Why the elites favor Bitcoin over Gold and Silver (First Steemit Post)

The Bitcoin community was enchanted and enthused when an unidentified man decided to hold up a sign with the words "buy Bitcoin" during Federal Reserve Chairwoman Janet Yellen's testimony on July 12, 2017. But what many might consider a random act of virtual currency activism is most likely a message from those at the very top of the US monetary and banking hierarchy: buy Bitcoin because it is the future. Rather than being a fluke or scam currency, Bitcoin is here to stay not only because of its decentralized nature and rising popularity, but also because those at the top of the US power structure are in favor of it's continuity and promise as a sustainable monetary safe haven. Bitcoin will continue to outperform precious metals like gold and silver simply because these precious metals have been and will continue to be manipulated in secrecy by those in the Federal Reserve and Deep State that see them as illiquid and a challenge to the US Dollar's supremacy. Let me Explain.

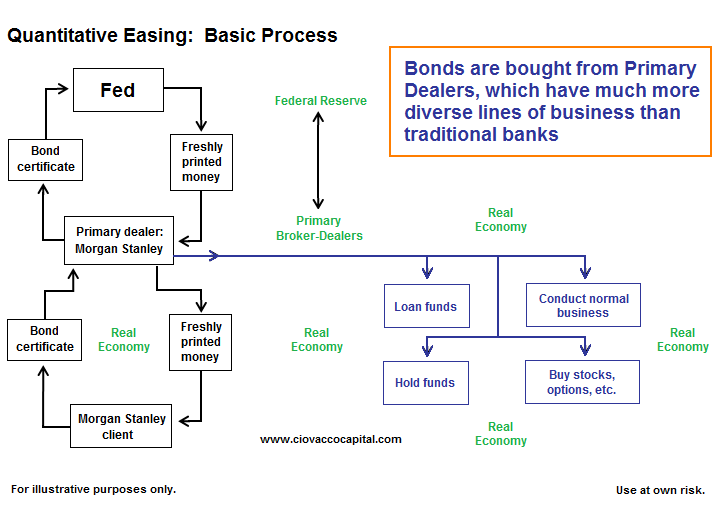

To first understand why Monetary Elites and the Deep State are not in favor of Gold and Silver, we first must take into account the general monetary methodology of the US for the past nine years. Since December 2008, when the US and the world was in the downward spiral of the Global Financial Crisis (GFC), the Federal Reserve Bank of the United States was engaged in Quantitative Easing (QE) until 2014. This monetary strategy of purchasing 45 Million dollars of US Treasury Bonds from the open market and 40 million dollars of Mortgage Backed Securities from Freddy Mac and Fannie Mae, along with keeping interest rates near zero, was intended to promote an inflationary environment in the US, one where the stock market and housing would rise in value.

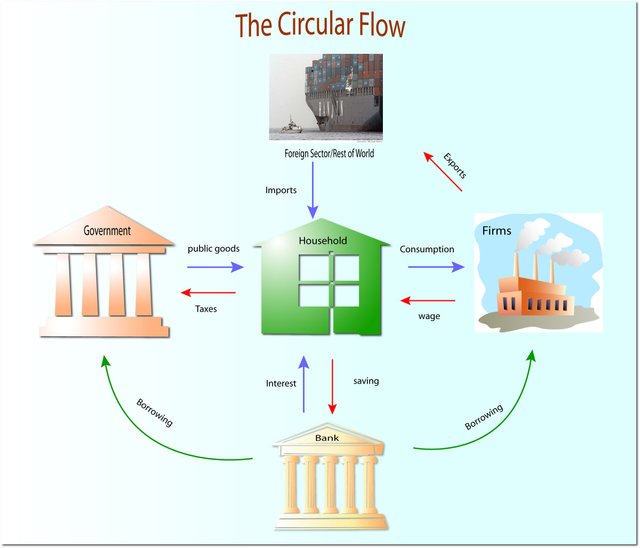

The Federal Reserve, following the central tenets of Keynesian Economic Theory, believed that the economic downturn ailing the US economy after the GFC could be cured if those that owned stocks and property saw their assets rise in value, which would in turn cause them to experience the Wealth Effect, making them feel wealthier and therefore have a higher "propensity to consume," or in other words, buy more goods and services in the US economy. This, along with the incentive to borrow money with near zero interest rates, is the means by which a central bank like the Federal Reserve can buffer an economy during a recession with the goal of ultimately growing the US economy back to normal, expansionary levels.

