Is Bitcoin Governance Truly Decentralised? Should It Be?

What does the recent New York Agreement tell us about Bitcoin Governance?

Introduction

One of the central tenets of bitcoin and cryptocurrency protocols is decentralisation.

The idea does not just exist for purely egalitarian reasons.

In theory a decentralised system should be more resilient than a centralised one.

For example imagine if you were running your service on a single server. If that server crashed, was hacked or had a power cut, your entire service would be taken out until it was fixed.

Definition of governance from the Google Dictionary

If you ran your service on multiple servers in different locations, then if a single server stops working you wouldn't lose the entire service, and depending on how many alternative servers you had the damage to the network may even be negligible.

In the case of bitcoin the decentralisation doesn't just apply to the network itself, it is supposed to apply to the actual governance and control of the network.

Decentralisation in this respect helps to reduce attack by more human elements such as self-interest.

If a single company was in control of bitcoin its interests may not necessarily align with the community as a whole and they might be able to force changes through that benefit them to the detriment of the rest of the community.

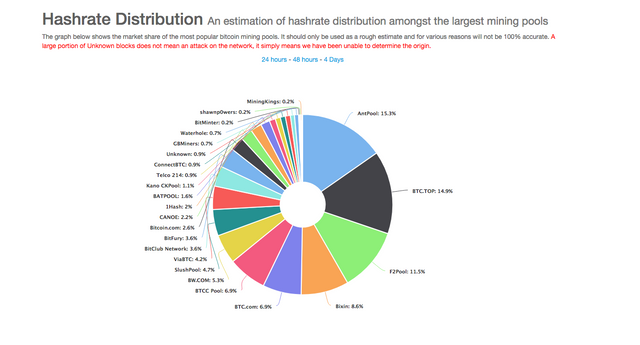

Most of the Mining Hashrate Comes from Just A Few Pools

Whilst we don't have a single company in the control of Bitcoin, we do seem to have several groups that have a large chunk of the say in what happens by way of controlling a huge amount of the mining power.

The recent saga of SegWit 2X vs UASF has illustrated this to a significant degree.

Distribution of Bitcoin Hashrate - Source Blockchain.info

In the case of SegWit 2X it appears a large number of vested interests (mainly large mining companies and pools) got together in private in New York and decided to support an initiative which (at the time) the rest of the community knew very little about.

The Bitcoin Core Developers were invited to attend but refused to come - presumably because they saw it as a snub or attack on their own initiatives.

These events seem to run counter to the open nature of changes to the bitcoin protocol and community openness.

Although I am strongly in favour of scaling (I think we need it ASAP) some of these actions set a troubling precedent.

Overall the situation, illustrates behaviour that is more consistent with a cartel.

It is more reminiscent of the old world business and banking models that I thought we were trying to escape in the cryptocurrency world.

Why is this Bad?

Put simply it can result in a conflict of interest.

.jpg)

The interests of these companies and mining pools may not necessarily align with the overall community and I can't imagine that Satoshi had this in mind when he envisaged decentralisation.

Don't get me wrong I don't believe these people are deliberately acting to take control of Bitcoin or have any sinister motives.

Many of them, the mining pools, ASIC makers, and bitcoin businesses are the very people who have the most to lose by the continued stalemate.

I believe they are doing what they think is best to move things forward and do it in the most efficient manner.

I think the risk is that long term we may actually end up losing an important part of what makes Bitcoin so strong.

Would a New Governance Model Help?

Part of the problem with this is that the current model of decision making only considers one part of the community (miners) for voting on different issues.

The miners are the ones that signal and have the say.

The problem is that the interests of miners are not necessarily aligned with the bitcoin community as a whole - at least not in all situations.

Indeed this may be one of the big reasons for the current stalemate.

After all, in the short term at least, as a miner you might actually like the higher fees that come with smaller (hence fuller) blocks as you might make more money. The long term consequences may not be as relevant to you personally.

As I have discussed before people often prioritise short term gains over long term gains, so it is perhaps not surprising that many miners have prioritised their own profits over long term viability.

One could say that the New York meeting and the UASF were both prompted by people getting frustrated by this situation.

Could there be a better way of achieving the same ends though?

One way of improving things might be to allow all users of the Bitcoin network to have a vote.

The problem is that there is no easy way to do that and the obvious solutions would likely be open to sybil attack.

That is not to say there is no solution or better way to do things. I believe we should explore other options as a community - even small improvements might be helpful and make the system fairer.

In summary I think the time to look at improving governance is long overdue.

Conclusion

I wanted to keep this short so I have only been talking about the centralisation of governance.

Obviously there are other potential sources of centralisation (e.g. geographical concentration of mining) that can also be a threat and which I might discuss in future posts.

.jpg)

With regard to governance I think we are dealing with a basic human issue. No perfect model of governance yet exists whether it comes to regular life or online alternatives.

Current blockchain methods have their problems - stalemate being a huge one but concentration of power must also be taken into consideration.

It seems that almost every time someone comes up with a solution to a problem, it creates a new problem which must then be mitigated against.

Unfortunately I don't have an easy answer to these problems but I don't think we should give up on looking for new solutions.

What do you think?

Thank you for reading

Bitcoin has a very basic design with many design flaws. It was genious in the begininning (and everybody thanks bitcoin for that), but now is outdated by newer solutions... DPOS here at Steem for example is with a few dozen delegates more decentralized than bitcoin, where 3 mining Pools have 80% of mining power...

Good points. Things have moved on. I think one of the problems is that the stalemate we have had has prevented evolution of Bitcoin too.

Yeah I also feel that there should be centralization of governence. At least some sort of control to keep market a bit stable so we can be relax and not see many red days.

I'm not arguing in favour of centralised governance. Far from it. It may seem appealing but it goes against some of the principles of the cryptocurrency as I see them.

Yeah decentralized nature has attracted us in crypto world. Lets hope everything got better in coming years.

This post received a 1.3% upvote from @randowhale thanks to @cryptokraze! For more information, click here!

Sorry, but it seems nothing can ever be truly decentralized. We have had organized forms of governments, whether the leaders were a few people or a single person, since the beginning of recorded history. Even If people are allowed to rule themselves, there will be certain individuals who stand above the rest, redirecting and controlling, taking charge.

applying that to bitcoin, we start to see the reasons why the governance inst truly decentralized. Individuals will certainly come together, and interests will align. Groups form, and we are back to the old form of government, albeit a semi-decentralized one.

Yes I think you may be right. It is something we aspire for but can never truly reach.

Only looking in rear view mirror. Cannot change anything or make anything better if we are not to recognize that there are solution to the current problem ... even a partial decentralize is a step forward. It already means that there can only be partial control. Better than totalitarian or monopolistic type of control.

Stop overthinking. Look forward my friend.

We need to fight, and need to fight smart.

With big businesses such as the banks, Microsoft, and IBM starting to spend more time on developing off the Blockchain it seems like we run the risk of moving to a more centralized world for crypto. These businesses won't be willing to leave the power of their networks in the hands of the many, and will likely also be interested in making sure there is a base level of mining support for their networks. This will push development forward, but it may come at the expense of some of the current freedom.

Yes I think we run that risk.

The risk exists in all PoW coins... but here in Steem the software is not PoW... Dan thought about these issues from the start when he designed Graphene....

Great piece @thecryptofiend. What is the most amazing in all of this, is that we seem to be witnessing the same predatory behavior on and on and on ... no matter the subject of the investment asset or entity. It's all about cornering the market of it, so the little one (single vote, single miner) have no say and no reward what so ever to work hard promoting the asset or the entity here say. Like any greedy, narrow minded syndicate that has only one objective ... total control from top to bottom ... the best monopolistic approach of empires and rulers.

Personally, we have to find a way to break this mold and behavior really fast or any new idea in the crypto world is doom from the get go.

Rise up ... or at least die trying.

I agree. We have to mitigate against self interest (assuming it is possible).

Half full or half empty? Does it really matter. The solution is now and looking forward. Not in the rear view mirror.

Cannot do the same thing over and over again and expect different result = Insanity (Crazy) " Albert Einstein"

We have to assume it is possible. It is cheap to do so.

If we wait and our life depends on it ... it will be to expensive to start any kind of revolution.

If you value your life and freedom in any kind of way. Keep up the good work my friend.

Thanks!

Don't really know anything about mining, but I do know when people group together they tend to put their own interests first. Seems to run totally counter to the very idea of decentralization to me. Things will play out as they will though, but IMO power and money always tend to corrupt towards wanting more power and more money, so it's not surprising that people are already grouping together to try and sway things in the way that they would like. Always great to read your articles @thecryptofiend, like I said I don't really know anything about mining but you write in such a descriptive and easy to understand way! Thanks for the post :)

Yes that is what I think. It seems to be against the spirit and human nature is very fallible when it comes to being corrupted by self interest. Thank you:)

Yeah it's sad but true, it'll be interesting to see how this plays out in the future, either way it looks like cryptocurrencies are coming more and more into the mainstream.

and the pools are all sitting in china?

Most of the hashrate is.

According to Elizabeth stark and Adam black, the segwit2x is only inviting people that agree. >This proposal has like zero developer consensus," and "Unfortunately, the [mailing] list is only for people that agree with Segwit2x." <

Yes I have heard that dissenters have been removed from the list.

I don't why miners are creating a big fuzz out of segwit...we all know bitcoin is facing scaling issue big time...and now we have altcoins that have 10x times faster block transaction capabilities...segwit is the need of the hour...it will definitely reduce the transaction time and fees...also, at the at end of the day it is a soft fork so even if consensus is not there still it will get implemented...thanks for bringing this up.

Segwit is way too complicated of a change to the codebase. Just remove the block size limit. Malleability really isn't an issue and there are much simpler solutions to that as well.