We can now use Visa to pay Bitcoin network transaction fees!

For several years now Blockstream and Core supporters have been advocating a "fee market" and having full blocks all the time. Many have even gone so far as to claim that Bitcoin is unstable without full blocks, while completely ignoring that the blocks were not full for the first 8 years of Bitcoin's existence.

As any Bitcoin user knows, the network is completely full now. Every business is spending countless hours dealing with customer support requests relating to transaction that haven't confirmed. In the last year confirmation times have gone up from about 10 minutes, to nearly two hours!

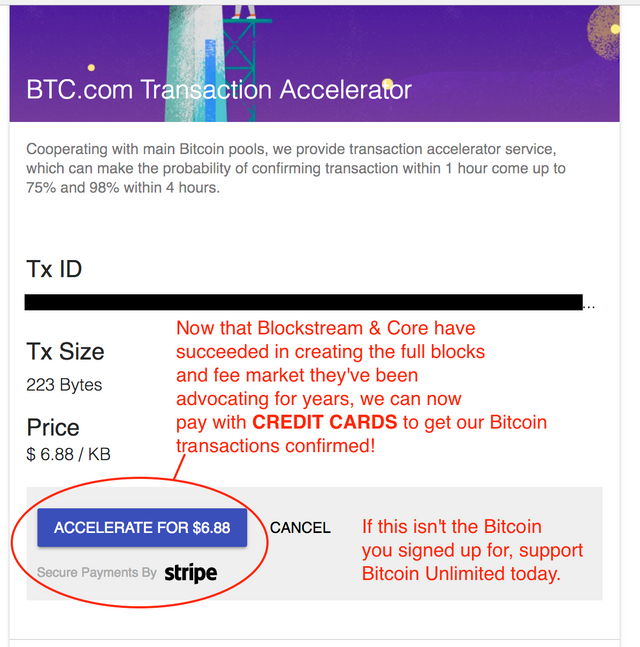

I was stunned earlier today when I came across a service that now allows people to pay with CREDIT CARDS to have their Bitcoin transaction confirmed!

This certainly isn't the bitcoin that I signed up for, and I think everyone should be shocked by how bad things have now gotten thanks to Core and Blockstream's misguided economic policies.

Segwit is not the answer.

It is worth noting that this kind of fee market is exactly what the current Core team have been advocating for years. Now they have it, and it is a disaster just like myself, Gavin Andresen, and many others have been saying all along. The owners of Friendster, and then Myspace thought that it would be impossible for any other social network to supplant their position. Facebook proved them wrong.

The current Core developers think that it is impossible for any currency to supplant Bitcoin, but if Bitcoin doesn't grow and adapt to keep up with consumer demand, it will be replaced by something that does, and it will be the current Core developer's fault for blocking every on chain scaling attempt and intentionally implementing disastrous economic policies.

If you love Bitcoin and want to see it become a currency used all over the world, it is time to reject the insane economic policies of Blockstream and Core, and support Bitcoin Unlimited instead.

Segwit is the answer.

i will help you to push tx (transaction acceleration ) i'm bitcoin miner I will include your tx in the block working on 24/7 ,Try our service contact info : https://telegram.me/emmaanjelina

Forum link

https://bitcointalk.org/index.php?topic=1937408

You sure must be feeling silly now.

Good to have you back on Steemit after 6 months. Good post! :)

May I ask you: Are you against Segwit in general or only against Segwit as a solution for the problem with full blocks (as a scaling solution)? What if we enable Segwit together with a block size increase?

Glad to be back! The improvements made by segwit will also be implemented by the Bitcoin Unlimited team, but are not urgent. Fixing the congestion of the current Bitcoin network is super urgent.

Adopting Segwit would start offloading mempool congestion almost instantaneously, How is this not urgent?

FYI, I am running a bitcoin brokering business doing dozens of transactions with beginners every day and had not a single person complaining about the fee costs even when it's the 1$ range. If blockchain.info receive so many support request for transaction fee problems it's because the wallet has constantly been behind in terms of setting the right fee given the network condition. Still to this day BC.info has no reliable way to select Low Normal or High priority.

I've listened to that whole "debate" at anarcopulco and was completely mind blow by your lack of understanding of why zero-confirmation transactions are not and have never been secure. If anything RBF make these transaction more secure by signaling miners that a doublespend really is a double spend when it's not flagged as RBF. You seem to think that because 99.99% of past double spends attempts have not been included by miners mean that the incentive isn't there for a miner to decide to include a transaction with 100$ transaction fee over the standard fee.

Yes, indeed. I always told friends Bitcoin is fast and there are almost no transaction fees. I can't make those arguments anymore. In its current state Bitcoin looks more like gold. People use it as a safe haven, but as a payment method there are cheaper and faster options.

Steem for example has a 3 seconds block time and always zero transaction fees.

