The debate is on between economist Nouriel Roubini and Vetalik Buterin of Ethereum about the actual value and merits of cryptocurrencies and the blockchain. Nouriel Roubini has described cryptos as “the mother or father of all scams”, that “will never have the tools to pursue economic and financial stability” and Roubini, who prefers to keep 95% of his wealth in cash, has branded cryptos fake cash printing machines, worse than all the QE of central banks.

So, how does Bitcoin compare to the fiat currency financial system?

We've heard people call Bitcoin a scam because it's not backed by anything, but economists Aleksander Berentsen and Fabian Schär stated in a recent FED Review that whilst Bitcoin units may have no intrinsic value, “State monopoly currencies, such as the U.S. dollar, the euro, and the Swiss franc, have no intrinsic value either.” They also stated that compared to many national fiat currencies Bitcoin is more robust and that over time Bitcoin could function as a hedge asset akin to gold.

As we know, state monopoly currencies are known as “fiat” currencies, from the Latin “Let it be done” and this means that national fiat currencies are backed by absolutely nothing and have no value other than what is implied, its stability relies solely on full human trust and faith.

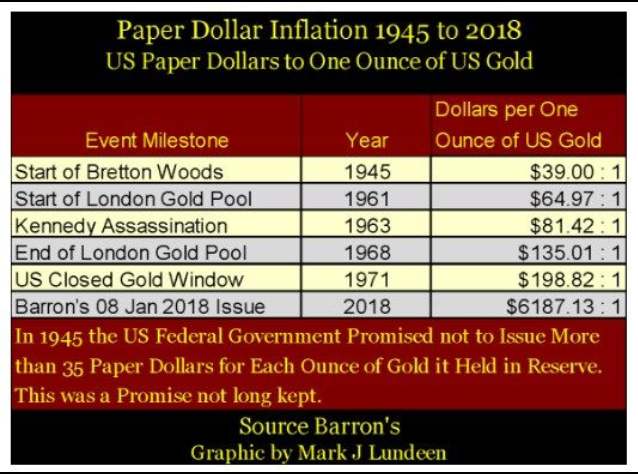

A US dollar bill used to state on it “Payable to the Bearer on Demand.” This continued to appear on the dollar until the 60s, although President Roosevelt and the US congress ended the right to convert the US dollar into gold by the Executive Order 6102 gold confiscation of 1933, forcing all banks to hand over their gold to Fort Knox, and reducing the wealth of private US citizens by almost half overnight, who had to hand over their gold in exchange for US dollars at a heavy discount.

This allowed the US government to deal with severe deflation, by pumping money into the economy and lowering interest rates to get the US out of the Great Depression. Numerous prosecutions of individuals and companies took place for non-compliance of Executive Order 6102.

An amendment by Congress, in 1933, to the Federal Reserve Act also defined paper money as legal tender, contrary to the US constitution, which states that “no State shall make any Thing but Gold and Silver Coin a Tender in Payment of Debts.”

The ability to redeem the dollar into silver ended in 1968 and all silver had been removed from 1965 onwards in quarters and dimes, with a reduction from 90% to 40% of the silver content in half dollars.

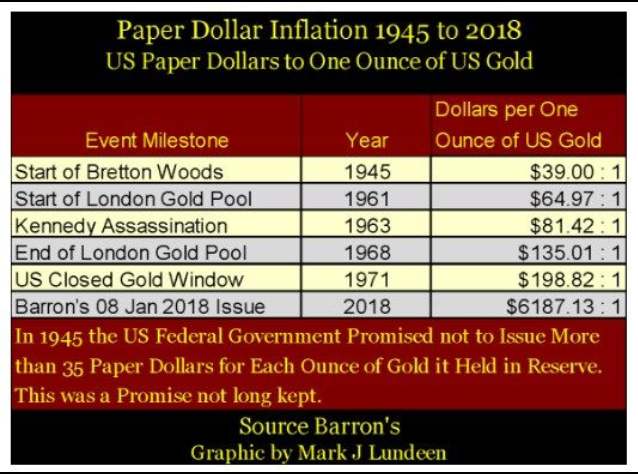

The U.S. had continued to allow foreign governments to exchange dollars for gold until Richard Nixon completely severed the peg, in 1971, with the “Gold Redemption Window”, to prevent a run on the US gold reserves by international speculators.

