Bitcoin Price Drops Amid Regulatory Concerns, Rising Interest Rates

Bitcoin Price Drops Amid Regulatory Concerns, Rising Interest Rates

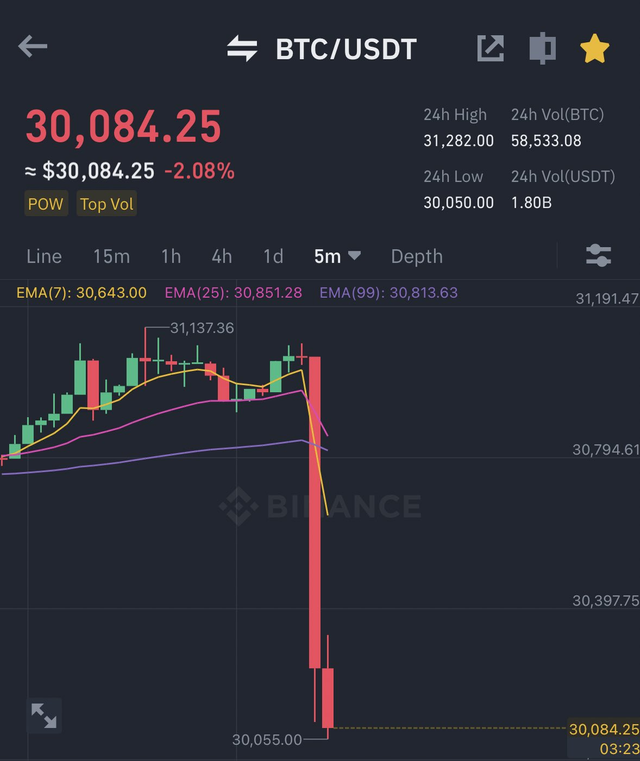

The price of Bitcoin (BTC) has dropped by more than 10% in the past week, as investors worry about regulatory concerns and rising interest rates.

The Securities and Exchange Commission (SEC) filed a lawsuit against Binance, the world's largest cryptocurrency exchange, alleging that it violated securities laws by allowing U.S. customers to trade on its platform. This news caused a sell-off in Bitcoin, as investors worried about the regulatory implications for the cryptocurrency industry.

In addition, the Federal Reserve is expected to raise interest rates several times this year in an effort to combat inflation. This could lead to a slowdown in economic growth, which would be bad for Bitcoin and other risky assets.

"The combination of regulatory concerns and rising interest rates is creating a perfect storm for Bitcoin," said Michael van de Poppe, a cryptocurrency analyst at CoinDesk. "We could see the price of Bitcoin fall even further in the coming weeks."

Other factors that could be contributing to the decline in Bitcoin price include:

Strict approach and stringent tax regime system in India. India's government has taken a strict approach to cryptocurrency, with plans to tax profits from crypto trading at a rate of 30%. This could dampen demand for Bitcoin in India, the world's second-most populous country.

Shutdown of major crypto exchanges such as Bittrex under strict regulatory environment. Several major cryptocurrency exchanges have been forced to shut down in recent months due to strict regulatory environments in countries like the United States and the United Kingdom. This could make it more difficult for investors to buy and sell Bitcoin, which could lead to lower prices.

Collapse of the largest global cryptocurrency exchange FTX. The collapse of FTX, the largest global cryptocurrency exchange, has shaken confidence in the cryptocurrency market. This could lead to further selling pressure on Bitcoin and other cryptocurrencies.