Good luck bro, it's up to people like you to make bitcoin transactions faster. I really miss those 20 minute transaction times from the good old days.

Following both you and your progress!

Nice to meet you steemjesus! The image you are using brings back some good memories. For those who don't know, it was originally created for use on my Bitcoin billboard in Silicon Valley: https://forum.bitcoin.com/bitcoin-discussion/the-newest-bitcoin-billboard-is-coming-to-silicon-valley-t149.html

Dude, you rocked the Acapulco conference. Too bad your beeper went off and had to cut your appearance short. I wish that the soft fork guys had half the passion as you man. Never stop following your heart and soul!

If STEEM has taught us one thing it's that TIME is the most valuable resource we humans have. The passion that you display proudly and publicly brings tears to my eyes knowing of all those who so dearly NEED blockchain tech RIGHT NOW!

Bitcoin Jesus 1.O ain't messing around yall

Transaction are still confirmed within an average of 10 min when you pay sufficient transaction fee.

Mycelium is a good wallet that allows you to set a priority fee it's "standard" fee is usually always next block too.

https://bitcoinfees.21.co/ to know what's a good fee for next block inclusion.

Transfering funds with steem in 3 seconds is a big mistake... Because after this experience and trying to send BTC again is a guarantee to commit suicide then after....

"Every business is spending countless hours dealing with customer support requests relating to transaction that haven't confirmed."

This is my biggest issue right now. I get so many emails about why a transaction has not confirmed and their order hasn't shipped out. And it's not just a couple hours, often we are talking 2-3 days later before a transaction is confirmed.

Yup! I actually had to take a break from helping with support tickets like this to write the article above.

Would I have to run a node to support Bitcoin Unlimited or are there other ways I can do that in my usual Bitcoin transactions?

Sure, running a full node helps. Make sure you have port forwarding enabled for your router as well. You can get the software here: https://www.bitcoinunlimited.info/ and check our percentage of the network here: http://nodecounter.com/

Don't forget to tell all your Bitcoin friends too!

This is the real problem with the Bitcoin model. There's so little ordinary users/stakeholders can do to hold miners accountable. We can sell our Bitcoin, and they are accountable in a loose sense to the Bitcoin price, but it is such a costly form of protest. Further, there is an argument to be made that Bitcoin miners don't actually want the Bitcoin price to rise in the same way stakeholders do. For a Bitcoin stakeholder like yourself, a price rise is pure gain. For miners the story is different. A rising price draws in more mining competition, and the difficulty adjusts as a result. A quickly rising price may justify R&D costs for those competitors, which would not be justified by a more stagnant Bitcoin price. As a result, for many miners, a quickly rising price may mean that their hardware becomes obsolete sooner, which is contrary to their financial interest.

ive made posts about free pushing of TXIDs by ViaBTC and AntPool in the past.

also today a few hours before you ive made a post on how to send BTC fast between exchanges using #litecoin #bitshares or #steem

but surely the full blocks are the problem this are just workarounds

I do agree that blocks could be bigger but the proposal of making blocks unlimited size and letting the network find a consensus for the limit seems like a disaster waiting to happen.

Personally I'd want to see a bump to 2MB in the short term. I think miners would be much more willing to do this now, as they may see the potential in collecting more fees.

Furthermore, I think a large and overlooked component of the recent mempool and fee swelling is well-intentioned but poorly implemented BTC clients that attempt to intelligently calculate a reasonable fee for a transaction. The end result, as we can see watching new transactions scroll by on a website like https://tradeblock.com/bitcoin is an automated inflation of fees beyond what would happen if these clients weren't in play. I think a piece of low hanging fruit in the BTC network is to improve how the clients calculate or estimate fees and additionally make it clear that if you're not in a hurry, a lesser fee may be acceptable.

I've just sent you a transaction over the Steem network to illustrate its speed. As people invested in BTC, we want it to succeed but there is no guarantee. Maximalism is clearly not a tenable position as newer ideas and tech overcomes problems and limitations of the old. Steem is quite different from BTC but it shows that there are other possibilities that can make a real difference in bringing cryptocurrency to a usable state for everyday people.

Nicely stated. Why not SegWit now for the malleability fix, the innovation, and a blocksize efficiency bump, with a firm window for 2MB blocksize if blocks continue to be full (not counting dust)? Unlimited blocksize contentious hard fork will probably be a disaster of unlimited size. Better a contentious soft fork than contentious hard fork IMO.

Instead of constantly trying to fight Blockstream and Core, why not use and market a cryptocurrency that actually has better potential to be a real transactional currency? BTC has continually failed to prove itself as that. I think it may be time to stop wasting so much time and energy on issues that likely won't be fixed.

