Cryptocurrency Exchanges are growing fast

In bitcoin’s earliest days, you could count the number of cryptocurrency exchanges on two hands: Mt Gox, Bitstamp, Btc-e, Vircurex and a handful of others, as well as P2P exchange Localbitcoins. Today, the landscape has changed dramatically. There are now over 500 exchanges to choose from – and that number is growing with every passing week.

There Are Now More Than 500 Cryptocurrency Exchanges

Calculating the number of crypto exchanges in the world is a lot harder than it sounds. Coinmarketcap lists 208, and there are dozens more listed on other cryptocurrency tracking sites. In addition, there are hundreds of regional exchanges that are only accessible within certain countries and continents. Canada has Einstein Exchange. Africa has Golix. Australia has ACX and will soon have Nauticus, a multi-asset exchange that is launching this year. Blockbid has also just gained its Australian license.

None of these platforms features on exchange listing sites such as Coinmarketcap. Neither do major sites such as Coinbase, because it is technically a broker (although its volume is listed on sites like Bitcoinity.org), or P2P sites like Localbitcoins and Localethereum. And what about other forms of P2P exchange such as Radar Relay, Kyber Network, and platforms that operate on the deep web? It is extremely difficult to classify and quantify the number of global crypto exchanges. All that can be said for certain is it’s north of 500 and rising.

Choice Is Good – Up to a Point

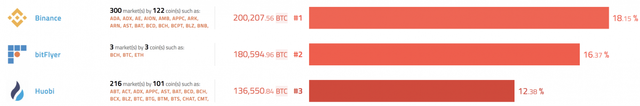

Back when the bitcoin ecosystem was beholden to just one exchange – Mt Gox – there was a single point of failure that duly crashed the markets when Gox eventually broke. With hundreds of exchanges to choose from today, that shouldn’t be an issue, and yet a glance at where the bulk of the trading volume lies tells a different story. In the last 24 hours, more than half of all cryptocurrency trading volume came from just three exchanges, with Binance accounting for 18% alone. If the exchange were to be hacked or go offline, it wouldn’t cause a Mt Gox-level crash, but it would still inflict a sizeable dent.

24-hour trade volume by exchange.

It is the meteoric rise of Binance, which has gone from nothing to billion-dollar platform in the space of 12 months, that has inspired many of the next generation of token-backed exchanges like Coinlion and Legolas. Each of these new entrants has a slightly different slant, whether it’s knowledge-based trading, ICO launching or, in the case of Ezexchange, a focus on customer service that includes 24/7 support. It even offers the prospect of video tutorials and phone support for crypto investors who are still learning the ropes.

Oliver Isaacs is a cryptocurrency advisor and investor who’s worked with a number of new exchanges. He ventures: “Customer service/tech support is important [with new exchanges] and so is the speed with which cryptocurrency deposit and withdraw transactions are executed. Getting your coin onto and off of an exchange quickly is important, especially for an arbitrage trader.”

For so long as money keeps pouring into the crypto economy and the ICO sector remains vibrant, new exchanges will continue to proliferate. Should things go south, however, and a severe crypto winter set in, many exchanges could wind up as little more than ghost towns, with only the dominant players capable of maintaining liquidity and weathering the storm.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.bitcoininsider.org/article/23364/number-cryptocurrency-exchanges-has-exploded