The Bitcoin Bubble - Does it exsist? (Tulip Fever)

One word that has been thrown around since I first engaged Crypto Currency three years ago is "bubble". This comes out of the mouths of economists, investment firms, Robert Shiller, and the media. As the value of Crypto rises, it's in the back of all of our minds. When will this bubble burst?

I am not trying to be overly optimistic here, but what if it's no bubble at all? Let's take a look at some of the biggest bubbles in history for a moment and look for commonalities to what we're seeing right now.

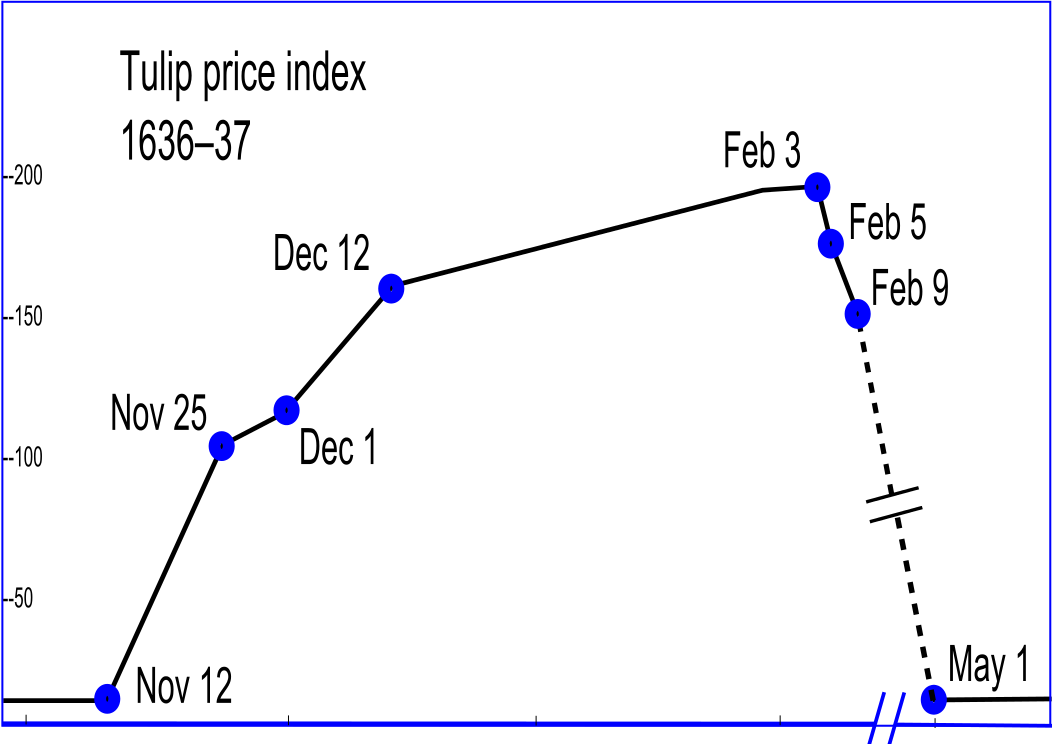

Today we look at Tulip Fever

Tulip Fever Bubble: - 1619–1622

As most of us learned this in High School economics, I will keep the back story short. The demand for tulip bulbs In early 17th century sky rocketed, and the value was inflated to a price exceeding gold! A lot of people cite this crazy increase in value to discredit Bitcoin and other Crypto Currencies.

The Problem with the comparison Bitcoins are not Tulips. I know that seems like an obvious statement, but let me elaborate. During Tulip Fever, you were limited to the quantity at hand when the fever started, but as time went on people started producing more bulbs. The effects of this were not immediately felt as you can not create them out of thin air, but after a season or two the producers get wise and the market floods. Additionally, Tulips have no long term value. They decay, they rot, and they can't even get you a Latte at Starbucks.

The faults of Tulips are seemingly the strengths of BTC. There is no decay. It can not be inflated or have its market flooded. It can be used as a tangible form of payment. Despite all of those who have called for a bubble to burst, here we sit. Many needles have come poking around, with only the occasional leak.

**Have a different perspective from the one I've written here? Please let me know in the replies below."