Forget about the social media aspect of this platform. Is STEEM and its blockchain not better suited for transactions? Is it not as fast as any other crypto and does it not scale very well to handle relatively large transaction capacity?

Here's your answer to the ongoing BTC problems. The trick is reining in the dev team and getting some stability so that other developers can build off of the chain and investors are more willing to invest in projects in the STEEM ecosystem.

I feel you but at the same time Bitcoin market cap is in the billions and comparable to some of the top S&P 500 company. This won't go away whether or not the 7 transactions or so per second is fixed. In fact it's only growing right now.

That being said I see a clear possibility for Steem to take over Bitcoin at some point but that clearly doesn't mean people should just stop looking for ways to improve Bitcoin. Now I don't think POW or any POS will ever be able to compete with DPOS.

The fact that the market cap is in the billions of dollars and the network can't even manage to confirm transactions after several hours is exactly the problem here. There is no advantage for the average person to use BTC over any other existing transfer service, especially without any protection/insurance of transactions.

Add increasing fees to the mix and what exactly is it that makes people value BTC? The fact that they want it to have value? Bitcoin is failing as a currency. In my opinion, Bitcoin is the most overhyped crypto token and it is extremely overvalued compared to how it actually performs

The speculation train will likely come to an end sooner rather than later. It offers nothing useful to anyone who has an actual need to make quick, cheap money transfers. Without BTC being able to do that, it has zero advantages over existing legacy transfer services or newer cryptocurrencies that can actually deliver on the speed, low costs (or free), and scalability.

If actual investors from outside of crypto ever look to get more heavily involved in cryptocurrencies and their blockchains, BTC will most likely not be where they go. (The Winklevoss ETF thing is actually quite laughable to me.)

It's not good good at transferring small amount of money but it still can serve to transfer large sum of money. Also the price of Bitcoin performed better way better than almost all company shares in the last 2 years and the difficulty to mine Bitcoin is going up so the price of Bitcoin in the next year is looking good.

We're not talking about a small decentralized company here. We're talking about a top S&P 500 company. Around top 240 something (link below). We can talk about all the down side of Bitcoin yet this mining industry and what come with it won't go down so easily I tend to think.

I recommend you take a look at my sub-chapter named Bitcoin here, (only the sub-chapter named Bitcoin) if you'd ever wish to learn more about my ideas on the subject.

https://cryptolization.com/

This is "The Titanic can't fail it's too big" logic which has been wrong countless times in the past.

Examples:

Enron

Lehman Brothers

Atari

Circuit City

The Soviet Union

Pets.com

Polaroid

Nokia

Kodak

The Titanic

The fees to transfer Bitcoin will grow as they are right now but that doesn't lead to system failure nor will it lead to people stopping speculating on the price.

I didn't said it can't fail but for the Bitcoin mining industry to go away, Bitcoin would have to systematically fail and the transaction limit isn't a systemic failure its only a known limit. That's what I tried to express with my comment.

Too big to fail logic is an oxymoron. I totally agree.

Do you not agree that Bitcoin can fail due to users leaving and moving to lower cost competitors ? In other words a competitive failure rather than a technical failure.

Yup but I tend to think this won't happen so easily. One of the rare coin that could make it happen is Steem. This is due to the distribution of coins. Bitcoin has one of the best distribution. There's still quite a lot of Bitcoins concentrated in the hands of a few large holders but compare to other coin Bitcoin's distribution is way better off than most if not all and this is quite important. (Steem distribution is another subject altogether)

Also one other reason why Bitcoin seems quite resilient is its mining industry which govern the ongoing distribution and is way larger than the other crypto mining industries. Here's one excerpt from a sub chapter I made on Bitcoin that explain some of the virtuous cycle Bitcoin mining feeds on.

The lower transaction fees aren't so true anymore for small amount but if the cost of "producing" Bitcoin is rising and thus the ability of Bitcoin to store value is ever growing well it seems to lead to what we're seeing right now and with "little" chance of seeing a drastic change in those trends in the near future.

Yet clearly black swan events can come in many forms and a lot of those event can easily be imagined so that's why I put the word little between quotation marks.

This website can give a good idea of distribution of the major coin. Damn Litecoin, Dogecoin and Peercoin. Also 25% of Dash could be own by the founder of Dash because of the ninja mine in the first day of mining. It doesn't look much brighter for Ethereum and when it will switch to POS this will advantage larger holder over smaller one which will further concentrate money leading to selling pressure.

https://bitinfocharts.com/

https://etherscan.io/accounts/1

I know a crypto with zero transaction fee and two second confirmations, all it needs is a bit of liquidity.

And everyone who studied Steem knows its very real potential to grow and see its liquidity follow.

This is an important issue and should be addressed urgently. Thanks for posting this explanation for us.

This is an interesting problem that I haven't paid any attention to so far. Is there a wiki or something that lays out the arguments on either side?