Macau's First ICO will be in Hong Kong

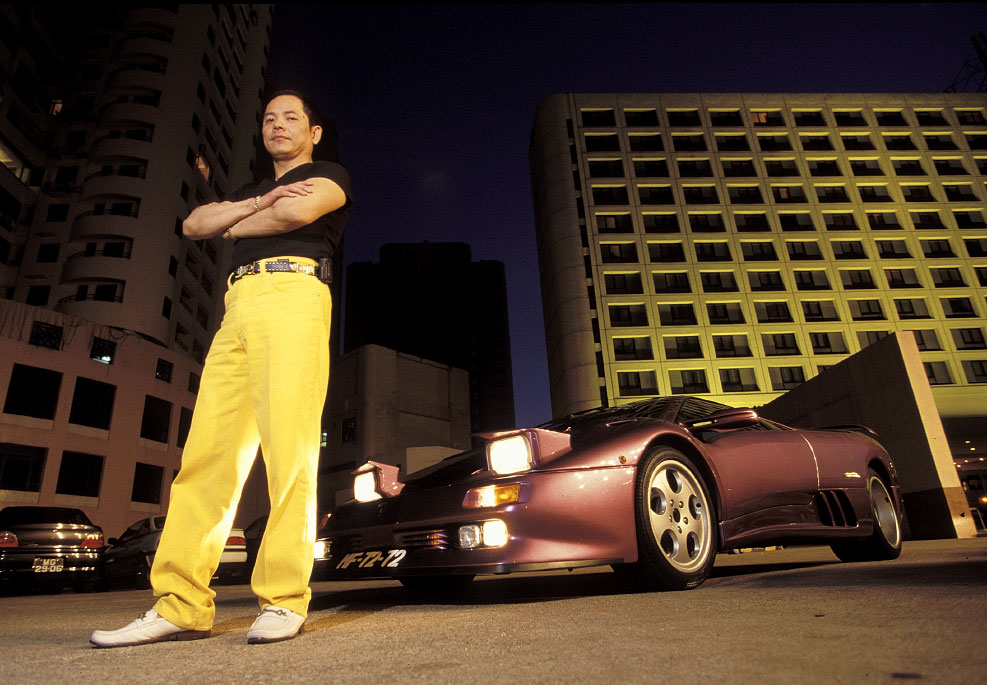

Broken Tooth with his Lambo

Broken Tooth with his Lambo

There is no denying the interest to put your Bitcoin to use if you live in China. Ever since the crackdown started, BTC naysayers were rejoicing but their celebrations were short lived when it started to go up again, thanks largely to commercial investors like JP Morgan who were buying into the trade whenever even when CEO Jamie Dimon declared it to be a scam.

Such sharp declines are good for the speculative business. A month ago, BTC was at an all high of US$4.6K and today it is US$3.9K. By end September, when all BTC and ETH exchanges are to close officially in China, there should be a rush to clear the virtual currency from China and taking that value down even further. But the value of both BTC and ETH is going up against expectations.

The Internet is porous. When money can be denoted by a string of code to show ownership and value in the real world, any attempts by the authorities to catch hold of it would be like trying to hold on to vapour.

Macau's first ICO will be led by Dragon Corp and its business partner, Wi Holding Company, where they plan to hold an initial coin offering for their new digital currency next month when they hope to raise $500 million. The twist to this problem is that they had received blessings from Wan Kuok-koi or Broken Tooth as he is fondly known. He was the Godfather of the 14K Triad group in Macau and to some point he still is revered figure with the underground.

When I was in Macau, I was fascinated when a taxi driver taking me to Coloane village told me about the inmate who lived in luxury in that particular prison. It was Wan he was referring and his prison was housed opposite the Police Academy in Macau.

During the turf wars of 1996 and 1999, Wan was instrumental in controlling the underground and when the turf war erupted, Stanley Ho intervened with a warning to all the Triad bosses, the notice came from Beijing of course and it said in very few words that such turf wars will not be tolerated when the Portuguese enclave reverts to Chinese rule and that Beijing will make them all 'disappear'. Needless to say the fighting stopped. Wan's signature threat was the one the sent to the media where an unsigned letter was sent to several newspapers in the area. It said: "Warning: From this day on it is forbidden to mention Broken Tooth Koi in the press; otherwise bullets will have no eyes, and knives and bullets will have no feelings."

