Goldmint is a Blockchain-based platform as a gold kriptoasset in the future

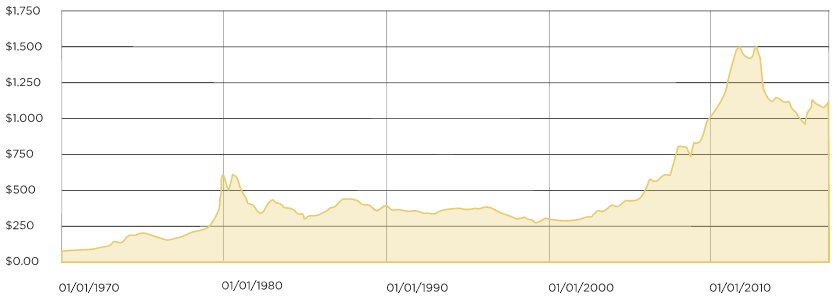

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risks, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and volatility as are other markets. Compared to other precious metals used for investment, gold has the most effective safe haven and hedging properties among a number of countries.

Gold’s relative scarcity, its portability (you can carry small bars, coins or jewelry), and its great demand in industrial applications, make it a highly desired commodity. Cryptocurrency has adopted some of gold’s benefits with the creation of a bitcoin that is scarce: through the introduction of a digital coin that can be easily and effortlessly transmitted and by the creation of a distributed, decentralized blockchain that aids business. Cryptocurrency also adds value by making one's transactions fast, secure and transparent.

GoldMint Place:

GoldMint gives you crypassasset (called GOLD) whose value is based on Gold. This asset runs on a decentralized blockchain and provides it Here are the benefits :

- It serves as a type of futures contract because there are legal ones agreement to buy or sell gold at a predetermined price at a specified time in the future.

- You can hedge the risks of cryptotrading.

If you invest in gold, you will find that GOLD benefits below way:

- GOLD helps you use investments with gold support as a credible guarantee.

- You can swap gold quickly and easily.

- You will get a higher profit from your gold funds when gold prices go up.

We plan to move in three stages:

- To gain access to 1% of the global gold circulation (over 300 tonnes) by launching the Custody Bot auto storage facility at the global pawnshop.

- To gain access to another 5% gold circulation by introducing Bot care to a shopping center.

- To gradually gain access to 10% of the final gold reserves, worth over $ 100 billion, and to develop a special version of Custody Bot for popular installations.

WHAT IS GOLDMINT?

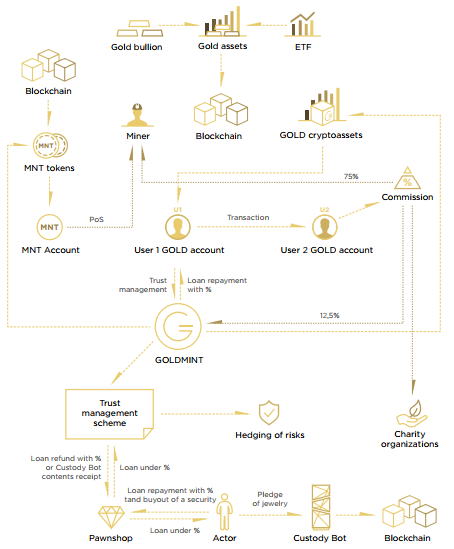

GoldMint runs on a blockchain ledger and works through a digitized cryptoasset called GOLD whose cryptocurrency value is based on physical gold. The decentralized platform uses a special blockchain that helps gold owners trade, loan, invest in and, generally, use their commodities for profit.

GoldMint buys, sells and repurchases GOLD at the current market price for physical gold. The company uses exchange-traded funds (ETF) or physical gold (of 999 quality) as its security. GoldMint’s gold reserves equal or exceed its mined amounts of GOLD.

Differences between GoldMint and other gold cryptocurrency blockchains include the following:

- GoldMint uses its own blockchain and altcoin, called MNT, for GOLD transactions.

- GoldMint uses Proof-of-Stake where miners are doled out blocks/ transactions according to the amount of MNT they have. -

- Proof of stake (PoS) is faster, simpler and cheaper than proof of work (PoW).

- Physical gold and ETFs are stored in a programmed decentralized storage unit.

- Custody Bot — GoldMint’s innovative storage unit is programmed to automatically identify and store gold jewelry, small ingots (up to 100 grams) and coins, without human intervention.

The characteristics of the GOLD cryptoasset include the following:

- 100% transparency of information about all Gold owned by GoldMint, disclosing the company’s gold reserves and its ability to buy back GOLD at its current trading price.

- GoldMint uses the decentralized blockchain for smart contracts and for harboring its cryptoassets.

- GoldMint uses ETF for liquidity and elasticity. ETF helps you trade gold much faster than physical gold does.

- A secured loan may contain gold, like jewelry or coins. GoldMint helps you store this collateral in its unique Custody Bot.

- The ability to receive passive income as market price of GOLD rises.

- Buyback of GOLD for fiat according to the current price of GOLD.

- A fast user registration system and identification.

The GoldMint platform includes:

- Its own blockchain that uses GOLD and MNT cryptoassets.

- Programmed safe deposits – namely, Custody Bot.

- Application Programming Interface (API) for building application software and for helping software components interact.

GoldMint Place

GoldMint gives you a crypassasset (called GOLD) whose value is based on Gold. This asset runs on a decentralized blockchain and provides it. Here are the benefits:

- This serves as a futures contract because there are legal ones agreement to buy or sell gold at a predetermined price at a specified time in the future.

- You can hedge the risks of cryptotrading.

If you invest in gold, you will find that the benefits of GOLD in this way :

- GOLD helps you use investments with gold support as a credible guarantee.

- You can swap gold quickly and easily.

- You will get a higher profit from your gold funds when gold prices go up.

MARKET TARGET GOLDMINT

Crypto traders These participants can use GOLD for hedging cryptocurrency volatility, as described in the white paper. GOLD can also be used to convert cryptocurrency into fiat.

Standard investors These investors may want to buy GOLD as cryptocurrency or as a type of security.

E-commerce and self-employed individuals GOLD can be used to pay for goods and services. Its low volatility as an asset and its predictability make it an invaluable form of currency.

Banks GOLD cryptoassets give banks new opportunities. There is free liquidity and extra earning potential from trading gold into fiat and vice versa.

SAVINGS STORAGE GOLDMINT

GOLD cryptoassets can be stored long-term in a special and secure storage bot with options of either converting the gold to fiat or to some form of cryptocurrency, such as BTC, ETH, Dash, etc. GOLD uses the current price of gold set on the LBMA Gold Price, so its market value fluctuates accordingly.

GOLD SECURED LOANS

You may be able to receive a cryptocurrency or fiat loan from GoldMint PTE LTD, using GOLD as collateral. All applicants will need to undergo the KYC procedure.

The GoldMint team has already launched a special bank card called “ Bogatstvo ” for prominent pawnshops like “ Blago ” and ” Fianit “.

Process:

- GoldMint loan applicants transfer their GOLD as collateral to a certain GoldMint application.

- The rate of the loan is established at the time of issuance and remains fixed through the loan period. Applicants must consent to GoldMint loan terms prior to receiving the loan.

- Applicants are given various options for loan repayment and for mode of repayment.

- If the borrower defaults, his GOLD cryptoassets are transferred to GoldMint.

- Credit card limits are set according to the value of the user’s GOLD. These cards can be used for payment in shops, restaurants and cafes. Interest is accrued on unpaid credit debt. If this remains unpaid, GOLD reverts to GoldMint.

GOLD INVESTMENT RETURN

Process required :

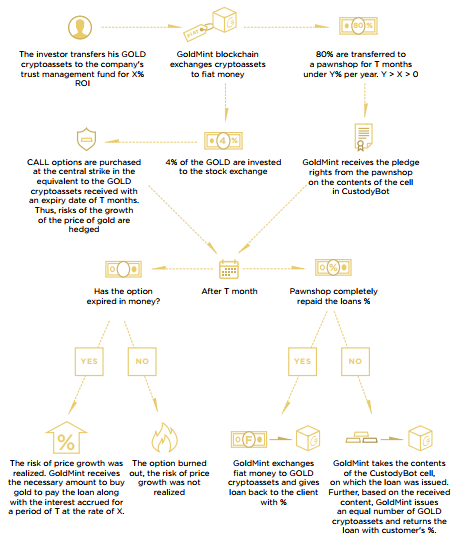

- The investor transfers his GOLD cryptoassets to the company's trust management for X% per year for a certain number of months.

- Simultaneously, GoldMint uses Custody Bot to lend to parties for Y% per year through pawn shops all over the world.

- Interest on trust management is paid in GOLD.

The amount payable to the investor at the end of the period is the following:

SUM = (1 + (X / 12) × T) × Q where the number X (i.e., x%) is set by GoldMint based on market conditions.

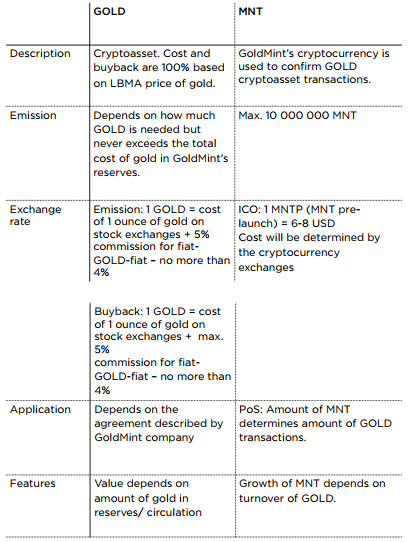

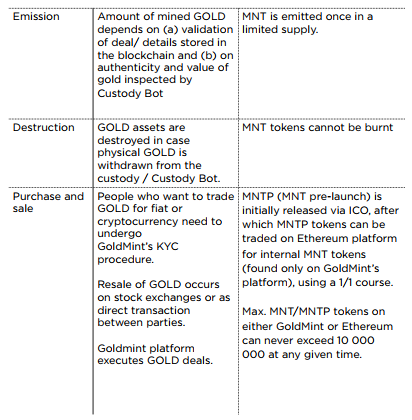

Gold Cryptoasset and MNT Internal Token Details Here’s how GoldMint uses its GOLD crypto asset and its internal MNT currency.

GOLD as a crypto asset issued by GoldMint that uses the current gold price on LBMA exchanges at the time of sale.

GOLD Criteria

- Same with one ounce (31.1035 grams) of gold (999 qualities).

- Fractions to 100,000 parts.

- The Commission is given in GOLD.

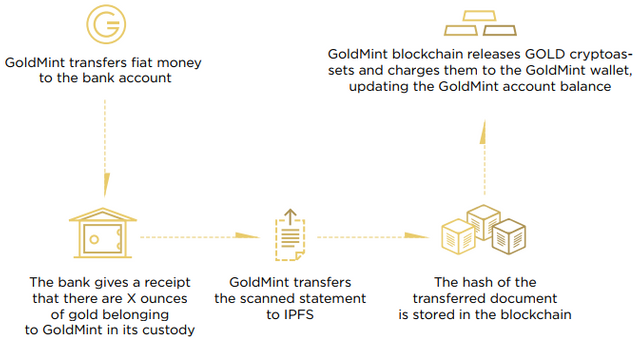

Gold Emission Process as Information is transmitted to the blockchain ledger about the number of ounces of physical gold or ETFs owned by GoldMint.

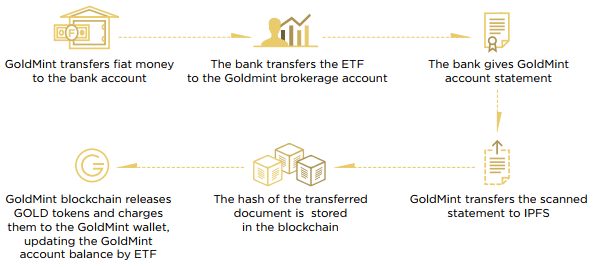

ETF is bought on the stock exchange NYSE Arca and subsequent information is publicized on GoldMint’s decentralized blockchain, making it transparent and open to all members. Statements are received from the depositary (electronic or printed).

All physical gold owned by GoldMint exists in the following forms:

1). Manufacturer-certified bullions

2). Gold coins

3). Gold jewelry

4). 999 quality granules, stamped by manufacturer

Physical gold is locked-up in storage and rated according to its value:

1). Moody’s – A2 and above.

2). Standard & Poor’s – A and above.

3). Fitch – A and above.

ETFS Release and Converting them to the Gold Cryptoassets

ETF (Exchange Traded Funds) is An ETF, or exchange-traded fund, as a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange.

These types of investments have been around since 1993, but large scale use began about a decade later, when investors found them to be cheaper and better than mutual funds. Investors also discovered that ETFs offer low-cost diversification, trading and arbitrage options. New ETF launches number from several dozen to hundreds in any particular year.

The three most popular ETFs are “Spiders” (ticker (NYSEARCA:SPY)), “Diamonds” (ticker (NYSEARCA:DIA)) and “Qs” or "Qubes" (ticker (NASDAQ:QQQ)).

Buying Bullion and Converting them into Gold Cryptoassets

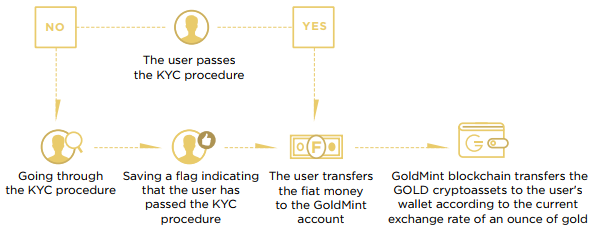

Buying Gold Cryptoassets for fiat money

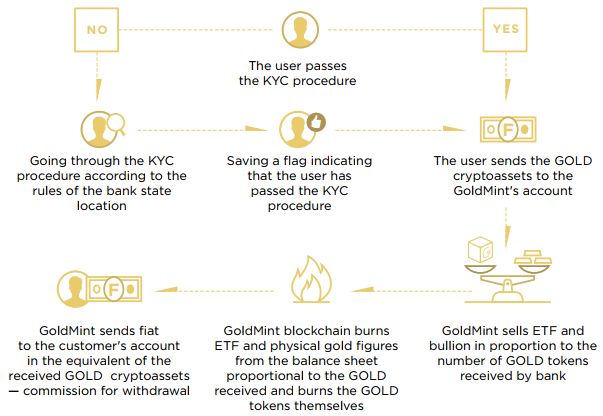

Converting Gold Cryptoassets to fiat money

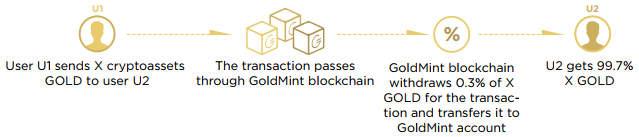

GOLD commission Z% (no more than 0.3%), but no less than a fixed Y amount of GOLD (i.e., more than 0,0025 GOLD depending on the current gold price).

Transaction with Gold Cryptoassets

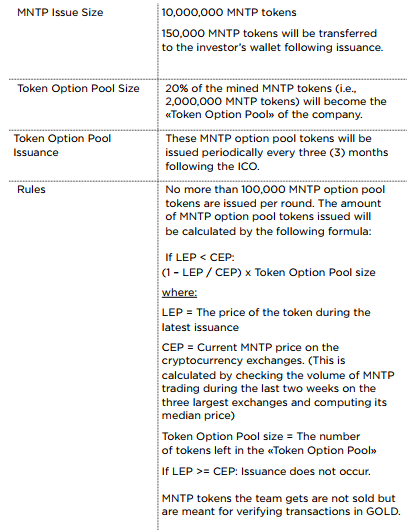

ICO

At ICO launch the MNTP price will be $7 which can change during the crowdsale due to the changes in the exchange rate:

- ICO investors are given MNTP (MNT pre-launch) tokens that can be converted to MNT after GoldMint has mined enough GOLD to independently support its platform.

- MNTP tokens will be moved to GoldMint’s blockchain and converted into MNT in a 1:1 proportion.

- ICO cap will be set in fiat 15 days before ICO.

- minimum cap for ICO is $150 000. If less than that is raised, the investors recieve their funds back.

MNTP tokens are released when tokens are distributed around one month after ICO starts.

Gold Architecture

GoldMint billing system

GoldMint billing involves the following:

- The company accepts credit card and bank payments for GOLD conversion, for fiat, as well as for buyback of GOLD.

- The company uses KYC to validate trade. All bank charges will be paid for by customers with no extra charge.

- GoldMint may allow payment via PayPal and AliPay in the future.

GoldMint is Application Programming Interface (API)

GoldMint plans to develop an Application Programming Interface (API) to regulate GOLD. This will achieve the following:

- E-commerce can use GOLD for transactions.

- Local banks and Monetary Financial Institutions (MFIs) can use GOLD as collateral.

- GOLD can be used escrow for bank accounts and as financial guarantees.

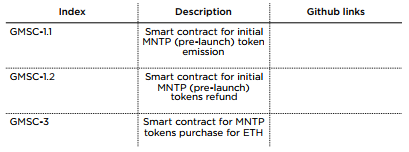

GoldMint as Smart Contracts

Token Sale Terms

Target in crowdsale is $40 million

Total token supply is 7 000 000 MNTP

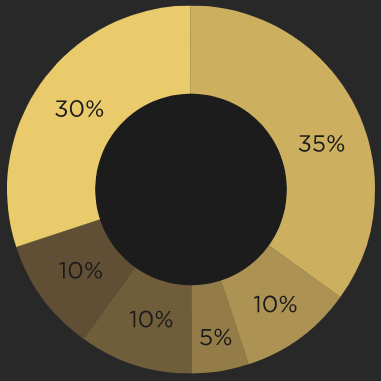

Expenditure lines:

- 30% Marketing

- 35% Development

- 10% Team

- 5% Legal, registration

- 10% Staff expansion

- 10% Other

Ethereum ERC20 token

Purchase methods accepted is BTC and ETH

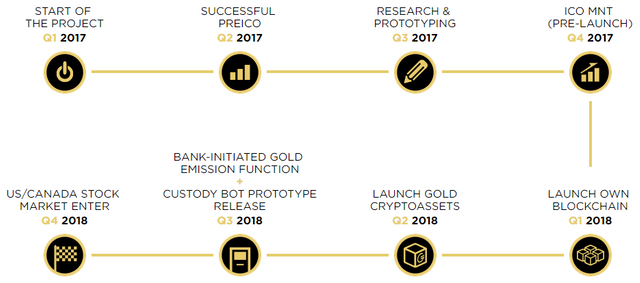

Our Roadmap:

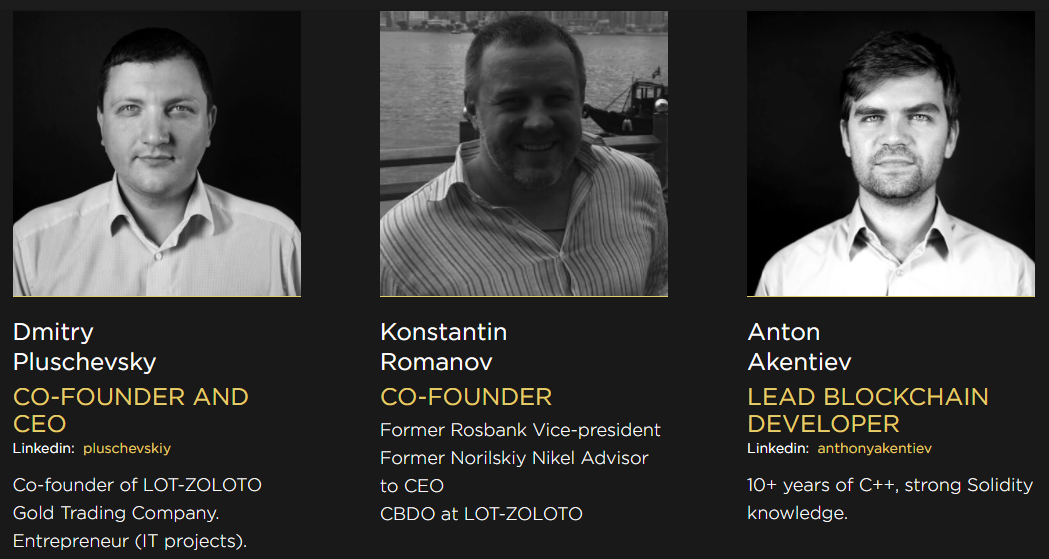

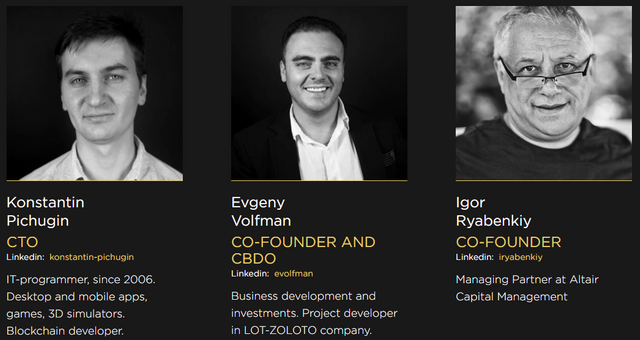

GoldMint Team :

For more information, you can visit our site or our community below :

- WEBSITE : https://www.goldmint.io/

- FACEBOOK : https://facebook.com/goldmint.io

- TWITTER : https://twitter.com/Goldmint_io

- TELEGRAM : https://t.me/goldmintio

- REDDIT : https://reddit.com/r/goldmintio

- GITHUB : https://github.com/Goldmint

- ANN BITCOINTALK : https://bitcointalk.org/index.php?topic=2091726.0

Posted by Dico88 : https://bitcointalk.org/index.php?action=profile;u=1001632

A nice post. @tristan88crypto followedd