Its not sexy financial advice but honestly it will save you a shed load

Honest truth if you're in the UK and checking savings rates today ATOM bank 2.05% for a year fixed rate you put your 10k in and you get £205 back next year.

what can you do with £200 these days ???

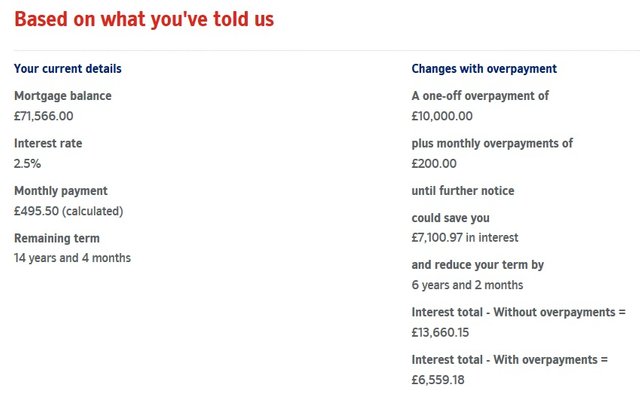

Yet I sit today with £71566 left on my mortgage and £35,000 in the bank, how much do I need for a rainy day??

The bank is charging me 2.5% a year on the full amount I borrowed 10 years back.

so whats SEXY in 2018 having 10k extra in the bank or reducing your mortgage by 6 years and 2 months ?? and financial freedom.

Let me know? that new car losing 1000s I'm tempted to go EV but surely the savings alone on the mortgage counter act the owning of a new electric vehicle.

Come on share your thoughts?? this is financial advice from me