Crypto Users Who Did These 4 Things Performed Better

Investing in cryptocurrencies is a complex process. The amount of information on effective strategies is still limited for this emerging market and many investors are still experimenting with strategies to find what works for them. In order to cut through the noise, we have taken a data driven approach to discover what has been effective over the last year. By constructing and running backtests for hundreds of thousands of different portfolios under different conditions, we have been able to produce results that illustrate promising strategies from the last year.

These simple strategies can be integrated into your investment portfolio today. They don’t require extra funds, expensive tools, or a significant time commitment.

Rebalancing Frequently

Rebalancing has been a strategy used by traditional financial institutions for decades. In the crypto market, rebalancing can take advantage of the extreme volatility which provide opportunities to repeatedly buy low and sell high. Over a long period of time, these results can compound to improve performance. Our most notable evaluation of rebalancing can be found here:

Rebalance vs. HODL: A Technical Analysis

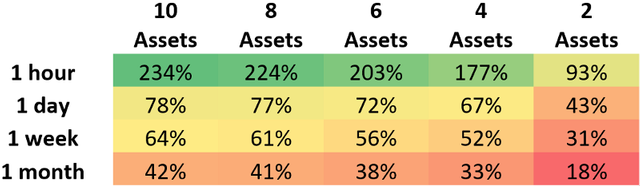

The conclusions of this study demonstrated that the frequency of rebalancing played an important role in increasing the median performance over the last year. The results can be summarized by the following chart.

The median performance demonstrates that lower rebalance periods with a higher number of assets presented the highest returns for rebalancing. Each value represents a percent increase OVER buy and hold. That means a value of 18 means the median of that group performed 18 percent BETTER than buy and hold.

While monthly rebalancing provided a 42% median performance increase over buy and hold, 1 hour rebalances introduced an astonishing 234% median performance boost. This means simply the act of increasing the frequency of rebalances was able to provide a large increase in value for a portfolio during the last year.

Selecting Mid Cap Assets

The last year has seen intense swings in value for most crypto assets. While many investors may know the successes of large market cap assets, what we have found is that it was actually mid cap assets which performed the best. Over the last year, these mid market cap assets outperformed both small and large market cap assets to provide the largest returns. A deeper analysis of these findings can be found in this article:

Evaluating Crypto Portfolio Performance Based On Asset Market Capitalization

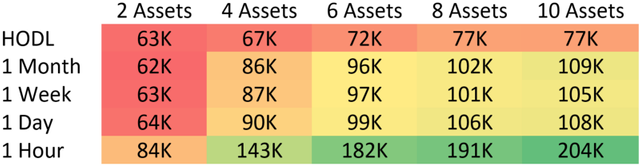

The conclusions drawn from this article demonstrated that mid market cap assets resulted in the highest portfolio value after 1 year. These results are summarized in this chart:

These values represent the median total holdings of mid market cap portfolios after one year based on a $5,000 initial investment. The top left value represents the median portfolio which performed no trades over the course of a single year and contained 2 assets. The bottom right represents a portfolio of 10 assets which rebalanced every 1 hour. Every cell represents exactly 1,000 backtests which were combined to calculate the median.

The highest performance for mid market cap assets was also when rebalanced every 1 hour. This illustrates a clear advantage for mid market cap assets which were rebalanced frequently.

Diversifying to 16+ Assets

Cryptocurrencies have presented exciting opportunities over the last year. Huge profits have dared investors to shoot for the moon by investing heavily in a few risky assets rather than focusing on stable growth through diversity. Results from our studies have shown that diversity tends to add value to portfolios over the long term. You can read our most prominent study discussing diversity here:

Crypto Users who Diversify Perform Better

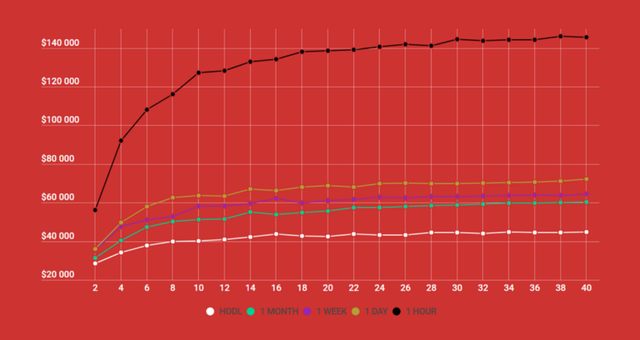

The conclusions drawn from this study strongly support the case that portfolio diversity had a positive affect on performance over the last year. Around 16–18 assets in a portfolio, the returns began to level off, however increasing the number of assets continued to provide higher returns after one year. This graph summarizes the results.

This graph shows the results of a $5,000 initial investment that varied the number of assets in each portfolio. Each data point on the graph is 1,000 backtests which were run by randomly selecting the number of assets on the x-axis. Each line on the graph represents a different strategy. These strategies increased the frequency of rebalances from HODL to 1 hour rebalances.

The highest performing portfolios in this study were those which both held the most assets and rebalanced frequently. Although adding more assets continued to provide additional returns all the way up to 40 assets, the increase began to have diminishing results after 16 to 20 assets.

Maintaining an Even Distribution

Although we observed that diversity showed positive trends over the last year, the type of diversity matters. This is why the next study we introduced examined the way allocation distributions affected the performance of a portfolio over the last year. Our latest study discusses these findings here:

Optimizing Asset Distribution For Cryptocurrency Rebalancing

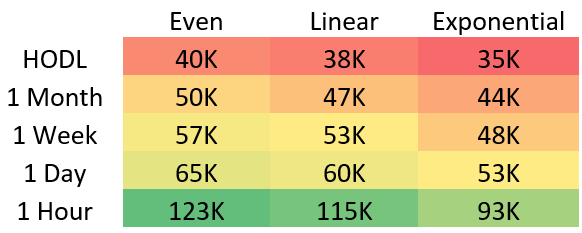

The conclusions we can draw from this study are that more evenly distributed portfolios performed better over the last year. As assets become more unevenly allocated, the returns over the past year suffered. This chart summarizes the results:

These are the median portfolio values for each set of backtests. Each value represents 1,000 backtests. With a starting portfolio value of $5,000, these median values represent the final value held by the portfolio after 1 year.

The highest performing portfolios in this study were evenly distributed and rebalanced every 1 hour. Both linear and exponential asset distributions reduced returns over a 1 year period.

Conclusions

The last year showed that these four things generally improved performance of crypto portfolios on average.

- Rebalancing frequently

- Selecting mid market cap assets

- Including more than 16 assets

- Evenly distributing assets

These simple adjustments made a world of difference. Without expensive tools or complex strategies, these 4 improvements drastically changed the returns over a year of investing.

Shrimpy Can Help

The Shrimpy website can help automate this entire process. Quickly select assets, instantly allocate a portfolio, and rebalance on a consistent time period. Shrimpy is the easiest way to manage your portfolio. Best of all, it’s completely free to use right now!

Sign up by clicking here.

If you still aren’t sure, try out the demo to see everything we have to offer!

Additional Reading

Portfolio Rebalancing for Cryptocurrency

The simple backtest for rebalancing a crypto portfolio

10 Tips for Creating a Killer Cryptocurrency Portfolio

Don’t forget to check out the Shrimpy website, follow us on Twitter and Facebook for updates, and ask any questions to our amazing, active communities on Telegram & Discord.

Leave a comment to let us know your experiences with Shrimpy!

The Shrimpy Team

Ok I get it but how did they choose the assets? I usually have 10-15 projects at any given time and reallocate after taking profits.

Great question! The assets were chosen randomly. The purpose of these studies was to compare all portfolios, instead of specific portfolios. This allows us to see how the strategies are performing rather than the selected portfolios. Each article provides a more in depth explanation as to how assets were selected, included in the study, etc. Please let me know if you have any other questions!