BITCOIN Just Blew Through $1,900 to Hit New All-Time High... BERWICK VS. DUANE

by SGT, SGT Report:

Bitcoin hit a high of $1,918 USD according to real time data on Coinbase Thursday night, before pulling back to $1,902 at the time of this posting. The granddaddy of cryptos has been on a tear today, rising 5% or $90 USD. Bitcoin is up $690 USD over the past month, a 57% increase in just 30 days.

There remains several schools of thought on the crypto currencies, and Bitcoin in particular. About a year ago I became vocal about the potential rise of Bitcoin back to stratospheric levels and advised listeners to consider taking a small, speculative position in Bitcoin as a hedge against inflation, and as a gamble on the potential for the crypto to hit new all-time highs. Which it has, and then some.

Clif High's web bot project predicted the current rise of Bitcoin, and if memory serves, this leg of the rise is predicted to go just slightly north of $2,000 USD. Then, if web bot data proves accurate, one can expect a massive retraction, possibly as much as 50%, before Bitcoin once again continues the march to brand new all-time highs -- with web bot data indicating an ultimate price north of $10,000 USD (a price that most certainly suggests the beginning stages of hyperinflation of the US Dollar).

For critics who continue to demonize and doubt the viability of Bitcoin, the evidence may now be tipping against them. In late May, Japan announced that Bitcoin would be accepted as a legal payment method beginning on April 1, 2017. And on May 11 Coin Telegraph reported that Australia will recognize Bitcoin as money and protect Bitcoin businesses, while exempting the crypto currency from goods and services tax.

We continue to cover the crypto currencies which appear to be impervious to the criminal element on Wall Street that use Comex to create unlimited amounts of DIGITAL precious metal to cap the prices of PHYSICAL silver and gold - metals which have been REAL money for more than 5,000 years.

As I stated above, there remains two prevailing thoughts about Bitcoin:

It's a fantastic opportunity and it represents the future of decentralized money.

It's a con, a Ponzi scheme - a new Tulip bubble meant only for the greater fool.

So far, camp #1 is in the lead. And it's a lead that continues to grow.

Here are two new videos from You Tube producers we respect, representing group 1 and group 2.

[By the way, THANKS for the UP-VOTE or RE-STEEM, I really appreciate it!]

WannaCry Ransomware Virus Is a Globalist False Flag Attack On Bitcoin - Jeff Berwick

BitCOiN and Ransomware - Chris Duane

In my opinion Bitcoin will fail. Can you trust a currency that is reliant on vulnerable technology?? With the creation of a number of new competing cryptocurrencies being developed and eventually diluting the market. If a cyber attack occurred would your Bitcoin be safe. Would you intrust thousands of dollars to the system? How long before Government infiltrate this technology and causes it to fail? Why would Government do that? Because central banks will not tolerate a currency that they do not have complete control over, thats why. If they cause a failure in the system, then people will lose confidence in them, unless of course the federal government comes to the rescue and offers to insure the currency FDICA baby. Look what they did to Precious metals. The feds found a way to manipulate it and fix it. The banks simply print and sell enough paper contracts to dilute the market. Some say that there are up to 200 hundred paper contracts per ounce of gold. The silver and gold markets are easily moved by the simple push of a computer key. They must regulate it in order to keep the value of the dollar intact. The same is true with cryto. If they let the market run, paper currencies would diminish in value. Is it possible that the cryptocurrency was ordained by the central banks as a trail to see if people would buy into this type of monetary system? But for now enjoy the wealth it has created, just don't think they will let the party continue.

BUY CRYPTOES SEEL THE US DOLLAR

The dollar will begin its 18 year cycle with a 9 year downturn period to the eurocurrencies as it always has done. This will probably be very bullish for precious metals.

Check out this post for more on the cycles of weakening US dollar and the current state of the dollar.

https://steemit.com/dollar/@sjovmaiin/the-coming-fall-of-the-us-dollar

I say to sell the Paper and Digital Fiat dollars and buy Pocket Change... @pocketechange

I hear ya wct, I'm following you now - gotta keep an eye you man! :)

Some added reading you may find interesting. These are words of Konstantinos Karagiannis

CTO, Security Consulting, Americas, BT.

But is it safe?

My RSA 2017 talk, “Hacking Blockchain”, includes a fair amount of time explaining historic and current attacks faced by all implementations of the technology. A lot of these attacks are old school, focusing on supporting technology and not on the blockchain itself.

