The Dark Side of Bitcoin Mining .

Bitcoin marks a pivotal moment in the history of finance. Its decentralized issuing mechanism along with proof-of-work system returns financial freedom to us, the users and provides trust and transparency to a rather shady world ensuring that no transaction can be censored or reversed by third parties.

Bitcoin has put currency issuing itself in the hands of the people, rather than in a centralized entity. This has allowed Bitcoin to thrive as a global currency and store of value, which some believe to be an entirely new frontier, not just of freedom but of occasionally outrageous profits.

Basically, mining actually involves getting a computer to search for the answer to a hard mathematical problem. The miner who finds the answer typically gets rewarded with newly minted coins. And, since it is designed to be hard to mine you need dedicated processors. In comes ASICs, or highly efficient purpose-made processors which have made it all but impossible for the vast majority of people to mine Bitcoins. Technically, mining is still open for all, but is now dominated by groups or people that have tied together hundreds of dedicated processors and have access to resources like cheap electricity with which the average home miner cannot hope to compete.

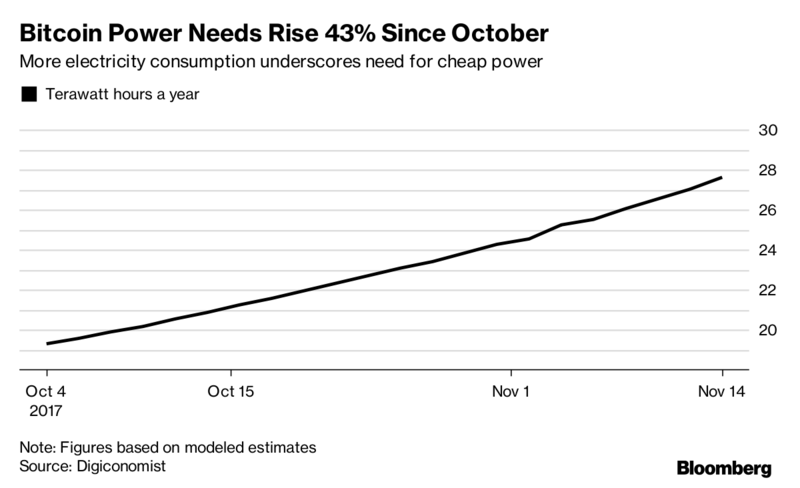

But all that computing power takes energy, which poses a enormous hazard to the environment, with an estimated consumption of 288 megawatts, according to data from the Global Cryptocurrency Benchmarking Study by the Cambridge Judge Business School. But more on that, a little while later. Mining bitcoins can cost you more in electricity than you can make cashing them in.

Let's understand how this process works. A group of Bitcoin transactions, chosen from the list of all currently pending transactions are recorded and put in a block by a miner into the record of blocks known as “the blockchain.” A new block is created on average every ten minutes. Miners have to do a cryptographic task which requires computational power, and the solution to task leads them to define a new block. The task is basically like solving a puzzle, known as Hash. Whoever correctly does it is rewarded with newly created/mined Bitcoins. Simple.

But, finding the solution to puzzle depends on Hashrate, a measure of a miner’s computational power. The higher their relative power, the more solutions the more probable that miner is to get the block rewards. Since network maintains an average rate of 10 mins for a new block, the difficulty is auto-adjusted every two weeks. If total hashrate increases, the Difficulty of Proof-Of-Work hashing adjusts upwards – and the inverse also applies.

So, basically unless you command a tremendous hashrate (computational ability ), your odds of solving a block by yourself are extremely low, which is why there are mining pools. If you're a hobby miner who's just starting up his own make-shift mining rig out of his garage, your chances of making a profit are pretty slim. An estimated 70% of hashrate is owned by China which is highly dependent on Coal as a source of energy and has relatively cheaper electricity than its western counterparts. It leads to a couple of problems-

It leads to centralization. ASICs have a much better chance over regular joe miner with a home-made mining rig and definitely beats the idea of a desktop PC mining, which the system was initially supposed to be.

Mining pools hold a major stake over the network which can possibly affect the integrity of system. A 51% hashrate owner can have a lot of influence over the correct longest Blockchain. A 51% attack is a possible scenario where the network is dominated by very large miners with extremely powerful equipment.

This means that Bitcoin mining has a very large carbon footprint. The power requirements to run the mining machinery and cooling apparatus to manage the heat produced is taking a huge toll on the environment.

So, a probable solution proposed to counter this is "Virtual Mining".

It suggests to modify a critical step in the ecosystem of bitcoin mining economics. Instead of having to spend money on buying power and equipment in order to operate their mining rigs to find puzzle solutions, you could just mine by using that money directly within the system.

Say you're sending your money to a special address. And then a winner is chosen in a random manner in order to receive a mining reward based on the amount of money that has been contributed by miners to this special address. We can employ the same dynamics and reward structure in this virtual mining scheme as is in current Bitcoin mining. The only thing that's removed is the external step of having to use real power and real hardware.

HOW CAN THIS BE DONE ?

Well, there are a couple of methods that have been suggested.

Proof of Stake (PoS) - In this each coin is assigned a stake value. The longer a coin remains unused, the higher its stake gets. Everytime you use that coin in a transaction, its value gets reset. It relies on a process called “forging.” You can stake your currency and have a chance to be selected to forge a new block and earn more currency. Those who own more currency receive more chances to forge blocks. So, the more coins you have, the more coins you'll earn.

Proof of Burn - When you decide to use a coin, you have to send it to a unspendable address here it is forever gone or deleted and can't be used again. This proves your commitment to the system and if you win the mining reward you have made a profit and recurred your losses.

Proof of Deposit - In this variation you deposit your coins in a time-locked account where they aren't permanently deleted and can be retrieved back after a certain amount of time has passed. In this you're effectively loosing the opportunity cost to whatever you could have done with your coin at that time.

Although there are a lot more varieties to virtual mining schemes but we would limit our discussion to these only.

The possible benefits of the above mentioned virtual mining schemes would be-

De-Centralisation - It will prevent the consolidation of power by eliminating the need for use of ASICs, and any dominating influence that mining pools would have had on the network. Realistically, it would bring the mining power back in the hands of individual bitcoin network participant.

Discourages 51% Attack - In POW scheme, a wealthy attacker can get hold of efficient and much better mining resources than competition and gain an access of 51% of the BTC network. But, in a virtual mining scheme since all the value is intrinsic and based inside the network he has to buy 51% of the coins which in turn would increment the price of each coin and boost the system. Along with boosting the system which probably wasn't the intention, expending their wealth outside the system to acquire tokens inside would arguably be a very expensive ordeal.

It eliminates the need of any dedicated use hardware, lessens the consumption of resources needed to manufacture and keep them running. Since no computational machinery will be required, it will lead to a greener mining process where although same rewards distribution dynamics will be at place but the environment won't be at stake.

Now this is actually a matter of active discussion and ongoing research and the best trade-off is yet to be found but unless there's any form of security or benefit that you can only get by having a proof of work system that involves expending real resources, requires real hardware and electrical power in order to find puzzle solutions, then it will eventually give way in favor of cheaper alternatives based on virtual mining. Otherwise the apparent waste of resources in a POW system can be thought of as just the cost of the security that you get.