot the line in the middle of that range.

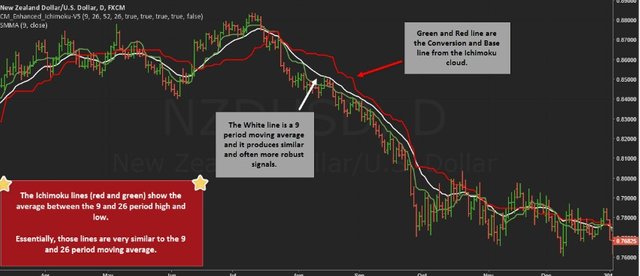

In the screenshot below, the green and the crimson line are the Ichimoku Base and Conversion lines. For comparison, I also plotted a 9 period transferring common in white on the chart; the shifting average is very similar to the Conversion line, but does no longer healthy it 100%.

Tenkan Sen / Conversion Line: The middle of the 9-period excessive and low

Kijun Sen / Base Line: The center of the 26-period excessive and low

Conversion and Base lines alerts and meaning

The Conversion and Base strains have two purposes: first, they act as aid and resistance throughout trends, just like shifting averages. Secondly, they provide momentum information. When rate is trading above the two lines and when the Conversion line is above the Base line, it signals bullish momentum. This is additionally very comparable to shifting averages: when the shorter transferring average crosses above the longer transferring average, it capability that momentum is up and rising.

- Base and Conversion traces act as support and resistance at some point of trends

- Only take purchase trades when charge is above the two strains and promote trades when rate is beneath the two lines

- A cross of the two traces confirms momentum When the shorter line moves above the longer-term line, it means rising bullish momentum (and vice versa)

- When fee strikes above the two lines, it confirms the momentum

The Ichimoku Cloud

The Ichimoku Cloud is made up of a lower and an upper boundary and the house in between the two strains is then regularly shaded both inexperienced or red. Let’s discover what this means.

The first and faster shifting boundary of the Cloud is the common between the Conversion and the Base lines. The second, slower moving boundary is the center between the fifty two period excessive and low. An essential attribute of the Cloud is that it is projected 26 intervals into the future.

Again, in the screenshot below we plotted two everyday shifting averages subsequent to the Cloud and used an offset of 26 (shift the transferring averages into the future). You can see that the moving averages are nearly same to the Ichimoku Cloud.

Seknou A – faster moving boundary: The center between Conversion and Base Line

Senkou B – slower transferring boundary: The middle between the 52-period excessive and low

Important: The Cloud is shifted 26 periods into the future

Ichimoku Cloud indicators and meaning

The frequent concept at the back of the Cloud is very similar to the Conversion and Base traces seeing that the two boundaries are based totally on the equal premises. First, the Cloud acts as assist and resistance and it additionally gives trend course and momentum information. But for the reason that the Cloud uses a 52 length aspect (as antagonistic to 9 and 26), it moves slower than the Conversion and Base lines.

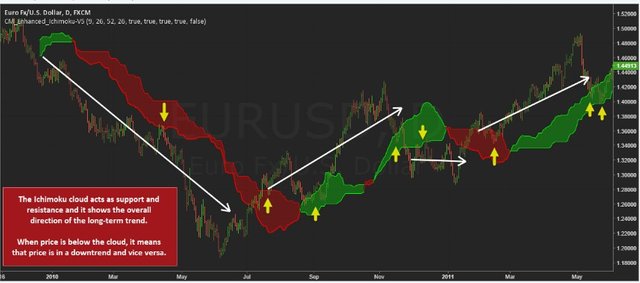

Basically, the Cloud confirms an uptrend when price is above the Cloud and a downtrend when charge is under the Cloud. The space within the Cloud is a noise sector and buying and selling here be avoided. A rally is bolstered when the Cloud is inexperienced and a sturdy downtrend is proven by a purple Cloud.

The Cloud, thus, is a way to change with the longer term style and we can sum up our findings as follow:

- Trend-following trading based on which facet of the Cloud rate is

- The Cloud acts as support and resistance in the course of trends

- It’s a noise sector when fee is in the Cloud

The Signals – how to use the Ichimoku indicator to find trades

Now that we have a strong perception of what the person components do and what their alerts and meanings are, we can take a appear at how to use the Ichimoku indicator to analyze fee charts and produce buying and selling signals.

1 The Cloud: lengthy term trend, resistance and color

With the help of the Ichimoku Cloud, merchants can without problems filter between longer time period up and down trends. When price is under the Cloud, it reinforces the downtrend and vice versa. During robust trends, the Cloud additionally acts as assist and resistance boundaries and you can see from the screenshot below how fee saved rejecting the Cloud at some point of the fashion waves.

Thus, the Cloud is perfect when it comes to filtering between bullish and bearish market phases. However, as most momentum indicators, the Ichimoku Cloud loses its validity throughout vary markets.

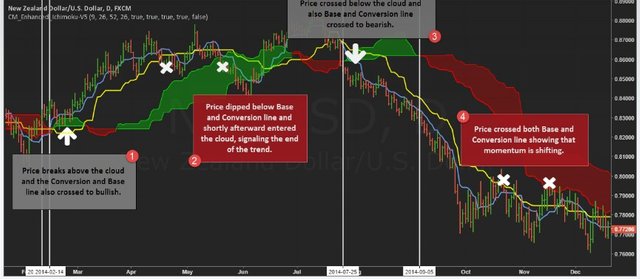

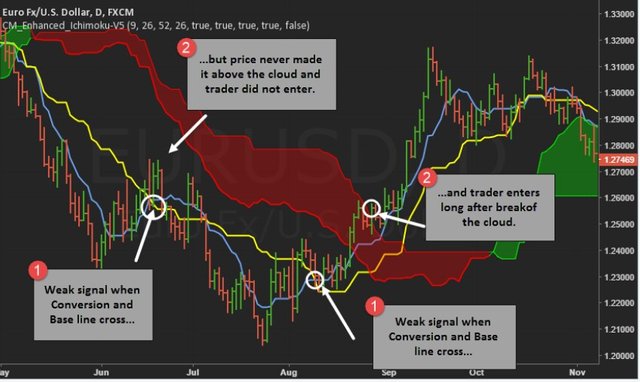

2 The faster Conversion and Base lines signals

The Conversion and Base strains are the fastest shifting element of the Ichimoku indicator and they provide early momentum signals. In the screenshot beneath we marked exclusive factors with the numbers 1 to four and we will now go thru them to recognize how to use the Conversion and Base lines:

The Conversion line crosses above the Base line which is a bullish signal. At that time, charge was also trading above each traces which confirms the bullishness. Price dipped back into the Cloud for a moment, but discovered support. This ought to have been seen as an entry.

Price started out to violate the Base line (yellow) which is a warning signal of a vogue shift. The Conversion and Base strains additionally crossed into a bearish setup, in addition confirming the momentum shift. Finally, fee entered the Cloud validating the change.

Price strongly crossed beneath the Conversion and Base strains and the Conversion line also crossed the Base line; both are bearish signals. At the same time, price was buying and selling beneath the Cloud. All those signals affirm a strong downtrend and could have been used as a promote entry.

Price commenced to violate the slower Base line which is an early warning signal. Then, the Conversion and Base lines stored crossing each other, which similarly proven that momentum was once shifting. Eventually, momentum died off and fee consolidated sideways.

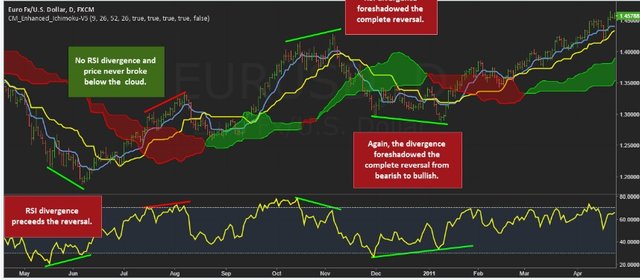

RSI and growing confluence

We are all about generating confluence which skill combining distinctive buying and selling equipment and ideas to create a greater robust buying and selling method. Our preferred indicator is the RSI and it works collectively with the Ichimoku perfectly.

When the use of the Ichimoku indicator to experience trends, it’s necessary to recognize when the style is over and when a attainable reversal alerts a change exit. The screenshot beneath shows that by means of adding the RSI and looking for RSI divergences, it is feasible to become aware of high likelihood reversals. If, after a RSI divergence, rate crosses the Conversion/Base lines, a reversal is very probably and it can even foreshadow a longer vogue reversal into the contrary direction.

4 Stop placement and exiting trades

Just as shifting averages, the Ichimoku indicator can also be used for your end placement and exchange exits. When exiting a trend-following change based totally on the Ichimoku signals, there are a few matters you need to know:

When, at some stage in a downtrend, price crosses above the Conversion and Base lines, it can sign a transient shift in momentum…

…but as lengthy as the Cloud holds as resistance, the trend has now not but been broken.

When fee breaks above the Cloud, the downtrend is subsequently over.

Traders can use the Ichimoku for conservative and aggressive change exits:

The conservative exit (1): A greater conservative trader would exit his trades as soon as the Conversion and Base traces cross into the contrary route of the ongoing trend. Such a dealer commonly avoids a lot of the choppiness that exists before reversals happen. On the other hand, he may omit on future vogue moves when fee reverts returned into the original direction; not all Conversion-Base line crosses lead to vogue reversals.

The aggressive exit (2): A trader who wants to ride developments for a longer time exits his alternate solely once rate breaks the Cloud into the opposite direction. The gain is that he can now and again hold trend trades much longer and is not as vulnerable to temporary retracements. On the different hand, he might exit some of his trades too late and could stop up giving lower back a sizeable amount of his profits because the Cloud-cross usually takes place very late.

Conclusion: The Ichimoku indicator is a strong buying and selling framework

Overall, the Ichimoku framework is a very solid, all-in-one indicator that offers a lot of facts at once. As we have shown, there is no secret when it comes to using and deciphering the Ichimoku indicator and the man or woman elements are very intently correlated to buying and selling primarily based off of transferring averages. Nevertheless, the Ichimoku indicator surely has its vicinity and merchants who determine to comply with such a trading strategy can create a strong framework. We additionally exceedingly inspire to combine the Ichimoku indicator with other equipment such as fundamental support/resistance principles, charge motion and chart pattern reading and, potentially, other indicators.

To sum it up, right here are the most essential matters you have to understand when it comes to buying and selling with the Ichimoku indicator:

Use the Cloud to discover the long term trend direction. Only change in the path of the Cloud.

The Cloud also acts as aid and resistance for the duration of trends. But when charge enters the Cloud, it signals a shift in momentum.

When the Conversion line crosses above the Base line, it can sign the shift closer to a bullish trend

During a trend, the Conversion and Base traces act as guide and resistance

Only alternate in the direction of the Conversion and Base lines

A dealer can either use the Conversion/Base traces for his exits (conservative), or exit when fee breaches the Cloud (conservative)

During ranges, the Ichimoku indicator loses its validity

very useful information , thanks for share this ....

For hindi crypto news follow me, upvote, comment, and resteem my post.

thank you for your special support, and sure i will give you same response...........