Consider attacks against credentials used at an online cryptocurrency exchange. Such exchanges act as hot wallets, or storage of funds available for transacting online at any time. Traditional authentication hacking of these sites can lead to illegal transactions. Some attacks are even more creative, such as the ability to force a cold or offline wallet to become hot and therefore a target for fraudulent transactions.

The major issue I cover, though, is the inherent flaw on page one of Satoshi’s paper. That elegant if pesky line about “computationally impractical to reverse” transactions. You see, the crypto behind cryptocurrency is actually public key. We are likely less than three years away from this being completely hackable by a quantum computer.

Facing reality.

Fantasy? Hardly. Labs around the world have already proven that quantum computers can run Shor’s Algorithm and almost instantly find the private key of a public key pair even 4,096 bits long. Because of how public key works in most blockchain implementations, including Bitcoin, this would mean any time a transaction occurs, a quantum computer has everything it needs to obtain a user’s private key. Spend a single cryptocoin, and any entity with a quantum computer can download that currency’s blockchain, see your transaction, and in a few moments spend the rest of your funds.

The threat seems even worse if you consider blockchains designed to prove ownership of land or other critical identity-related transactions. A private key attack here can lead to an irreversible type of identity theft, at least within that blockchain ecosystem.

The NSA has already warned against the use of non-quantum-safe encryption. Its’ time to realise we may be rushing towards putting everything on a digital house of cards rather than an unbreakable chain. Let’s fix blockchain’s inherent flaws now, before it’s too late.

If you want to see our Blockchain demo in person, why not visit Innovation 2017, our technology and innovation exhibition taking place in June.

$0.00Reply Edit Delete

I share your skepticism. While crypto appears to be impervious to the same level of manipulation found in all other markets, it is difficult for me to believe that there are asset classes and tech that are immune. The recent, massive increases in the value of crypto remind me of the rapid share price advances in precious metals mining stocks in 2016. I believe that the manipulators were the main purchasers of those stocks last year. Which were then strategically sold off in tandem with pm to suppress sentiment. With that said, cryptocurrencies must be taken note of and may be an incredible opportunity for astute and risk tolerant people.

These are words of Konstantinos Karagiannis

CTO, Security Consulting, Americas, BT.

But is it safe?

My RSA 2017 talk, “Hacking Blockchain”, includes a fair amount of time explaining historic and current attacks faced by all implementations of the technology. A lot of these attacks are old school, focusing on supporting technology and not on the blockchain itself.

Consider attacks against credentials used at an online cryptocurrency exchange. Such exchanges act as hot wallets, or storage of funds available for transacting online at any time. Traditional authentication hacking of these sites can lead to illegal transactions. Some attacks are even more creative, such as the ability to force a cold or offline wallet to become hot and therefore a target for fraudulent transactions.

The major issue I cover, though, is the inherent flaw on page one of Satoshi’s paper. That elegant if pesky line about “computationally impractical to reverse” transactions. You see, the crypto behind cryptocurrency is actually public key. We are likely less than three years away from this being completely hackable by a quantum computer.

Facing reality.

Fantasy? Hardly. Labs around the world have already proven that quantum computers can run Shor’s Algorithm and almost instantly find the private key of a public key pair even 4,096 bits long. Because of how public key works in most blockchain implementations, including Bitcoin, this would mean any time a transaction occurs, a quantum computer has everything it needs to obtain a user’s private key. Spend a single cryptocoin, and any entity with a quantum computer can download that currency’s blockchain, see your transaction, and in a few moments spend the rest of your funds.

The threat seems even worse if you consider blockchains designed to prove ownership of land or other critical identity-related transactions. A private key attack here can lead to an irreversible type of identity theft, at least within that blockchain ecosystem.

The NSA has already warned against the use of non-quantum-safe encryption. Its’ time to realise we may be rushing towards putting everything on a digital house of cards rather than an unbreakable chain. Let’s fix blockchain’s inherent flaws now, before it’s too late.

If you want to see our Blockchain demo in person, why not visit Innovation 2017, our technology and innovation exhibition taking place in June.

$0.00Reply Edit Delete

Same thought... I think this bubble will pop very soon back to around 1000$. Yes ... cryptocurrency is just getting started, but bitcoin has to many flaws.

These are words of Konstantinos Karagiannis

CTO, Security Consulting, Americas, BT.

But is it safe?

My RSA 2017 talk, “Hacking Blockchain”, includes a fair amount of time explaining historic and current attacks faced by all implementations of the technology. A lot of these attacks are old school, focusing on supporting technology and not on the blockchain itself.

