Modern Portfolio Theory for Cryptocurrencies- Efficient Frontier

I love cryptocurrencies and HODL, buy, sell and have written about them for independent online newspapers (and now for my fellow Steemians 😊)

Equally, I am a student of Economics and Finance and believe in having a Balanced Portfolio of the various asset classes to suit my risk ability and risk tolerance.

This post aims to give you a quick overview of an essential financial concept, provide you with links to some excellent websites which have vital data and how this concept can be used in the world of cryptos so that you can maximise your returns while lowering your overall risk.

Whenever I hear articles in cryptocurrency magazines urging you to build a diversified portfolio, I notice they never explain how quite to achieve this! This lack of clarity is probably a function of the imperfect availability of information (until recently) required to efficiently create what is known as Modern Portfolio Theory (MPT) or ‘Mean-Variance Framework’. However, with the collection of data over a longitudinal time period and now publicly accessible through sites such as the Yahoo Finance Cryptocurrencies Section creating an Efficient Frontier is now possible with a little elbow grease and the magic of Excel.

Quick History of MPT and Efficient Frontier

If you have not already clicked on the links and had a review of what these concepts are about, then let me give you a quick overview of what they are and what they are not:

NOT:

- The name Modern Portfolio Theory is misleading as it is far from being Modern. It was introduced by Harry Markowitz a Nobel Prize Winning Economist in 1952.

- An Efficient Frontier is not a ghost town located somewhere in Nevada! 😊

ARE:

- Have you heard the saying 'don’t put all your eggs in one basket'? Well, simplistically put that is what MPT is all about. It is all about analysing the risk-return trade-off. It is the crucial model used by Central and Investment banks, Pension funds, during the process of portfolio construction.

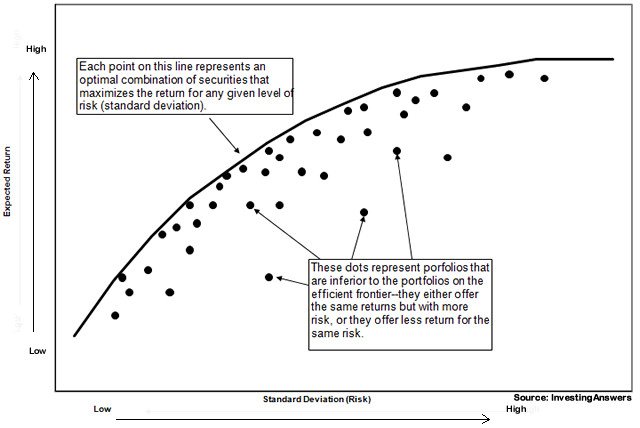

- The Efficient Frontier is the cornerstone of MPT. You can think of it like this: Different cryptocurrencies will produce different returns. Say if you select three cryptos for your portfolio then the Efficient Frontier will represent the best combinations of these three cryptocurrencies. Every point on the Efficient Frontier represents the maximum expected return for a given level of risk. Below is an example of a model of an Efficient Frontier which will provide you with a better insight into this concept and its importance:

Before you get into the couple of excellent YouTube tutorials which explain how you can construct and Efficient Frontier using Excel I have posted below, I would recommend you read this recent article by Coin Telegraph. It is a well written article on risk diversification in a crypto portfolio and will arm you with some key concepts and ideas.

After searching YouTube extensively, I found these two videos (Parts 1 and 2) which explain in a very lucid manner how to construct an Efficient Frontier (Albeit he uses stock data. For our purpose use the Yahoo Crypto link provided earlier to substitute and follow the steps). The thing is the videos are not just how to create Efficient Frontier using Excel, but he offers the logic and reasoning behind the use of the MPT and Efficient Frontier which I found most impressive and useful for someone new to the subject matter:

Part 1: How to Build Efficient Frontier in Excel

Part 2: How to Build Efficient Frontier in Excel- CAL and Use of Sharpe Ratio

Please do leave comments below if you need any further clarification or have any feedback.

Next time I look forward to demonstrating how another combination of top-down and then bottom-up portfolio methodologies can be adapted to cryptocurrencies to use your parameters so that you can use readily available online tools and spot crypto opportunities among the approximately 1,600 out there. I have used this technique to spot some new cryptos which I would never have otherwise looked at, and have made me significant gains in under a month.

Peace,

Shenobie

Such an interesting post.Nice way to discribe,keep it up.

Hi @nahid05,

Thank you for you kind words and awesome feedback. I look forward to producing more similar posts shortly.

Regards,

@shenobie

nice

Thank you @leyox.

Hope all is good.

Cheers,

Shenobie

Finally, someone else discussing MPT! I am going to follow and upvote you. You deserve my resteem, shenobie.

Hi @zanwaltz,

I appreciate your feedback and kind words. I look forward to producing more work that is of interest shortly.

Best Regards

Shenobie

Resteemed!!! brilliant concept

@zeus2010,

I greatly appreciate this! You are a star!

Regards,

Shenobie

I haven't been looking into MPT but have been examining my portfolio closely and trying to find the best way to allocate it. In my overall portfolio I'm treating crypto in a way similar to emerging markets.

However, the breakdsown of that small allocation is the hard part.

Hi @mcdform

I like the way you have compared cryptos to Emerging Markets (EM)! They share similar characteristics as they have high volatility (Std Dev) and differing levels of correlation to traditional assets.

The question of allocation is always a difficult one- it is entirely dependent on a person’s risk ability and risk tolerance. However, if you look at Emerging Market Capitalization as a % of World Market Cap, if I remember correctly, it was around 25%. Does this mean we should allocate 25% of our wealth to EM? I guess the answer is not as simple as is the case with cryptos.

As we are dealing with a very young and unregulated market, you should consider the following risk factors when considering allocation: Information Asymmetry, Lack of Transparency, Lack of Governance and Liquidity issues (with quite a few cryptos).

However, by using MPT, we can combine this new asset class with our traditional mix to enjoy higher returns while lowering the level of overall level risk associated compared with say just owning cryptocurrencies.

When generating the Efficient Frontier, you allocate the weights to each of the assets in the portfolio (see video 1), and it will allow you to review the model then choose the best portfolio that gives you the level of return you expect at certain volatility you can handle.

The videos are excellent as they teach you how to build an Efficient Frontier and show you the concepts at the same time.

Best Regards,

Shenobie

Extremely valuabe information. You're in a unique position as it seems to be the rare individual who has a decent understanding of both finance and cryptocurrencies. There is quite a learning curve in all of this and your post eases it quite a bit! Well done, indeed.

@technoguy,

Thank you for your detailed feedback. It means a great deal to me.

Look forward to catching up soon.

Shenobie

Thanks for your support @shenobie!

Your contribution is appreciated.

To have your post shared with over 10,000 followers send 0.250 SBD or STEEM to @crystalhuman, your post will also be shared to twitter at https://twitter.com/Marketechnologi

✅ Send 1-2 SBD/STEEM for 100-200+ Upvotes.

Congratulations @shenobie! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThis post has been rewarded with 30% upvote from @indiaunited-bot account. We are happy to have you as one of the valuable member of the community.

If you would like to delegate to @IndiaUnited you can do so by clicking on the following links: 5SP, 10SP, 15SP, 20SP 25SP, 50SP, 100SP, 250SP. Be sure to leave at least 50SP undelegated on your account.

to get community support and guidance

. Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Resteem bot Service! Promote Your New Post.Find New Followers - Upvotes. Send 0.400 SBD to @stoneboy and your post url in memo and we will resteem your post to 9500+ followers from two different account.@stoneboy and @vimal-gautam.