A Real Life Example of How To Arbitrage Bitcoin And Ethereum

The concept of arbitrage trading has long held many a merchant’s fixation, especially when it can be done consistently. Arbitrage, which is the practice of simultaneously buying and selling a product or commodity for an instant profit, is usually up there along with Sports Illustrated models on a trader’s list of all-time favourites.

Arbitrage is usually made possible by a clear differential in trading volumes between different markets. That’s because in a market where product is much more scarce, there is likely to be a somewhat higher – and less consistent – stream of offers. In the 1970s, when computers made trading almost instantaneous for the first time in history, traders found they could pick up a commodity in a heavily-traded market where the price was relatively cheap and simultaneously execute a sell order in a different market where the same commodity was much more scarce, and therefore, expensive.

Due to the flourishing of quantitative systems designed to spot such aberrations in the stock, bond and foreign exchange markets, there aren’t too many of these opportunities still lurking about any more, at least not ones retail traders can meaningfully profit from.

Except in digital currencies. In the case of digital assets such as Bitcoin and Ethereum, in particular the past two months has represented something of a bonanza for virtual arbitrage traders. Volumes have risen sharply nearly everywhere in the world, while the primary exchanges on which digital assets trade remain somewhat cumbersome barriers to entry for many buyers. This is partly due to KYC (money laundering) hurdles that exchanges require in order to legally accept meaningful sized orders, and partly due to the exchanges themselves, which, depending on where they are located, often limit selling amounts to a daily maximum.

When inconsistent barriers to entry is combined with a bull market, arbitragers come out in full bloom.

A Real Life Example: How To Arbitrage Ethereum & Bitcoin

How does a regular digital currency (or even trading) enthusiast get started in arbitraging digital assets then? For a start, it helps to have bank accounts in more than one country, so if you’re at school or working overseas, especially if you live very far from your place of origin, you’re likely to be at an advantage. Second, you have find a reasonable amount of volume to ensure the few percentage points in gains you make are worth the effort. Finally, you should preferably find an exchange which is more than happy to welcome you.

A great example of an exchange that is positively welcoming sellers right now is the UK platform Bittylicious. Just go to their home page and you’ll see a classified-style ad actively soliciting your help selling to their users:

That’s a great sign, as it means the platform is probably experiencing higher volumes than it is able to feasibly serve. Bittylicious makes the following guarantee: if you have the better price, you get to sell first to the Bittylicious buyers, which is how an exchange always works: the trader with the fairest price gets taken out before the trader with the slightly dearer one, and so forth.

Early in the UK Saturday morning, Bittylicious’ most competitive sellers were offering the following prices for Bitcoin and Ethereum:

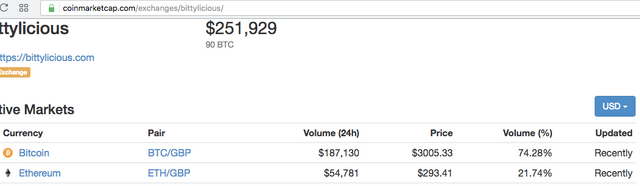

In other words, assuming you could better 2,359 GBP/BTC and 231.44 BTC you would be selling next. How much Ethereum are Bittylicious’ buyers likely to want from you, however? By checking the exchange volumes at Coinmarketcap, we discover that just shy of $250,000 of Bitcoin and Ethereum was bought and sold over the Bittylicious platform in the past 24 hours:

Assuming roughly 300 customers per day, and that is about $800 per trade average, which sounds probably about right.

In order to beat the Bittylicious sellers at their own game, a logical place to look would be a market with deep pockets of liquidity. Essentially, it’s either the North American-populated or mainland China platforms that are going to provide the best purchase venue for the digitally Brexit arbitrager.

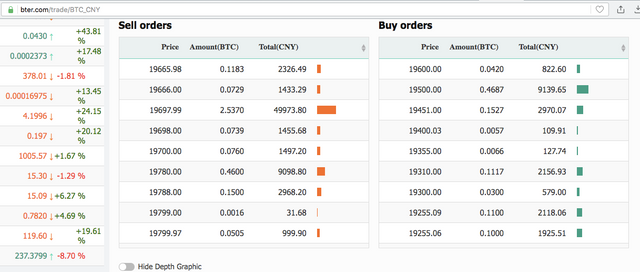

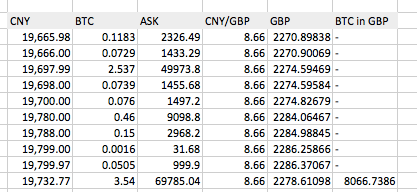

One of the more accessible Chinese exchanges, BTER, offers an interesting possibility. The most competitive prices are going to be if you can pay for BTC and ETH in Chinese Yuan Remninbi as opposed to another digital currency:

There are several ways to get the commodity in CNY, but the most common are either to begin your own Wholly Foreign Owned Enterprise in one of the outlier provinces and have a corporate Bank of China account set up (very easy), or, to find a friend or relative in the country to buy the commodity for you in their native currency.

In the case of Bitcoin, I can get about 3.5 BTC for about 8,000 GBP, which probably represents about equal the number of trades represented here (N/B. the buy and selling volumes on exchanges relative to their own local supply are almost universally similar even if the prices are not.) The worst price per BTC I will have to pay is about 2280 GBP. Now, Bittylicious needs a seller to beat 2,359 GBP, remember, so suppose we put a seller order in place at 2,330 GBP.

In other words, there is 2-4% profits in this trade, which, spread over the 8,000 GBP available, means about 200-400 GBP. By conducting the same exercise for ETH, we get almost exactly the same result: there’s a 1.9%-4.2% difference in price between BTER and Bittylicious.

How Much Would A Bittylicious-BTER Trader Make A Month?

Assuming we could capture 20% of the daily Bittylicious volume then, which is about $45,000, then 3% of that amount is $1,350. Let’s say our trading system gets good enough to execute in this manner 3 days out of a possible 7 days a week, and we do this four weeks in a month. If that is the case (and it’s not an unrealistic case by any means), then the arbitrager will make $16,200 in profits that month. Of course, there are a number of considerations, including buying CNYs, but since the purchase is taking place in the local China currency, as long as there is some sort of domicile there it should present no problem to repeatedly do this. Exercising profits in British pounds is clearly a cinch.

And that is how digital currency arbitrage works: in other words, the profit is right in front of your nose, there for the taking. To make it yourself, you really only have to Ask.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.coinspeaker.com/2017/06/10/real-life-example-arbitrage-bitcoin-ethereum/