The Reserve

13 November 2017 | SUBSCRIBE

// MONEY, POWER, CONTROL

You may not realise, but blockchain is in the middle of a full blown war. Billions have been won and lost this week, in a whole series of tactical moves in the war for control over the future of… well, no one can even agree on what that future should be. That’s half the issue - bitcoin can’t be everything.

The cancellation of segwit2x - a proposed bitcoin fork set to happen this coming week - has seen $20 billion wiped off bitcoin’s market cap, whilst bitcoin cash (which shares more characteristics with the proposed segwit2x fork), was at one point up $30billion, or 4X it’s market cap.

I’m not sure how anyone can truly still believe these blockchains are any different to the centralised governments or companies that have come before - currently. If you don’t think this is about money, power, and control, and you don’t think the game is oh-not-so-very-different to the world it’s attempting to replace - just with even less transparency - then, I’m not sure we are watching the same show!

---

We’ve also lost ~1M ether in the Parity ‘hack’ detailed in #disasteroftheweek, which will, I believe, actually highlight the maturity of the Ethereum ecosystem versus when the DAO (loss of 3.6M ether) occurred. When that happened, Ethereum was forked, to recover the funds.

That is entirely possible now, but it won’t happen. Ethereum is a different beast - processing ~500k transactions/day versus ~40k transactions/day at the time of the DAO. It’s implausible to roll back several million transactions for such a relatively small amount.

But the questions remains - what size loss will result in a renege on the rules? Because there is a number, as, if 100% was lost, Ethereum would be over. But how about if 5% was lost, or 10%?

As history, and blockchain has shown, the rules are there to be broken, repeatedly, when the situation serves someone so.

// MUST READS

- Segwit 2x is called off for now due to a lack of consensus in the community.

- Evolution of Blockchain Technology report by Deloitte.

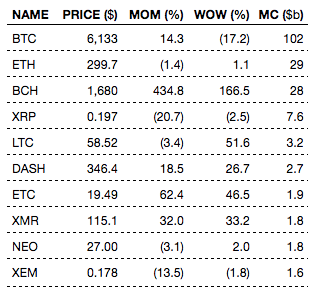

// PRICING SUMMARY

// DISASTER OF THE WEEK

More than $300m of cryptocurrency has been lost after a curious developer accidentally took control of Parity wallets, and proceeded to send the funds into ether - I mean, the ether - that unknown place that you can never return from - not the currency.This would be the second hack to impact Parity after $30 million of ether were stolen in July. And there will be more, it will just be the magnitude of severity, not whether they will occur.

// TRACTION

- Uruguay will issue its own cryptocurrency, a digitalization of the Uruguayan peso.

- A consortium of energy companies will develop a blockchain-based digital platform for energy commodities trading.

- Japan is using renewable energy to attract cryptocurrency miners.

- Business schools such as Yale and Wharton are now offering Blockchain tech courses.

- Professional investors appear to continue dominating ICO return profiles with their experience and due diligence.

// ROAD TO REGULATION

- New Zealand financial regulator releases guidance on the regulatory framework for ICOs.

- Sweden releases warning on the risk on ICOs.

- After Enterprise Ireland agency supported different ICOs, they are now asking them to take down all public mentions of their support.

- The Chief of Israel’s regulator, speaks favourably of the financial innovation ICOs represent.

- SEC chief reiterates that the vast majority of ICOs look exactly like securities.

// ICOS

Last week highlights:

- Pylon raised $24m for a decentralized energy exchange platform.

- BetboxAl raised $4.3m for an AI-driven hedge fund focused on sports betting.

Upcoming:

- Trade.io - Active – a blockchain trading platform.

- Jury.online - November 13, 2017 - a decentralised platform for dispute resolution.

- Auctus Project- November 14, 2017 - smart contract powered pension plans.

- Simple token - November 14, 2017 - the token to power your business.

- Aigang - November 15, 2017 - a blockchain protocol for digital insurance.

// OTHER

Guide of what bitcoin forks are and why they happen. The big paradigm of tokenization of securities. STARKs, Part I: Proofs with Polynomials by Vitalik Buterin. Read more about Trade, the new blockchain trading platform.

// EVENTS

Blockspot Conference 2017 - Lisbon, PT - November 13, 2017

Blockchain for Wall Street - New York, U.S.A - November 14, 2017

Digital Commodities Summit - London, UK - November 14, 2017

Finance Magnates London Summit 2017 - London, UK - November 14-15, 2017

Blockchain in Healthcare - Boston, U.S.A - November 16, 2017

Follow us on Steemit: https://steemit.com/@the-reserve

Follow us on FB: https://www.facebook.com/BReserve/

Follow us on Twitter: https://twitter.com/Blockchain_Res

Follow us on Medium: https://medium.com/the-reserve

© Copyright 2017 Blockchain Reserve Limited.