Wan's undoing was his attempt to murder chief of police Antonio Marques Baptista, and Antonio promised to put him behind bars for 14 years. The entire Portuguese judicial system was a farce at that time, bought out entirely by the Triads so to convict a Triad boss like Wan would have taken a fair bit of will power by the governing authority.

Fastforward to 2012, Wan was released and now a free man. The ICO mentioned in the media was blessed by Wan and for some strange reason, it is just right up his alley too.

Macau's first Casino ICO

The ICO is broken into two parts, the first being a floating casino and the second being a Junket operation in Macau. Now the floating casino isn't difficult to operate if you have the blessings from Stanley Ho. Apparently you can borrow a casino license for a fee and operate your own casino without much interference.

This was probably the deal struck with Wan and Ho before he agreed to go to jail. That upon release, Beijing will give him a clean slate to start with. Beijing cleaned up the mess left behind by the Portuguese but former underground chieftains have all legitimized its business. This is why the deal sounds like a payback.

You have no idea how bad a place Macau was during Portuguese rule. There were scams run under the guise of tourism to rob tourist, the whole police force was on the take....right up to the High court judges. After the handover, peace came back to Macau and the quality of life actually improved under Chinese rule.

This is why the ICO taking place is important for Wan but the Junket business has taken a hit since Beijing choked the gambling enclave with a crackdown on illegal funding.

For those of you who have no idea what the junket business is like then read on. The Macau ICO taking place will allow you to invest in a gambling business that includes junket operations. There will be a token exchange, which you swap your BTC or ETH for a Macau Token. The Macau Token will act as a security to your share of their gambling business.

This is no different than an IPO except that you don't get any voting rights or have a say who Wan appoints as CFO, who at this point could be anyone with links to the underground financial system found in China.

There is so much wealth and money escaping mainland China right now that all the Macau IPO has to do is mop up that excess liquidity.

The junket business is a different kettle of fish. How it works is simple. The casino needs a junket operator to underwrite a Chinese gambler and to do this, the casino will give the the junket operator a 2 percent spread in the value of NN chips. Now NN chips are non-negotiable chips used on the gambling table. You cannot redeem these chips for cash but you can use them at face value on the gambling table. This is what VIP gambling is all about in Macau.

These VIPs will be given a credit line of millions if they are able to pledge a collateral in China to the Junket operator. If the VIP loses, the junket will take possession of the collateral and sell it for profit. The junket only takes a 2 percent cut from the value of the NN chips and it doesn't seem like much if you talk about a few thousand dollars but VIP gamblers have 'donated' billions in USD annually to Macau casinos. This means that the real value in the Macau ICO will depend on the China side, which at this point is somewhat grey.

Over the last 5 years, VIP gambling has seen a sharp decline. It use to be 70 percent of the total gambling revenues in Macau but has shrunk to less than 50 percent. There was even a time when the VIP junkets were raking in so much money that Sheldon Adelson of Sands group tried to muscle in on the action by giving VIPs direct gambling credit. That didn't work very well since they have no control over any collateral. Macau gambling debts cannot be redeemed through the court system in mainland China.

Punters who are gambling on ICOs will be eager to know why Hong Kong has been chosen to be the base. As a financial gateway into China, there is no beating Hong Kong. ICOs are not regulated as yet, though the HKMA did sound a warning recently on the risky nature of ICOs. If there is any regulation to be realized, it would be the control the tokens which act as securities for investors.

The Macau ICO aims to raise US$500 million. The bulk of which will be used to fund the junket operations in Macau before the floating casino project gets its official blessing two years later.

Wan isn't a fool to back such an ICO. It is his way to legitimize his business and retire from the public eye. Here is the bet. As long as gambling revenue is on the upswing in Macau, the junket business will be good, but with a 2 percent spread on profits, it is the collateral market in China that will finally dictate the success of the venture. Should real estate prices crash in China, much of the collateral held will be in decline.

Remember that the collateral held by the junket still has to be sold at RMB$ and that has to be converted to BTC and ETH before it can be transferred out of China as profits. There are many elements to the deal which needs further research but I will give my two cents worth when the Macau ICO becomes official.