Bitcoin ETF - Waiting for Nothing

January 25, 2019

The Perpetual Wait - The Denial of Yet Another Bitcoin ETF

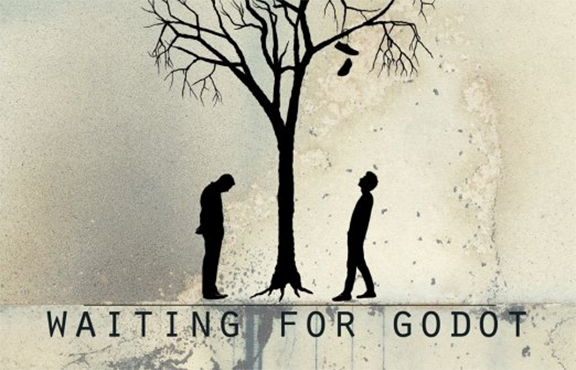

Waiting for Godot is a critically-acclaimed play written in 1948 by Irish writer Samuel Beckett, in which two characters, Vladimir and Estragon, wait for the arrival of someone named Godot who never arrives.

While waiting, the two are visited repeatedly by a messenger boy who proclaims that the person they are waiting for is not arriving today but is sure to arrive tomorrow.

By the end of the play, the circular nature of their miserable existence compels the two main characters to resolve that if by tomorrow Godot fails to appear, they will surely hang themselves from the tree they are waiting under.

https://en.wikipedia.org/wiki/Waiting_for_Godot

Cancellation of VanEck Bitcoin ETF

In a notice published earlier this week on January 22, U.S. Securities and Exchange Commission (SEC) deputy secretary Eduardo Aleman announced that the CBOE (Chicago Board Options Exchange - one of only three federal government approved exchanges of synthetic Bitcoin products) pulled its proposed rule change, which would have allowed the CBOE to list shares of the proposed VanEck SolidX Bitcoin Trust.

The Bitcoin ETF proposal was filed last June, when VanEck, one of the largest retail investment firms in the U.S., teamed up with financial services provider SolidX to provide a physically-backed Bitcoin ETF. Other proposals still in the application process with the U.S. federal government rely solely on Bitcoin futures contracts (synthetic-derivatives or fake Bitcoin), rather than the actual cryptocurrency itself.

Exchange-Traded Fund (ETF)

An ETF, or exchange-traded fund, is a marketable security that tracks a stock index, a commodity, bonds, or a basket of assets. Although similar in many ways to mutual funds, ETFs differ because ETF shares trade like common stock on an exchange, thus allowing individual investors with limited resources to participate in this type of security.

https://www.investopedia.com/terms/e/etf.asp

Physically-Backed Bitcoin ETF - Never

If you happened to have read any of my previous articles, you would know that the SEC and all other U.S. government agencies will NEVER willingly grant any type of approval of a true-ETF backed solely by actual Bitcoin.

They will, however, most likely approve in the future fake Bitcoin ETF's that are claims on a basket of fake Bitcoins such as cash-settled futures or options or even worse, empty promises by the fund manager, to “mimic” the performance of the underlying asset.

Like the false messenger boy in Waiting for Godot who repeatedly proclaims to the two pathetic main characters that their wait will soon be over, main stream media (MSM) shills have announced over the past year a number of “soon-to-be launched” Bitcoin ETF’s (like the recently cancelled VanEck Bitcoin ETF) that have all materialized into nothing more than a steady stream of empty promises and false hope.

It should be quite apparent that the Fed and its agents in the U.S. government will not allow the establishment of a true Bitcoin ETF because it will have a direct and immediate impact on the total supply of Bitcoin in circulation.

With no more than 21 million Bitcoin in existence, any sizable ETF that is backed by physical Bitcoin will have a high probability to force the price of Bitcoin significantly higher – a result the Fed definitely does not want to see.

A true Bitcoin ETF in the U.S. will not happen anytime soon until the denial of a true Bitcoin financial product backed by physical Bitcoin is a futile endeavor as the acceptance of Bitcoin around the world reaches a tipping point in the coming years.

For the time being, the most we should see is the issuance of more synthetic (fake) Bitcoin products, created out of thin air, most probably Bitcoin ETF’s that only utilize fake Bitcoin products such as cash-settled futures and options traded on the CME, CBOE, LedgerX and Bitmex.

Waiting, Waiting and Waiting - For Nothing

Waiting for a true Bitcoin ETF is a futile endeavor and a complete waste of time.

The price of Bitcoin and other cryptocurrencies that have true merit should eventually rise as an increasing number of individuals become aware of the security of certain, well-structured blockchain platforms and seek to hold crypto-assets directly and within wallets they control themselves and not in the custody of third-parties such as U.S. financial institutions hell-bent on destroying the rise of Bitcoin.

If you are waiting for the Fed and its agents within the U.S. government to promote Bitcoin with the establishment of a true Bitcoin ETF backed by physical Bitcoin, you’ll be waiting for a very, very long time – and most probably for forever.

Previous Articles:

i) https://steemit.com/bitcoin/@temujinx/the-fed-construct-known-as-ripple-the-blockchain-trojan-horse

ii) https://steemit.com/bitcoin/@temujinx/how-the-fed-manipulates-the-price-of-gold-and-bitcoin

A Bitcoin etf is never going to happen and that's ok the markerts are not even factoring them in anymore

Posted using Partiko Android

it would seem a bit hard to determine at any given time what the markets are "factoring" in or not in such a manipulated market. The price of Bitcoin is obviously manipulated - by how much, is to be seen. If and when a physically-backed ETF ever becomes listed somewhere in the world with a high enough volume such as in Korea or Japan where Bitcoin is legal, the price of BItcoin should go up a lot, it would seem. But not holding my breath waiting for either country to allow this anytime soon.

For sure if bitcoin hits a 1 trillion dollar market cap which is not honestly not a crazy number if an ETF takes off in one of those countries the value of just one bitcoin would range from $40,000 to $60,000 it would legit be a game changer and I have a strong feeling that is what the SEC fears and the amount of money that would be sucked out of the USD currency because of it.

Agreed 100%. Just waiting and researching myself until it happens - hopefully soon.