Consider attacks against credentials used at an online cryptocurrency exchange. Such exchanges act as hot wallets, or storage of funds available for transacting online at any time. Traditional authentication hacking of these sites can lead to illegal transactions. Some attacks are even more creative, such as the ability to force a cold or offline wallet to become hot and therefore a target for fraudulent transactions.

The major issue I cover, though, is the inherent flaw on page one of Satoshi’s paper. That elegant if pesky line about “computationally impractical to reverse” transactions. You see, the crypto behind cryptocurrency is actually public key. We are likely less than three years away from this being completely hackable by a quantum computer.

Facing reality.

Fantasy? Hardly. Labs around the world have already proven that quantum computers can run Shor’s Algorithm and almost instantly find the private key of a public key pair even 4,096 bits long. Because of how public key works in most blockchain implementations, including Bitcoin, this would mean any time a transaction occurs, a quantum computer has everything it needs to obtain a user’s private key. Spend a single cryptocoin, and any entity with a quantum computer can download that currency’s blockchain, see your transaction, and in a few moments spend the rest of your funds.

The threat seems even worse if you consider blockchains designed to prove ownership of land or other critical identity-related transactions. A private key attack here can lead to an irreversible type of identity theft, at least within that blockchain ecosystem.

The NSA has already warned against the use of non-quantum-safe encryption. Its’ time to realise we may be rushing towards putting everything on a digital house of cards rather than an unbreakable chain. Let’s fix blockchain’s inherent flaws now, before it’s too late.

If you want to see our Blockchain demo in person, why not visit Innovation 2017, our technology and innovation exhibition taking place in June.

$0.00Reply Edit Delete

Why is it vulnerable? And if it gies down, dont we have more serious problems thsn money ? The present system actually relies more on the network than bitcoin. Everything hrinds to a halt!

Yes, you are right. It is better to do something rather than nothing. As long as people spread it out and diversify more now than ever, hopefully one of the things they invested in will get them through.

I keep hearing these same arguments while people are having great gains in crypto. You my be right, but i think your thoughts are holding you back. Just dip your toe in. Noone says sell all you metals and buy bitcoin. FOMO is happening.

These are words of Konstantinos Karagiannis

CTO, Security Consulting, Americas, BT.

But is it safe?

My RSA 2017 talk, “Hacking Blockchain”, includes a fair amount of time explaining historic and current attacks faced by all implementations of the technology. A lot of these attacks are old school, focusing on supporting technology and not on the blockchain itself.

Consider attacks against credentials used at an online cryptocurrency exchange. Such exchanges act as hot wallets, or storage of funds available for transacting online at any time. Traditional authentication hacking of these sites can lead to illegal transactions. Some attacks are even more creative, such as the ability to force a cold or offline wallet to become hot and therefore a target for fraudulent transactions.

The major issue I cover, though, is the inherent flaw on page one of Satoshi’s paper. That elegant if pesky line about “computationally impractical to reverse” transactions. You see, the crypto behind cryptocurrency is actually public key. We are likely less than three years away from this being completely hackable by a quantum computer.

Facing reality.

Fantasy? Hardly. Labs around the world have already proven that quantum computers can run Shor’s Algorithm and almost instantly find the private key of a public key pair even 4,096 bits long. Because of how public key works in most blockchain implementations, including Bitcoin, this would mean any time a transaction occurs, a quantum computer has everything it needs to obtain a user’s private key. Spend a single cryptocoin, and any entity with a quantum computer can download that currency’s blockchain, see your transaction, and in a few moments spend the rest of your funds.

The threat seems even worse if you consider blockchains designed to prove ownership of land or other critical identity-related transactions. A private key attack here can lead to an irreversible type of identity theft, at least within that blockchain ecosystem.

The NSA has already warned against the use of non-quantum-safe encryption. Its’ time to realise we may be rushing towards putting everything on a digital house of cards rather than an unbreakable chain. Let’s fix blockchain’s inherent flaws now, before it’s too late.

If you want to see our Blockchain demo in person, why not visit Innovation 2017, our technology and innovation exhibition taking place in June.

$0.00Reply Edit Delete

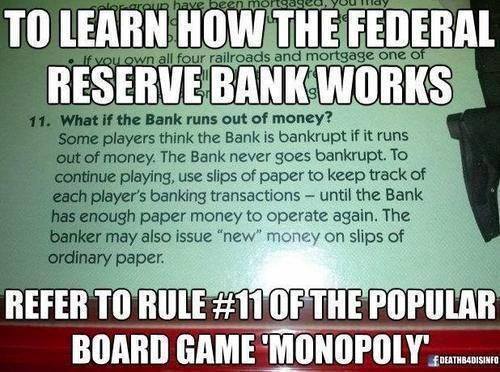

When in DOUBT, always refer to RULE # 11.

