CFTC Subpoenas Bitfinex and Tether as Questions Mount Over Audit

Questions surrounding one of the world’s largest cryptocurrency exchanges and its relationship with embattled startup Tether are set to receive a hearing from US regulators.

The US Commodity Futures Trading Commission (CFTC) sent subpoenas to both companies on December 6th, according to a Bloomberg report, which cites an unnamed source familiar with the matter.

“We routinely receive legal process from law enforcement agents and regulators conducting investigations,” Bitfinex and Tether told Bloomberg Tuesday in an emailed statement. “It is our policy not to comment on any such requests.”

Bitfinex, which is home to the most heavily-traded BTC/USD trading pair, is run by many of the same executives as Tether, a company that has issued the dollar-pegged USDT token on both the Omni and Ethereum platforms.

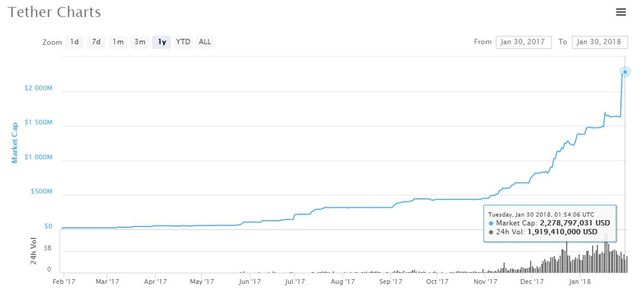

As Tether’s market cap has ballooned in recent months to nearly $2.3 billion, questions have been raised about whether USDT is fully-backed by US dollars stored in company-owned bank accounts — as Tether claims.

Some, most notably pseudonymous critic Bitfinex’ed, have alleged that Tether is operating a fractional reserve to artificially inflate the Bitcoin price and — he claims — cover up alleged insolvency at Bitfinex. The exchange, meanwhile, has promised to pursue legal action against individuals making “patently false” claims about the company.

While these claims have not been proven, Tether’s long-awaited balance sheet audit has yet to materialize. On Monday, CCN reported that the relationship between Tether and its auditor, Friedman LLP, has been dissolved, although neither firm responded to requests seeking more information.

“Given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of Tether, it became clear that an audit would be unattainable in a reasonable timeframe,” Bloomberg quotes Tether as saying in a statement.

Analysts have forecast that if Tether were operating a fractional reserve and evidence of this came to light, it could trigger a widespread cryptocurrency market crash that could slash prices anywhere from 10 to 80 percent.

Consequently, the bitcoin price plunged following report of the CFTC subpoenas, briefly dipping below $10,000 before bouncing back to $10,110 at the time of writing.

Editor’s note: Bloomberg has now rectified its report to note that the subpoenas were sent in December, not last week as reported previously.

Featured image from Shutterstock.

source : https://www.ccn.com/cftc-subpoenas-bitfinex-and-tether-as-questions-mount-over-audit/

Coins mentioned in post: