Day 9: Bitcoin price crash explained (July-August)

The recent deep in the Bitcoin price is caused by a combination of different factors:

- Scalability, network performance decrease

- Uncertainty, risk of a hard fork on August 1st

- Market correction

- Moby Dick attacks the network

While other Altcoins don't have the same problems of Bitcoin, they're still following the sentiment of the market. It's important to understand what's happening to Bitcoin in order to understand why the entire market is deeping.

Scalability, network performance decrease

The number of people adopting Bitcoin and the number of transactions increase is causing a decrease in the performance of the network, so transaction that once took 10 seconds average, now can take up to hours. When Bitcoin was created, Satoshi Nakamoto, set a block limit of 1Mb. A proposed solution, called Segwit2x, consists in increasing the size to 2Mb.

Bitcoin was designed to be immutable, in order to implement this solution, 90% of the node in the blockchain needs to signal (read approve) the use of 2Mb blocks. On August 1st, assuming we reach that number, Bitcoin blockchain will update to Segwit2x.

Uncertainty, risk of a hard fork on August 1st

The risk is that we don't reach the quorum for Segwit2x, in that case, Bitcoin will fork into 2 Bitcoin version, one called Bitcoin148 (or simply Bitcoin) and the other one Bitcoin Classic. We already saw a hard-fork in Ethereum, and while the price probably appreciated, breaking the main rule of the immutability of blockchain, definitely affected the long term reliability and trust in Ethereum.

As many pointed out, Segwit2x will be a temporary solution to the network traffic, so we can expect this problem to show up again in the next few years.

Market Correction

Bitcoin and other Altcoins this year have seen an incredible increase in price, Ethereum from just $10 to $400, Bitcoin from $1000 to $3000, Litecoin from $4 to $50. Reaching a new all time high is a good reason to have a price correction especially with investors taking their profit gains. When this correction happens in a combination of the above scalability issues and uncertainty, the price can crash quite hard. Also let's not forget that volatility in crypto is always being very high and that's because of a "relatively" low volume, because of whales manipulating the market, news and other factors.

The point here is, a correction was necessary and healthy. I'm personally expecting lower low, the week before and after August 1st will be a very interesting entry point for new investors. My speculation is that, either we have a hard fork or not, the price will most likely appreciate from August 1st to the end of the year, possibly reaching again the ATH, possibly reaching a new one.

Moby Dick attacks the network

We recently discovered that the Bitcoin network was under a coordinated flooding attack that decreased the network performance and increased the transactions fees. The whale behind this attack stop just a few days ago, giving us a glimpse of the path of Moby Dick, you can read more about the attack here:

https://twitter.com/i/moments/885827802775396352

Many are guessing the reason of this attack and why it stops, and if it will start again. Here's a tweet from Charlie Lee, our favorite Cryptocurrency developer, who noticed that the Bitcoin mempool was all of the sudden free:

https://twitter.com/SatoshiLite/status/884011944708931588

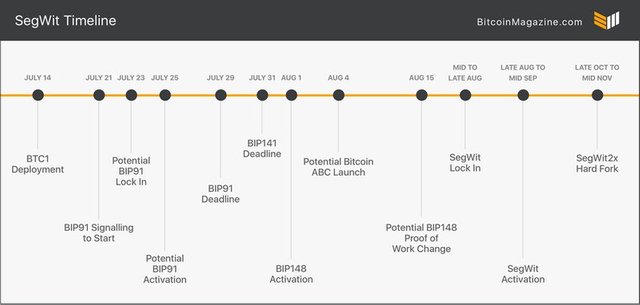

Timeline

Here's the timeline for the activation of Segwit and other Bitcoin new features:

We'll all be looking very closely to see how the situation evolve, meanwhile a few suggestions. If you own Bitcoin, move them into a paper wallet. In case of a hardfork, you'll now own both BTC classic and BTC 148. Possibly the price will split and will grow from there like it happend to Ethereum and Ethereum classic.

Have some USD ready to buy at the next price deep, and always HODL!!

This post is part of the Writer challenge: 30 articles in 30 days.

Federico Ulfo

Creative Software Engineer

Creative Software Engineer

https://twitter.com/feulf

https://linkedin.com/in/federicoulfo

Well described

(Image from… twitter.com/i/web/status/8…

Disclaimer: I am just a bot trying to be helpful.

You've been UpVoted via the UpVote Experiment 002 Bot. Depending on my VP & the price of STEEM you should get a $.01-$.03 for your trouble.

Read more about this experiment here.

Thank You - @blueorgy

I don't really care if there is a hard fork of BTC or not. It worked out just fine for Ethereum and I think everyone knows where the future of BTC is - the chain with prospects for handling higher transactions. A BTC-classic will stick around for a long while, but like ETC - is it really going to survive and be useful long time? It could be the new Litecoin I guess. I suppose with BTC we don't have ICOs to drive volume to one chain or the other but I think eventually just scalability will make it's choice.

All the forward thinking companies are backing Segwit2x right so we'll just get a classic BTC with a bunch of Luddite miners who eventually will regret not joining the masses. An analogy is while the transportation industry had a hard fork and moved to the motor car we still have people driving horse and carts - but it's just a old-timey throw back, good for some short distance trips if you want to be retro, but not a serious form of mass transport any more.

Yes, that was my point, either we fork or not I believe we're still in long term bull market, in case the fork happens, I couldn't be surprised to see the flippening.

I only wish Segwit2x was happening with more consensus and fewer debates like Segwit for Litecoin, this way the price could've to drop less and in a healthier way. The problem of these debates and crashes is that it scares new investors who prefer to put their money in less volatile and risky markets. I believe, in fact, that the last ATH is thanks to the sideways and low volatility of last year, which gave more trust for new investors.

We'll see how things evolve!

Interesting post! I like it! It summarizes and explains all about the price of Bitcoin and the "August 1st" ! I will Upvote it and Resteem it :)

Thanks. I love when my suggestions are spot-on

Hope you all got your Bitcoin Cash!

My next guessing was that a week after August 1st it could be an interesting entry point:

I want to confirm that and I may have to change my projections, because of the current state of things, I believe in the next 15 days the price of Bitcoin will reach a new ATH. That is because Bitcoin Cash just added $10 billion to the total cryptocurrency market cap, out of thin air, and in just a few minutes.

I wrote an article to explain my theory and guesses, and a potential strategy (not a trading advice):

https://steemit.com/bitcoin/@rainelemental/day-15-bitcoin-over-usd3000-in-the-next-week-thanks-bitcoin-cash-not-a-trading-advice