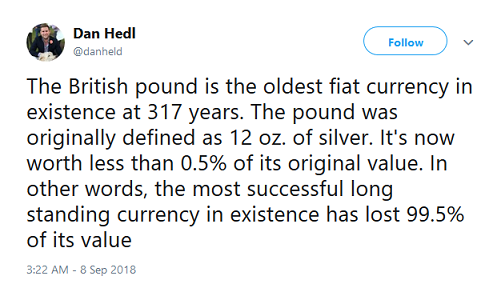

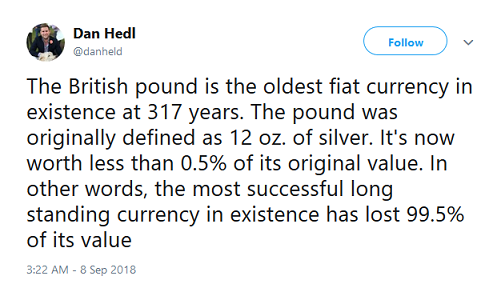

The US dollar has lost 97% of it's value, since the introduction of the Federal Reserve in 1913. The oldest currency, GBP, which has been fiat since 1931, fares much worse;

Take a look at what it says on the US dollar today, it merely states that “This note is legal tender for all debts, public and private.”

In other words, the US dollar passes as money although it is not backed by gold, silver, a commodity, or anything else. Its value rests solely on the full faith and credit that it will be honoured by the US government and that it can continue to be used to buy the goods and services in the economy and pay taxes.

Governments now use monetary policy to regulate and control the circulating supply of money in the economy and they can conjure-up trillions of extra dollars, GBP, Yen, out of thin air, by buying from private banks on the open market and crediting the accounts of banks with this new money, which they invest or lend, thus increasing the overall circulating supply, also known as inflation, because to maintain the value of a currency it must be scarce.

In 2012, James Surowiecki reported that “only about 10 percent of the U.S. money supply — about $1 trillion of the roughly $10 trillion total — exists in the form of paper cash and coins” and the level of M2 money supply has expanded by roughly 50 times since 1959.

Whilst there have been calls for President Trump to restore the gold standard, as he has previously advocated, the US would then be unable to increase the circulating supply of money without also increasing its gold reserves, but the global supply of gold increases very slowly and, as President Trump has stated, “we don’t have the gold. Other places have the gold.” Well, the US doesn't have enough gold anyway.

The value of the US dollar also derives from the fact that it is exclusively used to buy and sell oil, whilst the threat of military force maintains its importance in the international framework. However, the US dollar faces threats from a possible deal between countries such as China and Russia that oil will be transacted in Yuan and many countries around the world, such as Russia, China, Japan, Iran and Turkey are now liquidating their US treasuries, Russia has dumped 84% this year in response to US sanctions and as a “a matter of national security", because of a possible dollar crash.

Bitcoin’s value, as in the case of fiat money, derives from the demand that people place on it, but also from its deflationary, mathematically provable supply cap of 21 million, as noted by Berentsen and Schär and is secured by cryptography, which no central bank like authority has been able to alter over the last 9 years. It is also a store of value, a key feature of currencies and is beginning to prove itself as a medium of exchange, which can be used to buy goods and services and pay taxes.

Bitcoin is also the symbol of hope for a generation that has come to question the financial status quo of central banks, the unstable financial system that lurches from crises after crises, with the resulting austerity politics, the disappearance of the new deal opportunities enjoyed by their parents, their jobs being exported to countries whose workers are super-exploited and the threat of AI replacing their jobs. All of this only serves to make Bitcoin stronger and fiat weaker.

It's all just people making money out of thin air, they are just not happy that now anyone can get away with that as long as they have a decent concept. Surely there is just as much greed in crypto, but I can't understand how anyone believes it could be much better in fiat

I like here"We've heard people call Bitcoin a scam because it's not backed by anything, but economists Aleksander Berentsen and Fabian Schär stated in a recent FED Review that whilst Bitcoin units may have no intrinsic value, “State monopoly currencies, such as the U.S. dollar, the euro, and the Swiss franc, have no intrinsic value either.” They also stated that compared to many national fiat currencies Bitcoin is more robust and that over time Bitcoin could function as a hedge asset akin to gold."

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Please give such valuable post again and again. I am waiting for you.