AML and KYC issues for Bitcoin in China

When it comes to money laundering, you have to see how it works in China to know what is possible even though much has changed. For one, I have seen this happen in real life because I know people involved in this type of business. I remember a case in China about 17 years ago when a Chinese general was asking around his close associates on how to 'exchange' his money.

He had about US$100 million in paper notes, he was happy to pay a premium to have that amount transferred into an account outside of China but didn't know how.

So a group of friends tried to help him out, the only problem was during that time was that the underground banking system in China was only able to transfer about half a million USD a week to Hong Kong and it would take months to make all of his ill gotten gains to re-appear in Hong Kong. There were concerns for the money laundering folks that the money itself was peppered with fake notes. To protect their own interest, half a million at a time was all they are willing to take. There is no honor among thieves so to speak.

The military general in question was uncomfortable as the longer period of transfer would expose his hand in the game, so he declined and sought other ways to make his money reappear on foreign soil. I know that he had the real currency in hand but he wasn't willing to leave a paper trail that would lead to his doorstep.

In China, money laundering is a death sentence. Once convicted, you are made to kneel and they put a bullet at the back of you head. There are no court appeal processes which can secure your freedom.

Moving large amounts of paper money was only possible through Macau, where Banco Delta Asia played a hand in moving money out of China for casino gambling. Later it became exposed for activities related to Pyongyang's money laundering game. Banco Delta Asia isn't a big bank by any standards. It was reputedly started by casino tycoon Stanley Ho to fund his gambling business with the blessings from Beijing. This was all before the China handover of course.

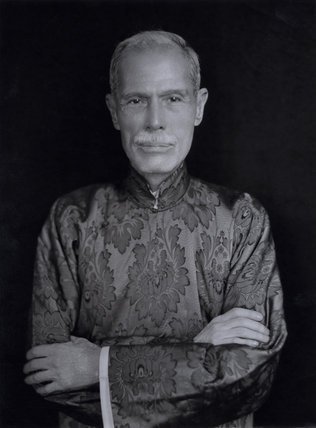

Ho is of course related to Sir Robert Ho Tung (Bosman was his sir name), who by the way isn't even Chinese to begin with. He was a Hong Kong Taipan in the colonial days and was evidently white. If there was ever a term for a Caucasian Chinese, Bob Ho Tung would be it. In terms of relationships, Stanley Ho's grandfather was the brother to Ho Tung. Robert Ho Tung made his money during the Opium era, where opium trading was legal in Hong Kong but illegal in China. Ho Tung was also known as the richest man in China at one time.

Success of Bitcoin as a currency for underground Banking

China has a thirst for foreign currency. Whatever paper dollars are in China will remain in circulation in the country, but it changes hands all the time. With the largest bitcoin mining rig in the world, China dominates the bitcoin industry. They were responsible for forking BTC to Bitcoin cash recently as a means to improve the transactions. The whole forking exercise is a bit technical so I won't be going into detail.

For the paper dollars that exist in China's ecosystem, these can be exchanged for BTC or ETH without the authorities ever knowing it. Even after the final exchange that will shut its doors at end September, there will be other ways to move money.

For China, there are two immediate destinations for money laundering, Hong Kong and Macau. Properties in two of these colonial enclaves skyrocketed after the handover when many were predicting a slump. Needless to say that many elite Chinese want to settle in these two places. In fact, many retired Chinese government and military elites end up living in these two places to further their business ambitions.

Virtual currencies like Bitcoin and Ether will always find a home there.

It is a fact that in the West, BTC and ETH are the preferred underground currency of choice and this is obviously the case for China as well.

Many ICO's outside of China found a way to tap into the purse strings of the Chinese elites by having their holdings of virtual currencies converted into token securities. The problem here is that ICOs may implement KYC and AML measures but that alone isn't going to stop the flow of money into ICOs. You can always use a legitimate third party to buy and sell ETH or BTC, and once this is passed back to you, the virtual currency of choice is redeemed into a virtual token from an ICO. This is how may you move money from one source to another. This is no different than paying a premium to Pros to have your money moved from mainland China to foreign soil. There is also nothing stopping one person from selling his bitcoin in a closed underground market in China or in Hong Kong and Macau.

The concept behind KYC and AML is to watch for some kind of money laundering patterns. If the person is exchanging BTC and ETH on a regular basis, that person will be put on a watch list. But how many ICOs actually share investor information to Interpol or the Finance industry? Do you think that they would care when no regulations are in place where they operate?

For the most part, AML isn't a effective tool anymore once virtual currencies like Bitcoin and ETH can be converted to cash like in the case of a Visa debit card like Bitpay and UQUID. This completes the cycle of a fiat currency. You can buy physical goods with it as well as use it as an investment instrument.

So for the naysayers of virtual currencies, the joke is on you.