Cryptocurrency Market Bloodbath: Bitcoin, Ripple, et al. Decline in Value

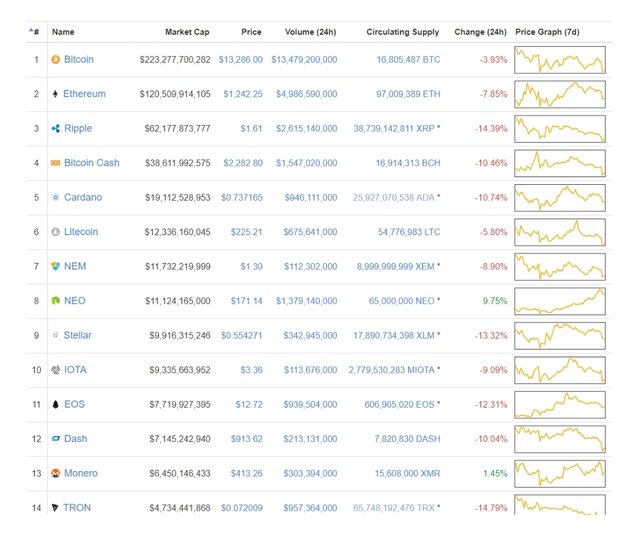

Today, on January 16, the cryptocurrency market experienced a major correction, for the third time in the past 10 days. The price of most cryptocurrencies including bitcoin, Ripple, Ethereum, and Bitcoin Cash declined by around 10 percent, while small cryptocurrencies recorded larger losses.

With the exception of NEO and Monero, all of the top 20 cryptocurrencies have fallen in value. Cryptocurrencies that have recorded a decline of over 10 percent include Ripple, Cardano, Bitcoin Cash, Stellar, EOS, Dash, Tron, Bitcoin Gold, and Ethereum Classic

Small Cryptocurrencies Take a Big Hit

Cryptocurrencies with lower market caps, specifically cryptocurrencies outside of the top 10 global rankings, have recorded larger losses than established digital currencies like bitcoin and Ethereum. Even cryptocurrencies with trading volumes heavily concentrated in South Korea such as Qtum and EOS have declined in value, even though the South Korean cryptocurrency market recovered from the latest trading ban FUD.

The recent correction of the cryptocurrency market was not triggered by South Korea or China, as the market have already recovered from the FUD produced by the authorities in both regions. Rather, it is likely that the major correction was caused by the abrupt surge in the market valuation of most cryptocurrencies in the market within a short period of time, with minor corrections.

Within the past 30 days, the market valuation of cryptocurrencies increased from $540 billion to $840 billion, with several cryptocurrencies with Tron that do not have enough users, decentralized applications, and user activity to justify their market valuations, surging by billions of dollars.

The technology of cryptocurrencies is irrelevant in this argument. The technology of Tron or other cryptocurrencies could be sophisticated and advanced. They likely are. But, not enough users are using these blockchain networks to give them multi-billion dollar valuations. As Ethereum co-founder Vitalik Buterin previously stated:

“So total cryptocoin market cap just hit $0.5 trillion today. But have we earned it? How many unbanked people have we banked? How much censorship-resistant commerce for the common people have we enabled? How many decentralized applications have we created that have substantial usage?

In the last 3 years, the crypto market cap has increased by 200x, but I definitely don’t feel like crypto’s potential has increased by 200x. In some key sectors (eg. payments) it has even regressed.

The answer to all of these questions is definitely not zero, and in some cases it’s quite significant. But not enough to say it’s $0.5T levels of significant. Not enough.”

Considering that public blockchains have not been able to demonstrate their potential through the success of decentralized applications, it is normal that the cryptocurrency market has experienced a major correction. It is also healthy that the market experiences corrections on a regular basis, as corrections prevent short-term bubbles from forming.