Blockchain Redefining Economy Of Scope: Know Your Onions

"Value is not intrinsic, it is not in things. It is within us; it is the way in which man reacts to the conditions of his environment." ~Ludwig von Mises

Legend has it S. G. Onions created sets of coins which were issued to schools in England from 1843 onwards; teaching aids to help children learn pounds, shillings and pence. They looked like real coins with inscriptions: 4 Farthings make 1 Penny or 12 Pence make 1 shilling. Onions’ coins had an intrinsic value directly proportional to the population of smarter students. You couldn’t spend Onions’ coins in a store but they had value. If Onions was around today his ICO market cap would be $15 million and the utility token OnionCoin would power a decentralized educational app that rewards students for learning, and those earned tokens might end up paying for college. If that sounds crazy or far-fetched or you read this first paragraph like, “what the hell is a token?” As the saying goes, it’s time to, “know your Onions.”

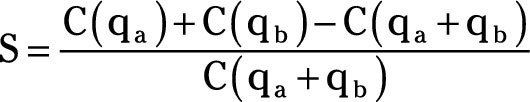

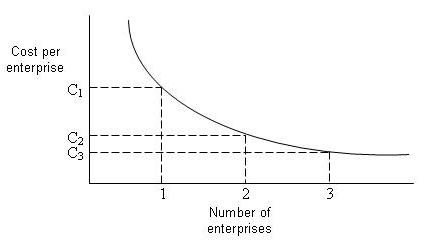

Economies of scope exist when the cost of producing two or more goods or services together is less than the cost of producing each good separately:

In the above formula, C(qa) is the cost of producing quantity qa of good or service a separately, and C(qb) is the cost of producing quantity qb of good or service b separately. The term C(qa + qb) is the cost of producing the same quantities of good a and good b together. Economies of scope, S, measure the percentage cost saving when the goods a and b are produced together. Thus, S is greater than zero when economies of scope exist, and the larger the positive value for S, the greater the economies of scope.

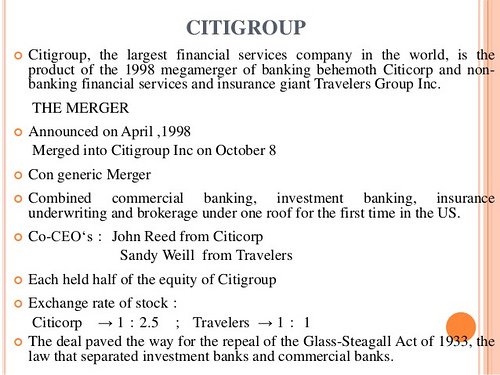

This equation is often used when a company produces multiple goods and services as a cost saving/profit enhancing mechanism; the combination of Travelers Group and Citicorp in 1998 was based on the logic of selling the financial products of the one by using the sales teams of the other, an economy of scope. Power struggles deflated integration and “cross-selling” financial products of one part of the merged firm to customers of another but by Q1 2000 the Citicorp/Travelers Group merger was lauded as a true “merger of equals” and Citigroup the most profitable company in the world.

By 2008 Citigroup was teetering on the brink of collapse holding $1.3 trillion off its balance sheet, failing to disclose an extra $39 billion in subprime mortgage exposure. Market value went from $250 billion in 2006 to $20.5 billion on Friday, November 21, 2008.

There’s short-term value for few when we accept a system built on a lie. Weill and Reed, Bob Lipp, William Campbell, Victor Menezes, Deryck Maughan, Jamie Dimon, Michael Carpenter, Prince Alwaleed bin Talal, and Robert Rubin, are just a few of the bad actors who traded value for vice. There was no true desire for an economy of scope, just a justification to gamble.

Now, what if economy of scope as an ethos is integrated into a decentralized ecosystem with no central authority? What if the very nature of your product or service is linked to an appreciating, tradable asset? And what if that asset is part of a collection of assets, linked to unique goods or services, thriving in a decentralized collaborative ecosystem, with a common base protocol, appreciating at scale together? Welcome to the ERC20.

The good actors in the ERC20 ecosystem resemble a decentralized economy of scope where each exist in an asset/utility duality and cost of production can be reduced in a decentralized peer to peer network, cutting out double-spending, and the tokenized economy when each unique token appreciates over time, creates its own value enhancing mechanism. The good actors can thrive, better together, offering market stabilization for Ethereum through gas payments at scale.

