Market crash in June 2017? Bitcoin falls over 10%!

Markets getting ready for June 2017 crash?

Depends who you ask. Most investors, both institutional and retail understand that the recent market inflation trade is the result of confidence in the Republican platform for tax reform, but with one scandal after another, it's slowly becoming apparent to savvy investors that this market is hanging by a thread and at any moment without notice, we could see a correction back to fair value.

What is fair value?

Fair value would ideally be determined by the value of an individual stock or indices based on actual earnings and corporate profitability (I'm really simplifying this for the average reader). However, similar to the shenanigans of the dot com bust (1999-2001) and the housing market correction (2007-2009) large corporations and small caps were inflated beyond fair value with the perception of future expected gains.

The reality is that fair value is based on market-price discovery, however with the inflation of quantitative easing, it's become difficult to determine fair value accurately, as such, economists and market investors alike have differences of opinions on fair market value.

What should we expect the market to do?

Here's where it gets tricky. With multiple macro indicators alerting of an upcoming correction poised in June 2017, the key is to watch the Dow Jones Transportation Index and a combine factor of multiple other indications, such as:

- Emerging market behaviours

- Geopolitical risks

- Perceived value of cryptocurrencies (I deliberately state "perceived" as the value of a Bitcoin in South Korea has reached upwards of $4000 whereas the US nominal value is trading close to $2500 as I write this blog)

- Precious metals

- Bonds and notes

- Interest rate expectations and hikes

- Commodities

- Potential market risks resulting from over leveraged investors

So what do all of these indicate in the near future? Well, my personal opinion is we are beginning to see some familiar expectations being set up for another 2-3% decline in the DJIA and SP500. The challenge we're faced with is that every time the market attempts to sell off, one of the Federal Reserve board members or contributors quickly come out with commentary to hype the market back to new highs.

Here are a couple of recent examples to note:

The market went into sudden downward spiral decline that was poised to drop greater than 2% on May 17, 2017 however Neel Kashkari came out to save the day by stating:

"The stock market isn’t as leveraged as the housing market, and so the impact of a bubble there wouldn’t be as great to the broader economy"

This comment alone forced the market to rage higher immediately:

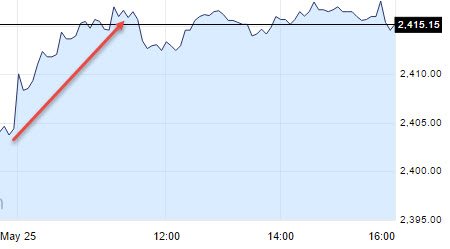

And now again, we're faced with a market that barely closed in the green on May 24th only to have fed board member Lael Brainard come to save the day with the following statement:

"The global economy is brighter than it has been for the last few years."

And the markets? Well, here's the reaction (albeit, senselessly closing 0.48% and making brand new highs):

So, with all the market hype, it's probably no wonder that Bitcoin took a dive from a 12% high today reversing to losing all gains for the day and closing slightly lower than yesterday:

Things to note

Alright, so basic things to note from this:

The markets are completely rigged (in case you've forgotten). The Federal Reserve is out there to keep the market hype going and to prevent (for as long as possible) another market correction that could force investors to finally give up and head for the exits.

Fed board members are diverging in language. Brainard, who is traditionally dovish is becoming more hawkish in her approach (September 2016 Brainard made some dovish comments that cause the markets to shed about 1% in a day).

Bitcoin takes a hit when the markets fall, we can thereby assume that it is gaining more prominence as a hedge against the market and perhaps a safe-haven in the near future.

Markets are setting up for a correction in June 2017. What should we expect? Well, it won't be identical to August 2015 but it will sure leave fright in all investors.

Cheers!

@randomsteeming should be interesting to see what happens with another fed rate hike. how long can we stay afloat with endless amounts of money being printed?

Rate hikes won't do much and endless printing doesn't affect the short term value of the dollar. As long as international investors are confident in the US economic model, they will continue to invest in the US markets (the recent rise in the markets can be attributed more to European angst than a "Trump rally".)

The challenge to the US dollar will come in the next crisis. With the advent of cryptocurrencies and many other nations coming together for trade without the use of the US dollar, the challenge to the US dollar is dependent on the next crisis. The crisis has to be large enough with concerning magnitude that it forces investors to seek safety in other tangible assets and not the US dollar. Then we'll begin to see the demise of the dollar. But this is not an overnight event. Lets not forget that a "collapse" in the US economic confidence model also means a renewed world war and this time it will be kinetic and not a cold war.