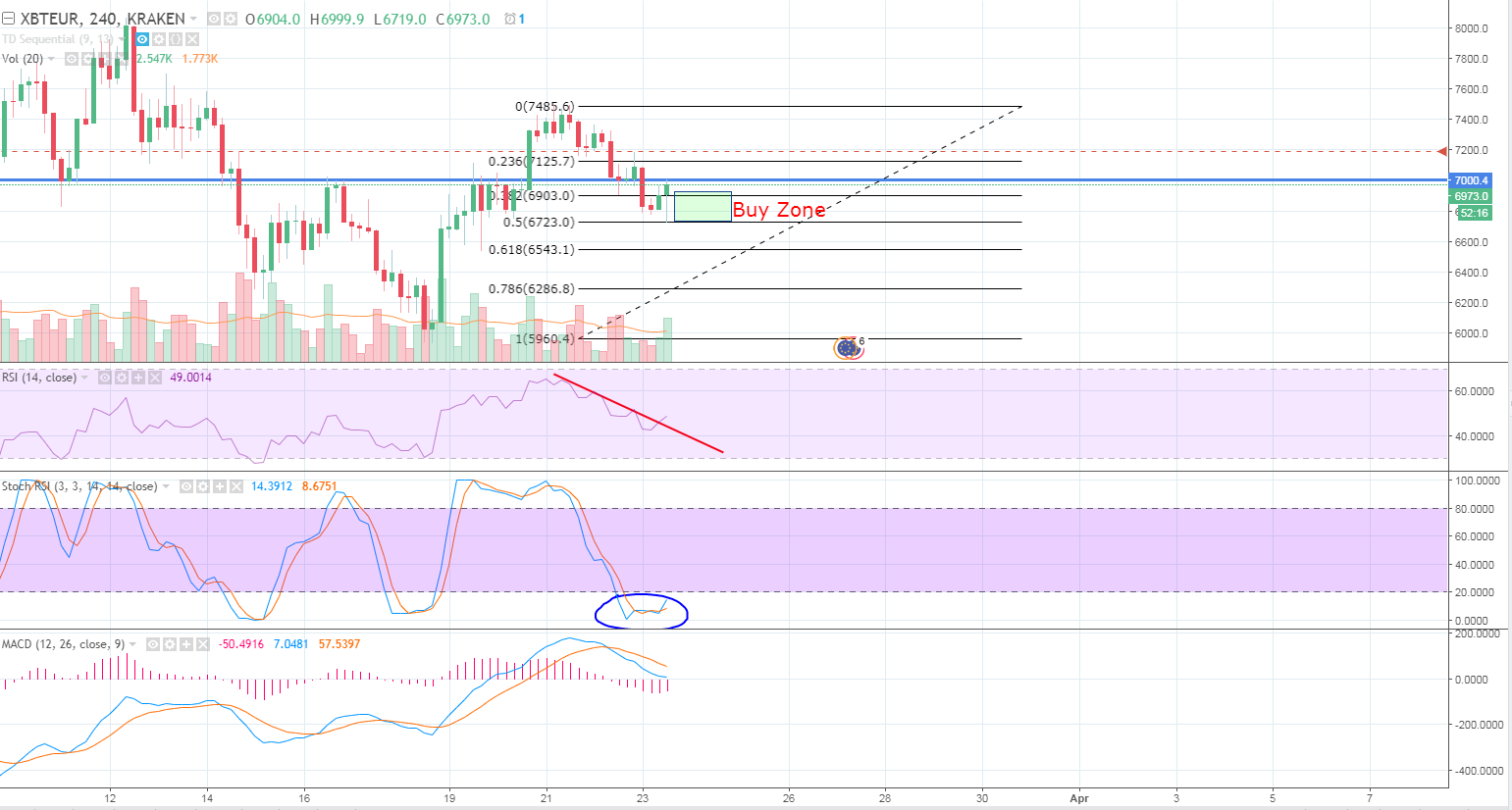

Bitcoin Market/Technical Analysis Shortterm 23/03/2018

After an amazing run, Bitcoin is eventually cooling off. However, the price of Bitcoin dropping more than first expected.

Reasons

Of course a lot investors and traders try to find possible triggers for this drop. At first, a piece of news about the biggest Altcoin exchange Binance was declared as the main reason. To be more detailed, there are rumors that the government of Japan warned Binance for acting without a license in Japan. At the time of writing, it is not yet clear if this is acutally legit or fake. However, I dont think that this is affecting the Bitcoin price that much.

Another trigger could be another noticeable red day of the stock markets, which is much more realistic in my opinion. The Dow Jones Industrial Average lost about 4% in the last two days . While this might seem like a joke to the crypto markets, it is an outstanding priceaction for stock markets. I'll definitely focus more on stock markets correlation with the crypto market, since it might affect the future development heavily.

Technical analysis / When to buy?

In the last hour Bitcoin has touched the 0.5 Fibonacci level. While this could already have been a nice buy-in opportunity, indicators of the 4 hour chart show, that me might dip a tiny amount further. - While I wrote this the Bitcoin price suddenly started to rise up very very fast, sitting now again right at the old resistance region. This can now mean that we have another uptrend before us, where the 9500$ area could be our target. My new entry point is the 0.382 Fibonacci Level, which equals 6900€. The volume, the RSI and the Stochastic RSI signal that a new uptrend is actually possible and realistic. The fast bounce might be a consequence of the US stockmarket which just openend in the green.

This is not investment advice, I am not a financial advisor. I am not responsible for any decisions made by the information given in this article