Tokens, Cryptocurrencies, and Decentralized Ecosystem

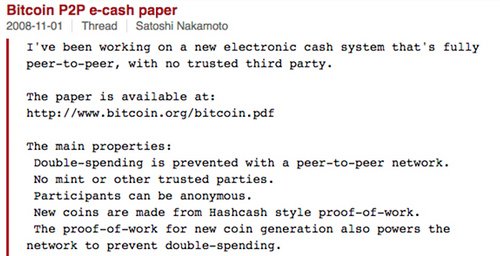

Bitcoin is the standard bearer of Cryptocurrencies. Released on Halloween 2008 by cryptographer Satoshi Nakamoto, Bitcoin introduced a few key integrations that define our accepted understanding of digital currency.

In Proof-of-Work miners solve complex math problems and receive rewards, in this case, Bitcoin, which is exchanged through a chain of digital signatures, where each new block has all the information from the previous blocks; a shared, encrypted, accounting ledger knows as Blockchain.

Bitcoin had a slow birth and adoption rate until 2013 when we started seeing Bitcoin morph into both an accelerated appreciating asset and a fungible means of exchange. Soon altcoins began emerging, utilizing blockchain technology in different ways, adding more security, or speed, or privacy. The original altcoins were forks of the Bitcoin blockchain including Namecoin, Dogecoin, Litecoin, and many others.

Other Altcoins developed their own unique methods including Maxcoin, Ethereum, Ripple, Omni, NEO, and many others that are emerging in the world of crypto. Some blockchain and others unique distributed ledger value propositions like HashGraph.

Also in 2013, 19-year-old Vitalik Buterin publishes the Ethereum white paper. Building off of the Satoshi inspired blockchain, Vitalik integrated a programming language and came up with a system to facilitate easy adoption, creating a standardized protocol for a decentralized means of exchange through smart contracts. Processing power to run these smart contracts come from a distributed network of nodes, rewarded with Ether tokens for verifying contacts and recording transactions. Ethereum is one big shared global computer. Cool right?

Satoshi is the unit of measure for Bitcoin so all transactions happen with a utility exchange of Satoshis. In Ethereum, Ether is the coin produced and gas is the transactional cost. New products and services started using the Ethereum protocol to create their own unique tokens. Tokens can represent an asset that is fungible and tradable and also serve as a unique utility or service; distributed to the public through an Initial Coin Offering (ICO) also known as a Token Generating Event (TGE).

In the Ethereum value proposition nodes earn gas through staking. Decentralized Apps known as dApps drive the next iteration of Ethereum, the ERC20 ecosystem, where dApp scalability directly increases gas payments, a net positive impact on the price of Ether as more ERC20 Tokens scale.

Large ERC20 market caps increase the market cap of Ethereum. Assets that are using Ethereum/gas are also going to benefit heavily from a larger Ethereum economy, so when ETH goes up, they will also go up. And those in collaborative ecosystem, thriving in a radical rethink of economy of scope will be the cream that rise to the top.

Collaborative Ecosystem > Value Web

Value webs create value based on knowledge exchange that drives proactive production of goods and services, through various collaborative processes. The decentralized token economy and ERC20 ecosystem are proving that knowledge exchange accelerates through collaborative ecosystem, and at critical mass.

It's starting to get a lil' bit crowded in the ERC20 space with 43,000+ token contracts and a market share over 91%. And that number changes daily. With this level of volume we aren't seeing the rise of a new asset class, it's been here, with a total market cap that is edging ever closer to 1 trillion dollars.

In this swarm of new currency there are winners and losers, there are valuable token utilities, securities, and as many bad actors as a Lifetime Original Movie. Not Without My Bitcoin, starring Roger Clinton and that guy from the Room. Oh hai Mark! Almost every other day there’s a spike, some beanie baby token or fetish coin with no real value being pump-and-dumped for a quick buck, and that may change with new SEC regulations.

For the new ICOs set to launch, ask yourself: What are the friction points to market and who in the ERC20, and the greater cryptoverse, are the right fit for collaborative ecosystem to accelerate process? With a broad spectrum of valuable enterprise assets and services in the crypto strata that math is simple. Align with the ones that add value, saving your users money, time, and offering them true data ownership. Your value depends on it.

The new flock of ICO launches are in a unique position to be the good actors that create interoperable and collaborative ecosystem through the use of goods and services (and tokens) that exist today. That OnionCoin bonus round would be a hot ticket!

I think that the way to see the market will be shifted.

ICO's and recent innovations/shifts are radically transforming the economy along with the market.

I think that the old systematic understanding framework might be too inefficient for development and will instead be nested into other sciences. This pattern is well visible in IT domains.

I agree! There's a paradigm shift, but that core, that foundation has been present in this space for some time. IoT is really a dramatic shift in understanding how these emerging economies communicate with one another and with AI, radically changing how we use and view tech, and accelerating the shift from legacy systems of technology, communication, economy, - it's everything. We are really just scratching the surface of a much deeper experience.