Bitcoin is coming to despair, which is simply a mistake

In the past few years due to mergers and acquisitions in the blockchain hair company, the integration of the operation and intensified. For blockchain technology, blockchain has given investors an amazing amount of imagination compared to their predecessors.

Take the internet for example.

Early protocols and packet-switched technologies were invented in the 1960s and, to the best of our knowledge, were developed throughout the 1970s. However, it was not until 1995 that commercial websites were authorized to run on the Internet. Thirty years have passed before entrepreneurs and investors can invest in companies built on the technology.

Compared with bitcoin, it started the modern blockchain movement.

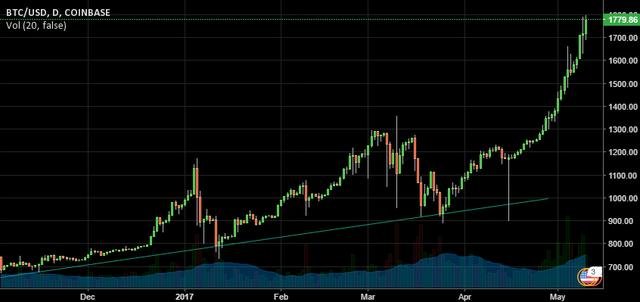

In the first run of the Bitcoin Quintessence White Paper, which was released at the end of 2008, the price rise occurred in mid-2011, then again in late 2013 and then the most recent peak in early December 2017. As a result, the technology became the focus of investment after three years of its development, and the speculation has not diminished from start to finish.

We can see the difference in arcs between hackers and financiers. Internet hackers have taken advantage of this new technology to broaden its boundaries and capabilities and have created decades of new products on it, but in most cases there is no sign that any of their work can be done financially get payback. Today, the legacy of this work lies in the open source community, which continues to drive the development of this technology.

Most financiers ignore the software Internet, but instead fund hardware infrastructure companies that make packet-switched equipment and other network equipment. They did not show up until the dot-com bubble burst in the 1990s.

The sequential pattern of technological development is parallel to the blockchain. Hackers keep patching up and expanding the capabilities of technology. They are still exploring the possibilities here. However, financiers invest more time in technology maturity and suddenly find the blockchain very early. No wonder some of them are on the first sign that they think the bubble is not what they think might be evaded.

So we started to enter despair, and when technology loses its charm among some types of investors, they complain that they have lost their foothold in the marketplace and that technology is dead. You can feel this in some media coverage of technology, and we fear it will only become more intense.

Engineers will continue to play this technology, and they will eventually create value "killer apps." This may happen this year or maybe 10 years from now. Or longer.

The potential of disruptive technologies like blockchain can take decades to fully understand. You do not have to be a true participant, but you do need curiosity and attention to the border that you never meet.

So do not despair in the valley of despair. Instead, consider it as an opportunity to clear all speculation (and the speculators themselves) once and return the area to the people who are actually going to build the future.