Make trading simple, logical and consistent. A look at stop losses and my strategy

This is possibly going to be my last Steemit post as I feel that I've shared enough knowledge on here that can take somebody with no clue of the market to a level in which they can identify key zones, limit the amount of gambling that takes place when trading, and overall improve their understanding of how a chart works.

My aim is to share the knowledge I've gained but also to help people stop depending on unreliable indicators that get overused, and to drop the dependency on people who have thousands of followers (for one reason or the other) that are wrong in their calls, making people lose a lot of money purely through being able to shout to a bigger audience. Number of followers is not proportionate to amount of trading knowledge.

My other aim is to get people to be able to look at the chart and make sense of it. Indicators don't help you with that. Wall Street cheat sheets don't help you with that. Only you putting a serious amount of time in front of the charts with the right direction can help you understand what you're seeing.

I've covered several different topics on technical analysis. Whilst they're not the entire depth of my knowledge, they are more than enough for anyone to study and practice for 6-12 months and become a consistently profitable trader, in my opinion.

I would suggest reading things in this order:

1 - engulfs. Understand how to find what levels are important

2 - flags. Understand how to identify and draw basic flags

3 - supply and demand. Understand the underlying principles of what the chart is showing

4 - support and resistance. Understand how certain price points can hold the chart down/up

5 - fresh orders. Understand why some levels are not worth looking at and increase your odds of a better trade

6 - FTR. Enhance your understanding of supply and demand with a nuanced piece of price action

7 - MPL. Understand how to take the best entry

8 - QM. More enhancements for entries

From there on, you're on your own, however I will be checking for comments/questions. You can also follow me on Twitter at https://twitter.com/technical_anal

In this post, I'll be talking more about my strategy with a real life example of it in practice. I'm in it for the long haul and sometimes I have to miss out on trades due to my rules, and improving your emotional control is another journey you'll need to undertake.

In this example of my strategy, I'll also explain how I use stop losses. Only in very extreme conditions should your stop loss be hit, or if you fail to follow the strategy properly due to greed.

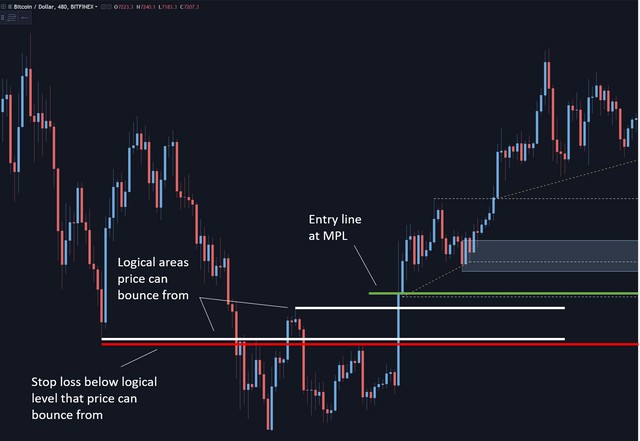

Let's look first at taking an entry - at MPL of course.

The top "logical area" is an SR flip

The bottom "logical area" is a support line where we had a near 30% increase in value from originally - you can can feel pretty safe that this will bounce price when we get back to it, especially since there isn't too much noise between there and a revisit.

The idea of this strategy is that if our entry level is engulfed, we are as close to the bottom of that engulf as possible (MPL) so that when price bounces, we have the opportunity to escape at break even or a tiny profit. If we are correct and the engulf doesn't happen, we are the lowest point possible in the demand zone to get more favourable R:R.

A quick revisit to my engulf article: when we get an engulf of a key level, that indicates that price wants to head in that direction.

In almost all cases, when we have a legitimate engulf, price will retrace. This can be quite deep or shallow. With the idea in mind that it's shallow, we can get out without suffering a loss, or at a minor loss. I like to err on the side of caution.

When I say "legitimate engulf", I mean that sometimes we can fake a level to take out some stop losses and bounce. Here is what looks like a fake out at present:

Let's now go back to the level in the first picture and see how it played out.

This was a pretty strong downward move which had a lot of people worrying. The patient can come out unscathed, especially with the right preparation.

The first bounce engulfed the SR flip line as well as MPL of the structure above but then went on to retrace back into the zone. At 7700 is where I cut my position, in the second circle.

However, had you not done that, we then got a second bounce just before that big support line which took us right back into the zone. Although I've circled one area, we actually had 5 opportunities to get out. The big wicks should also be an indication of the next sentiment.

If you STILL hadn't read the signs, we had a third bounce which gave us even more of a reason to finally accept things and get out. We had a lower high, and then another lower high before the drop.

And really, you could even look at this as a short setup that formed on the retouches of the zone, especially if you had got out early.

I have begun to determine when to exit these types of scenarios in order to make sure I don't fall victim to a fakeout of the level.

Essentially, if the engulf is around or more than 50% from my entry to my stop loss, I will automatically cut the trade on the retrace. If it's not, then I'm happy to give it a bit more time to run, especially with a logically placed stop loss. We've seen in the example above that price did indeed engulf around 50% on the first drop.

The second example I posted however (the fakeout), we could let run.

As I already said, sometimes it won't work in extreme drops or rallies, but I'm confident enough with my experience to say that about 95% of the time, we'll retrace. The key is to ensure you have a logical stop loss that's wide enough to let you stay in and not be the victim of a stop run.

Sometimes we may get a 50% engulf and then go on to have a big move in the other direction after cutting the trade. It's just one of those things you have to take on the chin. Longevity is the key. Entering at MPL can save you a lot of downsides and losses, but you can also miss some trades. This is why I said you need to travel a path of improving your emotional control. That's the real test in trading.

Hopefully now you can see why patience pays off and to aim for MPL.

Congratulations @technicalanal! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @technicalanal! You received a personal award!

Click here to view your Board

Hey, how's your trading nowadays?