The Worst Could Be Over for Bitcoin Price amid Exhausted Bears

While there may not be any glaring signs of a bitcoin turnaround in the market, the technical signals are suggesting that the worst of the selling pressure could be behind. Traders didn’t panic in response to the latest wave of bitcoin ETF disapprovals by the SEC, which is a sign of resilience, but there’s more.

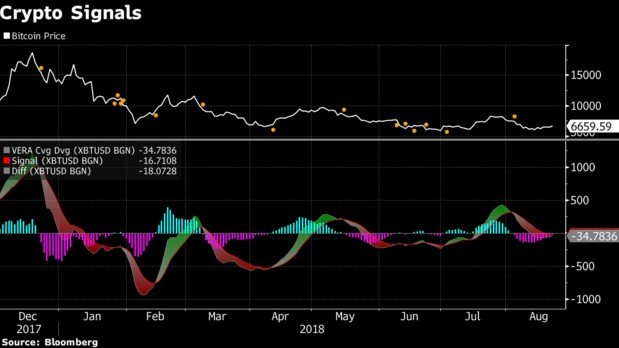

A Bloomberg report spotlights the technical signals, in particular, the GTI VERA Convergence Divergence Indicator, which is applied to identify “trend exhaustion” using MACD modified by GTI’s in-house Volatility Explosion Relatively Adjusted theory. The indicator reveals that the current trend for bitcoin is about to reverse course, taking the reins from the bears and placing them with the bulls. And if history is any teacher, this could be where the rally of 2018 begins.

According to Bloomberg, GTI’s VERA Cvg Dvg indicator previously accurately predicted a trend reversal that was followed by a bitcoin rally of nearly 40% in the following weeks. Considering the bitcoin price has lost more than half its value year-to-date, with a current price of approximately $6,464, such a rally couldn’t come too soon.

Anecdotal Signs

The beginning of a trend reversal that triggers a rally in the bitcoin price one month from now coincides with the outlook provided by BitMEX CEO Arthur Hayes, who believes the buyers will emerge once the summer malaise has ended. Hayes accurately predicted in July when bitcoin was trading at approximately $7,500 that the price hadn’t yet bottomed.

Meanwhile, in today’s commentary, Mati Greenspan, eToro Senior Analyst and Hacked.com contributor, pointed to the scalability of the Bitcoin network, observing a “significant drop” in the number of unconfirmed transactions since the beginning of 2018. The reasons, he suggested, are two-pronged, comprised of a fewer number of transactions per second coupled with the integration of SegWit technology.

“In November and December, the bitcoin blockchain became flooded by too many transactions as the miners weren’t able to confirm them in a timely manner. However, from the start of this year, that problem has completely vanished,” Greenspan said in the note.

In fact, the rise of SegWit adoption coincided with the decline of transactions on the Bitcoin network, and SegWit integration has picked up even as the bitcoin price has weakened, he pointed out. If the GTI VERA Cvg Dvg indicator is correct and a bitcoin trend reversal and rally are up ahead, a more scalable Bitcoin network couldn’t have come at a better time.sourcedhacked.com

Regards

Rocky

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hacked.com/the-worst-could-be-over-for-bitcoin-price-amid-exhausted-bears/

Congratulations @shoutloud! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard and the Veterans on Steemit - The First Community Badge.

Resteemed your article. This article was resteemed because you are part of the New Steemians project. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch