The crypto froth is forming

Amazing when you consider Bitcoin was just US$300 in January 2015. At the beginning of 2017, it was just under US$1,000.

And it’s not only bitcoin that’s on a tear. Dozens of crypto tokens are up hundreds of percent over the past few weeks.

Now, we’re seeing a lot of self-congratulatory backslapping from crypto investors. Folks talking victory laps, bragging about their returns. Hubris.

This makes me uncomfortable.

It’s easy to feel like a “genius” in a raging bull market. But make no mistake, markets don’t go parabolic forever…

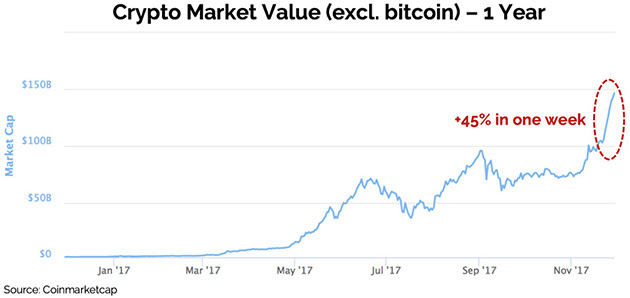

Just take a look at the chart below that shows the crypto market (excluding bitcoin) over the last year.

And now look at the gains in just one week. 45 percent. In a week. This is not sustainable.

But you should still own bitcoin

Regardless of the incredible volatility and wild west nature of this space, and at the risk of repeating myself, I still believe that if you have a little spare speculative capital standing by, then you should get some cryptocurrencies in your portfolio.

The most appropriate course of action for the majority of investors is simply to buy a little bitcoin – and forget about it. Buy, hold and ignore the volatility. Participate financially, not emotionally. It’s not a one-way ride, and it’s a bumpy one. Be prepared to stomach big declines and sit tight. And “invest” no more than you can absolutely afford to lose.

Bitcoin is an asymmetric bet… if it falls or even goes to zero, your loss is small (assuming you’ve put in only what you can afford to lose). But if over the next few years it continues go up, then gains of 10 to 50 times are entirely possible… and even bigger gains lie outside of bitcoin in the cryptocurrency space. There is no other asset class on earth that offers this kind of return profile.

In short, everyone needs to familiarise themselves with the process of buying, trading and storing cryptocurrencies. They’re here to stay. And being on the outside (and not understanding them) will limit your ability to profit from them.

great content man