Are you overpaying for Ether transactions?

I have come to realize over the past year that sending Ether or any ERC-20 tokens to the exchanges can take anywhere from a few minutes to a few hours. I have spent various amounts on transactions from just a few pennies to nearly $10 per transaction a few times because the network was really that backed up at the time. The Ether network got very crowded last December and the fees were about $3-$5 per transaction even with waiting 2-3 hours.

Before you send an Ethereum transaction from now on at least once a day check this website: https://ethgasstation.info/ This will tell you how much you should be spending on the transaction and save you literally probably $100 dollars or more over the course of a year if you trade daily. Right now, I bet some of you are still overpaying for Ether transactions because the network was so badly backed up when the Cryptokitties drama was still ongoing that you set your gas prices too high and may not have changed it. The Ethereum network is not very backed up at all right now, and a gas price of 10 gwei or a little less should be suitable.

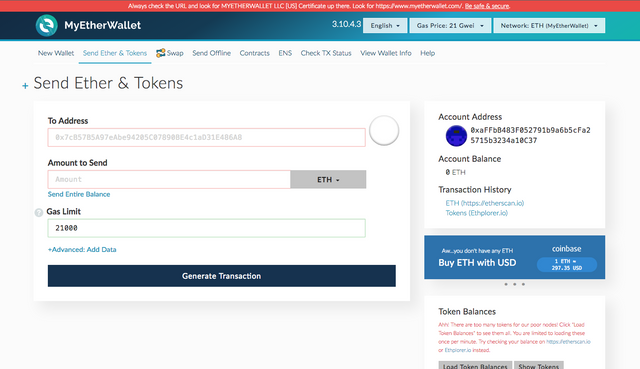

The gas price of an Ether transaction from MyEtherWallet can be adjusted near the top right corner where it says gas price. You can theoretically make this between 1 gwei and 10,000+ gwei, but a 10,000 gwei transaction would cost you thousands of dollars. Changing the gas limit is usually not a good idea unless you know what you're doing because each token has it's own gas limit. But changing the gas price is something you should be doing.

Personally, I'm sticking with 10 right now because that is still only about 4 cents per transaction or less right now, but if you're still paying 50 gwei per transaction then you’re overspending. Basically all I'm saying is that when the network prices get higher I'll pay a higher gas price, but waiting about 2-3 minutes for a 10 gwei transaction right now is fine with me.

Please Upvote or Leave a comment below. Thanks!

Hell yeah!!!! Gas wars are BS!!!!

Gas station is an amazing tool. Ethereum's gas mechanic is still too painful though, having to think about exactly how much gas cost to use each time.

I had no idea it could be so expensive. Thank you this post really opened my eyes :)

So true😞... thanks for telling us this

Posted using Partiko iOS

Very informative blog.

I will be waiting to see more of such awesome blogs coming up.

All the best!

Thank you for sharing this

very informative blog buddy hope you will post more informative post for us with time and guide us

@the4thmusketeer i felt the same crypto transactions are quite expensive.

I couldn't believe it last year, but I started paying $10-$12 per Bitcoin transaction last year before I decided to switch to Litecoin and Ethereum.

I don't know where you are, but here in Mexico, swift transfers amongst different national banks are approximately 0.50USD (if its between accounts on the same bank they are free). To avoid these costs you can pay a monthly fee of around 15USD for unlimited national transactions.

International swift transfers are around 25USD.

On the other side of the coin... merchants are used to absorbe the cost of the transaction (anywhere from 2-4%) and wait 48-72hrs (some times more if you use AMEX) to get their money if you pay with credit or debit cards. Now this cost is transferred to the buyer if you pay with crypto.

I don't believe crypto transactions are expensive, I just believe that they offer a more transparent, faster and equitable way for the transfer of money.

Any of you are merchants and accept crypto? Do you believe it is expensive or is better, faster and fairer for you?

Humble thoughts...

What used to be euphoria has fizzled into despair as the price of Ethereum (ETH) has taken a dive from a June high of US$400 down to US$240. Media outlets covering the crash allegated that it was due to “technical difficulties” that clogged the Ethereum network, causing significant delays in processing transactions.

The sheer volume of transactions from Initial Coin Offerings, or ICOs, significantly tested the Ethereum network to its breaking point. There were two weak factors at play: ICO frameworks and sophisticated fee estimation algorithms.

The scalability problem started escalating since June 1, tracing back to the Brave (BAT) token sale

Yeah, I know one person paid $8,000 in Ether gas fees to participate in the Brave (BAT) token sale.

Informative post