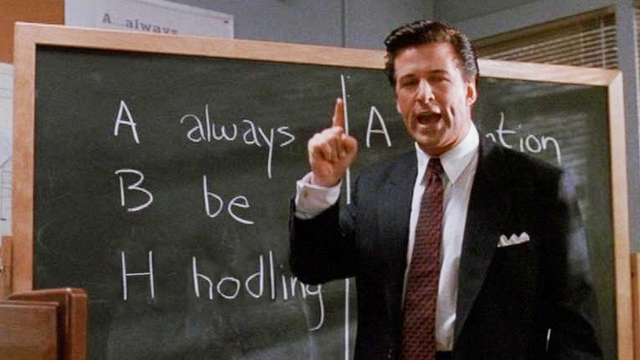

Don't Panic! HODL! More Evidence Emerges that the Future of Crypto will be Super Exciting

The End of Rampant Manipulation by the Whales, Custodian agreements for Institutional Investors, Bitcoin ETF.

Institutional money began to trickle into the cryptocurrency market at the end of 2017, mainly OTC. A report, recently published by Tabb Group, concludes that 2018 will be the year that institutional capital from hedge funds, pensions etc, will pour into the cryptocurrency market, altering the course of the market decline. These institutions are just waiting on the sidelines, but they need the following criteria to be in place, which is all that is holding back the tide;

The huge sums of institutional capital being amassed and waiting to flow into the cryptocurrency market has focused minds and compelled various parties to begin putting the above criteria into place. Regulatory oversight from the DoJ, CTFC and the SEC is being ramped-up, whilst trading venues are preparing to target institutions with custodian agreements, which will give institutional investors the go ahead, as trading venues require US SEC approval and a credit rating, before offering custodian services.

A custodian license essentially means, in a regulatory and legal sense, that a trading platform accords to the US SEC's standards guiding custodian guardianship of digital assets that an institution holds with them: Institutions will have the assurance that these digital assets will be stored in a cold wallet, offline, without the risks of being exposed to the vulnerability of an exchange hack and the difficulty of tracking stolen digital assets. Institutions would then have a safer way to add Bitcoin, Ethereum, XRP, EOS, Steem, Bitshares, VeChain, Ontology and a multitude of other coins to portfolios that include stocks and bonds.

So, who's preparing the custodian services for institutional investors?

Coinbase is almost ready to offer a custody service, in addition to Coinbase Markets, Coinbase Prime and The Coinbase Institutional Coverage Group. Coinbase aims to meet the needs and demands of institutional investors with these new products and an advanced cryptocurrency trading infrastructure. These new services are currently being tested by institutional investors and Coinbase is awaiting approval from the SEC.

The Vice President and General Manager of Coinbase, Adam White, has stated that;

BitGo has acquired Kingdom Trust, a qualified custodian and Goldman Sachs backed Circle have been talking with regulators, whilst investment bank Nomura Holdings Inc has co-founded the Komainu custody consortium with crypto firms Ledger and Global Advisors. eToro has just announced that they will be rolling-out offline cryptocurency wallets and at least three of the traditional global custodians of Wall Street are exploring trading and custodian services; The Bank of New York Mellon Corp., Northern Trust and JPMorgan.

Some of the largest fund managers in the world, such as Blackrock and Fidelity have trillions of dollars under management and they are in the process of employing cryptocurrency traders, so they will also pour billions of dollars and perhaps trillions of dollars eventually, into the cryptocurrency market, once trading platforms have SEC approval, credit-ratings and custodian licenses.

We can expect to see some SEC approved third-party custodian agreements in place at Q4 this year, which will kickstart a golden period of growth for the cryptocurrency market.

Why Do Institutions Want to Invest in Cryptocurrency?

Triad Securities recently conducted a survey of institutional investors and found that 62% were considering buying Bitcoin.

These large institutions view cryptocurrencies as a new asset class, which will provide higher returns compared to equities, bonds and real estate. For example, the 66 trillion-dollar equity market may provide a 3% yield on dividends and the 80 trillion-dollar bond market typically pays interest of 2 – 5%. This new asset class is viewed by institutions as an opportunity for exceptional revenue and alpha.

Institutions recognize digital assets as a new asset class that allows investors to build better, more diversified portfolios, in accordance with Modern Portfolio Theory, as they offer a better return stream compared to equities and bonds, as well as a store of value and a safe haven during economic and political uncertainty, akin to gold. Cryptocurrency is the best of both worlds.

Certain characteristics of cryptocurrencies will be used by institutions to determine their value, which include;

What Conclusion Should We Draw from All This About the Future of Our Crypto Investments?

