Bitcoin’s value consensus problem

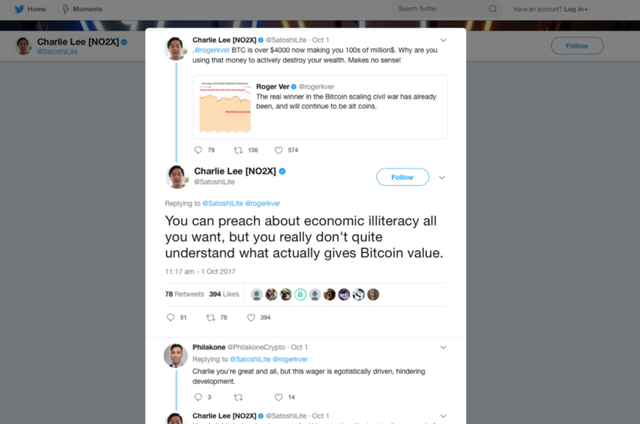

Things got heated on Twitter the other day between Charlie Lee and Roger Ver over the proposed forks that BTC may face in the coming months. Arguments aside, one thing struck me in the comments to one of Charlie’s posts referring to what gives Bitcoin it’s value. The answers spanned such a wide range of reasons it sent me on a 3 day mental quest to try and unravel what i’d read.

Here are a few highlight reasons people gave:

- Resilience to central control

- Supply and demand

- P2P transactions

- Previous investment success

- Lack of debt association (Compared to FIAT)

- Utility in the marketplace

- What it represents

- Stability against unstable FIAT (aka Venezuela)

- Bitcoin ‘Brand’

- Energy cost of mining

The main reason this left me pondering Bitcoin’s value is in relation to the wider media’s assumption that Bitcoin is a bubble. Almost daily you’ll find a comparison between crypto and tulip mania or the dot com bubble.

But with Bitcoin having so many use cases and/or so many perceived reasons of value, my opinion is that it will be more difficult to accurately establish if it is indeed a bubble. An asset bubble bursts when the perceived value meets the realisation of it’s true value. This can be applied to Tulip mania or the dot com boom, speculation leads to an increase in price above what the asset is actually worth. The problem with Bitcoin is it’s hard to establish a clear consensus of its true worth. What gives Bitcoin it’s value to someone in Venezuela is different to someone in the United States.

Let’s say each of the 10 reasons highlighted above each represents 1/10th of Bitcoin’s value. If the ‘bubble bursts’ for those who invested to avoid government intervention, due to implementation of regulation, the price would only fall 10%. After all, government intervention in the US wouldn’t stop the use case for citizens of Venezuela.

This is obviously a simplified example but it goes some way to explain my position on this. The fact there isn’t a clear consensus regarding the value, means there can’t be a clear consensus for when that value is too high. For instance, the price of gold is far above it’s real world use cases. When you strip away the aesthetic uses of Gold, you’re left with heat shields, electrical connectors and gold teeth. So why does the Bank of England store over $240bn worth of heat shield material and no one is calling it a bubble? And before you start talking about a post apocalyptic scenario, the only valued assets will be water and food.

I agree that there exists investment in crypto that is pure speculation based on nothing but hype, so the real question should be “how much of the market cap does that represent?”. Until we can establish a consensus on that, it’s impossible to categorically state we’re in a bubble.

If Gold is the asset of the physical world, then Bitcoin (or another cryptocurrency) is the asset of the digital world. And as I mentioned in my post Can Bitcoin Die? as long as the digital world continues to preside over the way we live, there will always be a value in cryptocurrencies.