Hey guys.

Since im new i want to introduce myself.

I make weekly calls on silver every sunday. Please check out my blog, follow and comment with critisism, discuss my view etc. I hope you check it out since im new on this platform. I got here on recommendation of the great Gregory Mannarino.

If you follow me i always follow back.

Cheers

That's priceless jtest.

Hey Sean,

Been following you for years. Glad to see you here on STEEMIT.

Glad you like the meme. It is actual rule of monopoly,.. can you say programming?

The history of the board game Monopoly can be traced back to the early 20th century. The earliest known version of Monopoly, known as The Landlord's Game, was designed by an American, Elizabeth Magie, and first patented in 1904 but existed as early as 1902.

Awesome !!

Up voted and re-steemed! Thanks Sean! Great article, and still love your comment about posting the videos on Steem, let Youtube carry the serving costs, ad free!

Thanks brother, I'm following you now too!

Check out my thoughts on this... $2100 is next in my opinion I explain why here

https://steemit.com/@starsteem/bitcoin-just-shot-up-usd80-to-usd1-822-in-the-last-2-hours-usd2-100-next-just-my-thoughts

I Upvoted and resteemed @sgtreport Thanks for this!

Starsteem out

Thanks star, will do.

always nice with free views on trading. check out my channel too :)

Love your work. Resteemed!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://sgtreport.com/2017/05/bitcoin-just-blew-through-1900-to-hit-a-new-all-time-high/

sgtreport is verified as the owner of that domain and youtube channel, can you please whitelist @cheetah , @anyx ?

This is the official SGT Report channel on Steemit. Thanks for stopping by. ~Sean

THE GREAT STEEMIT SECRET

https://steemit.com/economy/@sgtreport/the-great-steemit-secret-and-pedogate-update

haha i know its annoying isnt it? It cant figure oit that You are SGTreport? lol anyway dude yeah thats why I bought the 1TH mining contract on the brand new pool.bitcoin.com 1TH LIFETIME (while profitable) 1 TH for $150!

I am so adicted to smeeit! I feel i have to post liek ever minute now but i ccant post crap i only allow myself to post quality and sometimes if i see an aticcle i wanna rpeort ill make sure nooen else alreayd submitte one!

But yeah cheetah almost made me think you just copy pasted tis froom SGTreport untill I realized you ARE sgtreport LOL

Anyway ueah I got those 1TH mining contracts and spent $150 then $300, they uppe dthe minimum to 2TH and i emailed the owner asking if i could get a1TH but then i relzied ii cant wait or theyll be gone! it was 700 TH left yesterday now only like 200 at time of my buying and now im checking..probly less than 100 TH left! They can use the money they made off all these contracts to buy NEW mining hardware and then offer NEW contracts! But by then price of BTC will go up, and I also just cant pas sup a LIFETIME btc mining contract (until profitable) and its gona be many years of btc mining being profitable since BTC price just keeps rising!

LOl ceck out this VERY relevant Video I made of the Moana "How far Il Go" but for Bitcoin and i even show steem ripple steller etc

Are you plowing your Steem dollars into Steem Power? What's your strategy? BTW< I'm not up to speed on the mining contracts mention. Thanks for the info though!

I'm with you pal! I saw the potential of bitcoin back in 2014 and started buying every month. I miss the months when I could buy 6 bitcoins in one month. I doubt we'll ever see that again.

Hey guys.

Since im new i want to introduce myself.

I make weekly calls on silver every sunday. Please check out my blog, follow and comment with critisism, discuss my view etc. I hope you check it out since im new on this platform. I got here on recommendation of the great Gregory Mannarino.

If you follow me i always follow back.

Cheers

Awesome posts once again. Thanks for keeping us informed. DR

Hey digestingreality, thanks for caring enough to even want to BE informed in the first place. The sheeple people generally don't possess that quality.

:)

This is true. So many people I know just bury their heads in the sand or play follow the leader. They are completely incapable of free thought. Thanks for responding. DR

Following.

Thank you. Love your posts!

I been watching you for years, Welcome.

thanks art, glad to be here. Following you.

Great article. I wish I had gotten into bitcoin when it was less than $10.00 Sigh.............