An institutional flow of money into the cryptocurrency space will spell the end of the highly manipulated nature of the market and a whale's ability to impact the market. Friday's retracement below the $6000 level is in large part due to a whale moving 8000 Bitcoin, with the intention of feeding these onto the open market, much like the Mt Gox sell-offs we've seen this year, in order to move the spot price of Bitcoin down to meet the price of their futures contracts.

Perhaps the institutions would like to see a lower entry point before they enter the market? But once the institutions jump in, the releasing of 8000 Bitcoins onto the open market wouldn't be able to impact Bitcoin's price in anything like the same way. Institutional investment and more regulatory oversight will also mean there is less incentive for whales to create waves.

Until we get a regulated market and custodian agreements, the price of Bitcoin and other cryptos pegged to Bitcoin is going to continue moving up and down within a certain range, but at Q4 things will start to change for the better.

Personally, I'm stocking-up at the moment. We will soon be afloat on a full sea and today’s prices will seem like a bargain by the end of the year.

Charles Hoskinson, the founder of Cardano and one of the founders of Ethereum is certainly bullish;

UPDATE, 2nd July

Now we just need a few more of these!

https://steemit.com/bitcoin/@g-dubs/coinbase-custody-launches

https://www.prnewswire.com/news-releases/cryptocurrency-market-is-starting-to-attract-institutional-investors-682789871.html

https://masterthecrypto.com/cryptocurrency-new-asset-class-institutional-investors/

https://zycrypto.com/bitcoin-price-to-soar-phenomenally-with-launch-of-crypto-etfs-institutional-investors/

https://ethereumworldnews.com/xrp-not-a-security-and-bitcoin-btc-whales-will-die-out-says-crypto-expert/

https://www.bloomberg.com/news/articles/2018-06-18/regulated-crypto-custody-is-almost-here-it-s-a-game-changer

https://www.fnlondon.com/articles/three-reasons-asset-managers-dont-invest-in-cryptocurrencies-yet-20180515

Bitcoin is still going up, I think!

Yes it is, but not just yet. It may still be manipulated below 6k, but institutional money in Q4 and a Bitcoin ETF will change Bitcoin’s fortunes. 👍

The changes will of course be

Bitcoin will take back its worth and show its the king of crypto.

@sandwichbill

I agree with you future of crypto in the world will going to rock, what i feel btc can go over $50k by end of this year and by 2020 i see it around half a million dollar .. what do u think :)

Nobody could really tell you what the price of Bitcoin will be this year, or in 2020. My estimations are a little lower than yours over the next couple of years. We could still return to December 2017 levels this year and after that there will be more to come next year and beyond. Institutional money will trigger the next Bitcoin parabolic. The trade war between the US and Europe, China could have a positive impact on Bitcoin, if it escalates further. A stock market decline in the US is also on the cards at some point, that will help.

You are right the future of crypto is great , but when it will rise again ,like BTC went $20,000 this january do you have any idea sandwichbill

Thanks for your comment. As I say in my post, once these custodian agreements are in place for institutions to put their capital into the crypto market, then the prices of the coins with a utility value will break out. This will start in Q4 this year.

Yes bro holds is gold

I vote for you, you vote for me. I like your post, your post is very good.

this is what we all want to hear

I like you

Thanks

@sandwichbill , sign does not show for bounce back, the crypto future seems to be in dark worlwide

Don’t panic. It may seem like darkness is moving across the cryptospace, but let there be light 💡 in Q4, whatever happens between now and then. Crypto may go lower before the next parabolic in Q4, but at the moment Bitcoin is still respecting in 21 ema on the monthly charts.

ok let see, what happen's in future. In India RBI has asked not to trade in indian currency

Coinbase Custody is open for business. We just need a few more custodian services, from the traditional global custodians in particular, to increase the volume of institutional investors enough to prevent the whales from being able to manipulate the market in anything like the same way 👍

@sandwichbill ok, trust is the main this which drive the market .if country major finance regulator oppose the virtual currency then how common person will get confidence

Coinbase has received regulatory approval from the US SEC to operate its custody service. As for India 🇮🇳 I think they will arrive late at the party, or risk missing out on the Fintech revolution. The same applies to China 🇨🇳 Everybody else is bending over backwards to realise the benefits of this new asset class.

@sandwichbill ok great to know that

https://steemit.com/cryptocurrency/@pareshdudhagra/which-is-better-app-for-2fa-security-google-authiticatore-or-authy

Bitcoin for Beginners - Complete Guide

https://steemit.com/bitcoin/@leonyaniazi/bitcoin-for-beginners-complete-guide