What Is the Bitcoin Reward Halving and Why Should You Care About It

Bitcoin‘s value is currently standing at its highest level since 2014, trading at around US$770 a unit at the time of writing. Last time we’ve seen this level was in February 2014, while the digital currency was trending downwards following all-time highs of more than US$1,000 a bitcoin.

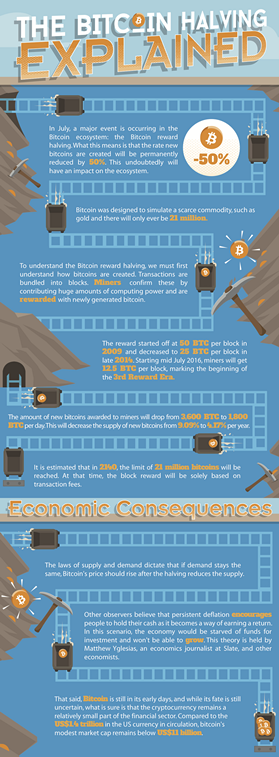

The sudden price increase comes ahead of a very important event in the bitcoin world: the Bitcoin reward halving, or “halvening.”

How are Bitcoins created?

To understand what the Bitcoin reward halving is, you first need to understand how bitcoins are created.

Bitcoins are produced by people and businesses, running computers all around the world, using software that solves mathematical problems. This process is called “mining,” and “miners” are rewarded with a certain number of bitcoins in exchange, in addition to the fees paid by users sending transactions.

The Bitcoin network collects all the transactions made during a set period into a list, called a block. Miners confirm these transactions and write them into a general ledger called the blockchain.

Mining is an important and integral part of Bitcoin that ensures fairness while keeping the network stable, safe and secure.

What is the Bitcoin reward halving?

Bitcoins are created at a decreasing and predictable rate. The number of new bitcoins created each year is automatically halved over time – halved precisely every 210,000 blocks – until bitcoin issuance halts completely with a total of 21 million bitcoins in existence, set to be reached in 2140.

Currently, a successful miner finding a new block is rewarded with 25 bitcoins. In July, the reward will be halved to 12.5 bitcoins per block: this event is called the Bitcoin reward halving.

In mid-July, the halvening will mark the début of Bitcoin’s third reward era.

Bitcoin was built this way to reflect the characteristics of a commodity, such as gold. The idea was also to create a medium of exchange independent of any central authority, transferable electronically, with very low transaction fees.

Because the monetary base of bitcoins cannot be expanded, bitcoin is often qualified as a deflationary currency.

Since supply is limited, there will come a point where, as demand rises, the value of the currency will only go up. This could lead to an increase in hoarding.

Some economists are unconvinced of the viability of bitcoin as a currency, arguing that deflation is bad for the economy since it incentivize individuals and businesses to save money and not invest in businesses, create jobs and value. After all, if simply holding cash becomes a way of earning a return, why would anyone want to invest in anything else?

Others point out that bitcoin’s deflationary nature won’t necessarily prevent it from flourishing as many deflationary currencies have flourished in the past.

“The analogy is gold,” Simon Johnson, a professor of entrepreneurship at the MIT Sloan School of Management and a senior fellow at the Peterson Institute for International Economics, told Wired in an interview.

“Gold is a finite resource, and until the big South African discoveries in the 1890s, there wasn’t that much gold. But people were happy to make payments with it. The whole idea that people won’t make payments with something that’s finite and held as a store of value is not correct.”

We’ve simplified the explanation of the halving with CoinJournal’s new infographic below:

"I think the fact that within the bitcoin universe an algorithm replaces the functions of [the government] ... is actually pretty cool. I am a big fan of Bitcoin" - Al Gore

bitcoin will be further developed in the future

Wow Bitcoin is rocking and #cornwins!

It's a new world!

we wait