Morgan CEO attacked Bitcoin and then hit the face, still provide special currency offer service

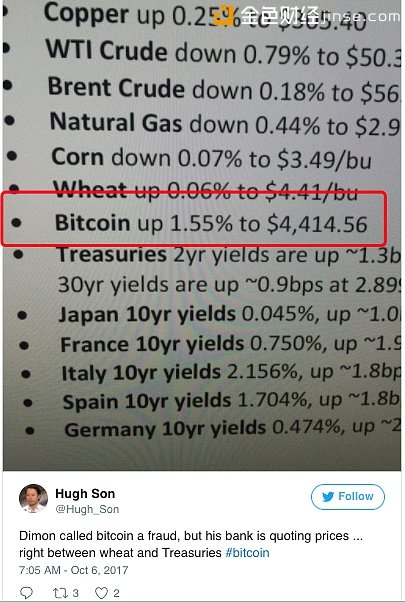

While JPMorgan Chancellor Jamie Dimon has attacked Bitcoin as a scam, the company is still offering a quote for Bitcoin.

In a JP Morgan offer table, Bitcoins are listed with mainstream assets such as copper, crude oil, natural gas, and 10-year US debt.

It shows that Wall Street is embracing digital money . At present, a number of financial companies are exploring the digital chain behind the digital chain technology. And as customers interested in trading bitcover more and more concentrated, these Wall Street banks also began to provide services.

Last month, JP Morgan CEO Jamie Dimon said the digital currency is "scam", "worse than the tulip bubble," and said it would not have good results, will eventually be shattered. He said that any trader of the deal should be dismissed for being stupid.

In fact, it was not Dimon's first attack on Bitcoin. Dimon last bombardment of Bitcoin was November 2015. At that time he said: "You are wasting time on Bitcoin." Virtual currency , bit currency against the dollar, which will end. No government will support a virtual currency that can not be cross-regulated . This will not happen. It is cheaper, more efficient and safer, we will use the technology. It can be used to transport money, and this currency will be dollars, not Bitcoin.

Dimon said: "There is no government will be long-term than the special currency swallowed, and now the size of the second currency is still small, many senators and congressmen will support Silicon Valley innovation, but in fact, no money can avoid government regulation.

Wall Street has a different view of Bitcoin.

Morgan Stanley CEO James Gorman said last month that Bitcoin "certainly not just three minutes of heat." He said that anonymous money is a very interesting concept - it is for people to provide privacy protection is interesting, its impact on the central bank system control is also interesting.

"I have not talked to a lot of people who hold Bitcoin," Gorman said. "This is obviously highly speculative, but it's not a bad thing, which is the natural consequence of the whole chain chain technology."

By the block chain technology was more widely accepted by the impact of bit currency in recent months soared. The market believes that block-chain technology will make it more widely used for faster trading hours. Bitcoin prices climbed four times this year, sparking a debate about the bubble.

@royrodgers has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond. To be Resteemed to 4k+ followers and upvoted heavier send 0.25SBD to @minnowpond with your posts url as the memo

They have a problem like any bank. They must attack.

:)

@sairahamdan Really good post.