[0244] - Bitcoin Breaks $4k, "Desperation for Gains" Hits Crypto Market

I've said it before and I'll say it again. Technical analysis without psychology is just lines and triangles.

Overnight, Bitcoin "hit the line of resistance at $4k" and the twitterverse erupts. The hype sets in. Calls for a bull run outweigh the FUDsters like myself who think the market is in for another dip to the lows.

The optimism is false. It's actually desperation in my mind and a bearish signal.

Why? Am I vitamin D deficient? Am I a depressing Dan?

If the majority of people are calling for sharper climbs, that relies of ever greater amounts of capital entering the retail market to support it. Hype alone doesn't propel price. At some stage solid and steady capital have to underpin the price move or else the momentum will run out and turn to the downside.

Like a plane that has run out of fuel and goes into a nosedive. Which is exactly what I predict will come next. A correction.

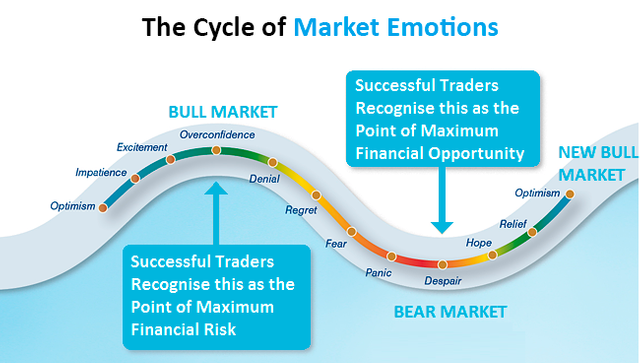

If you look at the info graphic above, I place the crypto market somewhere just after "despair". With the recent altcoin rally ( which are sporadic & short lived in many cases ), "hope" has only just come onto the horizon. In other words, we can see the light at the end of the tunnel but we're still driving in the dark tunnel.

While I agree you can do some ( very ) short term swing trading of alts, I expect a sweeping correction within the next month that will see us again at these price levels around late May or June. All based on psychological progressions that need to play out, not lines & triangles.

The fact that as soon as Bitcoin pipped the $4k mark, Twitter erupted with polls asking whether $6k was the next target told me the market is delusional. Are you kidding? Bitcoin passes some imaginary "line of resistance" for 5 seconds and it's viewed as a solid move higher from here?

Where is the logic in that?

The calls for a higher price of Bitcoin is really desperation caused by a long, drawn out bear market. Everyone is desperate to see the market move higher. Desperate to see the market can buy a lambo or help pay down debts. Given that a high percentage of people are up to their eyeballs in debt, you have to calibrate the market sentiment to factor for that.

Debt ridden speculators are desperate for any gain. They aren't patient for sold ones.

The calls for a higher market move aren't based on solid traction or a period of strong confidence. It's based on a strong desperation to escape the lows and the lifestyle that goes with it.

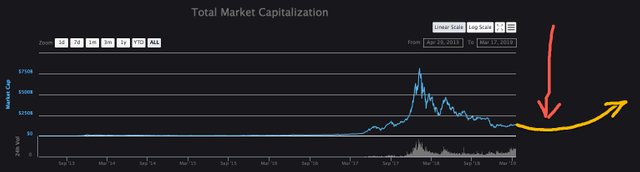

If anything, Bitcoins rise to $4k signals that we have just left despair... and the train is slowly moving towards hope. Hope is flickering. Whereas despair is still the dominant state of mind in the market.

The thing about the infographic above that shows the psychology of trading is that it is based on actual human psychology. The progression depicted is not random. It's a fixed sequence that human beings move through in daily moods and our longer emotional cycles.

If you understand the chart, you will see a story. You will also see that each emotional state cannot be altered, skipped or sidestepped. They all play out. And given that the crypto market is based on thinking & psychology, the market will follow that sequence. Almost robotically.

Which is why it boggles my mind that technical analysts don't relate charts to psychological states of mind. The reference is to mathematical lines of resistance, etc as opposed to emotional states that you any human being can recognize.

The TA I commonly see is really "advanced confusion" and an effort to appear intellectual. Lines and triangles with no substance to support what human beings are actually thinking. The divorce of TA from human thought processes is perplexing.

At the moment, sure, there will be signs of hope and definite money to be made trading alts, but I wouldn't bet the farm on anything long term just yet. You will have the chance, just not yet.

To be honest, I expect a "sweeping correction" that leads us into an upswing later this year and the market takes off from there in a 2-3 year bull trend. Given that a lot more capital has to flow into the market than during the 2017-18 bull market, other analysts also think this as well and predict a 2022-23 parabolic mania.

For now, given where we are in desperation and false hope, reality will kick in at some stage and we will see a fall to "retest" the lows. This process will take a month or four to play out before "hope" starts to assert itself as the dominant mentality and desperation begins to fade.

For now, while we are in the neighbourhood of despair, there is a high probability of silly trading mistakes that lead to disappointment. One of the biggest ones is the "bull trap" or tying up your cash flow in coins that are about to fall in price, thereby causing you to miss the real gains to be made when hope and real confidence kicks in around or after mid-year.

The recent signals should inspire you to get ready for the bull run. Doing some homework as opposed to pulling the trigger.

Thanks for watching,

Brendan Rohan - Indie developer of 'next gen' natural medicine from Melbourne, Australia

Www.Skyflowers.co ( see "botany" tab for the plant research )

Www.ClinicalFlowerTherapy.com

Social @iSkyflowers

YouTube Skyflowers.Tv

If you support natural medicine and an independent research project that began in 1997, then steem me. The creds I get will help me provide a solid body of information that future generations can build upon.

DISCLAIMER: This article and all information on this channel & all content is offered purely for educational & entertainment purposes. Always do your own research when investing money and seek the help of a registered financial advisor.