This increased consumption as a result of rising asset prices and low interest rates would alleviate the problem of US businesses having to fire workers as a result of significant profit losses. If businesses fire workers, the now unemployed individuals are less likely to spend money into the economy, leading to further losses for businesses, who will then fire more workers or hire less workers, leading to the downward spiral which only further hurts consumption and leads to a never ending feedback loop of rising unemployment, lower spending, and business closures. The central tenets of Keyensian Economic Theory, the economic ideology of the Federal Reserve, are that increased government spending to hire and pay workers, along with an inflationary monetary policies of low interest rates and Quantitative Easing will prevent or alleviate this recessionary trend.

There has been intense debate for several years now among economic analysts as to whether the strategy of QE and low interest rates was the best approach for solving the economic woes of the United States. While I have an opinion on the matter, I will refrain from providing it here because my goal is not to open a debate about what is the preferred monetary policy of the Federal Reserve but instead to explain why Bitcoin is seen as a valuable monetary system for the Federal Reserve and Deep State and why gold and silver are not.

What I want to make clear is that widespread purchasing of gold and silver by Americans is considered a national security threat because the rejection of the US dollar by the average citizen in favor of precious metals would lead to social calamity that the elites want to avoid at all cost. If US citizens reject the dollar for precious metals by exchanging goods and services with gold or silver, then the dollar's longterm hegemony is challenged. Additionally, gold and silver are illiquid assets. So if people in the US hoard gold and silver instead of US dollars they have a lower "propensity to consume" and therefore less money will circulate into the economy. The Federal Reserve and the Deep State therefore prefer that individuals own stocks, real estate, US Treasury bonds, US dollars, and even Bitcoins rather than precious metals because the ownership of precious metals is not conducive for the growth of the wealth effect and consumption.

Bitcoin, however, is more liquid and is far more easily exchanged for US dollars than gold and silver. Although the acceptance of Bitcoin for the purchasing of goods and services is on the gradual rise, most people in the world have to exchange Bitcoin into their nation's currency to purchase everyday items. In this way, Bitcoin is not a challenge to the supremacy of the US dollar, so the Federal Reserve and the Deep State understand that it is a preferable alternative to the threat of the popular use of precious metals by a large part of the population. There is also the possibility that the US dollar could become tied to Bitcoin or another virtual currency in the future if cash is banned.

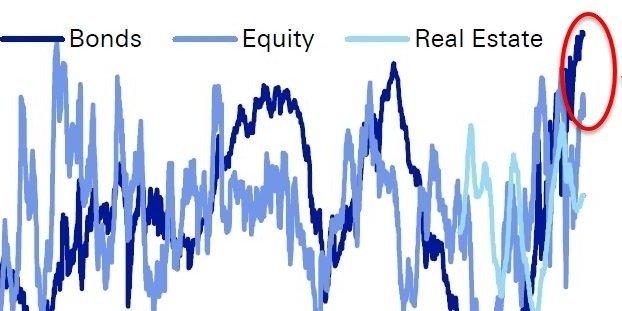

Gold and silver loyalists will argue that unless you can physically hold it in your hand, it doesn't hold intrinsic value. Some of the more hardcore precious metal devotees will even argue that gold and silver are the only real, tangible forms of money in a fiat money system that no longer maintains a gold standard like the United States. But, unfortunately for gold and silver bugs, gold and silver have been manipulated in the open market for years now, with several analysts like Zerohedge.com observing the rampant manipulation of the precious metals markets to the downsize with massive paper selling. Instead of actually selling physical gold and silver, major banks in London have been active in the suppression of gold and silver prices by naked short selling gold and silver, leaving precious metal holders in awe and frustration at the sight of these massive sell offs (see chart below).

The manipulation of gold and silver is all part of the financial elites plan to scare investors away from the "barbaric relic" of precious metals while they openly endorse investment into stocks and housing first and foremost, but also Treasure bonds or even just US dollars. That sign behind Janet Yellen's head suggesting to viewers that they should buy Bitcoin was a clear message that Bitcoin will continue to rise in value and is a preferred alternative currency to the US dollar over gold and silver.

I would like to mention that @ackza introduce me to Steamit and that we are college friends.

Im glad ur post got attentions so fast! I went to UC Santa Cruz with @uncerntropy and so far him and @tylersr are the UC Santa Cruz crew in steemit!

I want my followers to check Out unceetropy for hopefully daily macro economics and finance and Jungian pop culture analysis!

Uncerntropy will provide very intellectual posts and provide a high iq perspective of the bigger picture. He is versed iN just Jung and Nietzsche and that alone will provide a jordan Peterson type approach! @thejohalfiles and @stellabelle and @tj4real and @neoxian and @gigafart please check this new user! Ive known him 12 years and he's going to be a great addition to steemit, he will bring steemits collective IQ up a few percentage points

It has been evident that USD can not maintain its spot as the world's reserve currency. I think this should not be feared and I guess will be celebrated by everyone who does not earn in USD. The world reserve currency always change every hundred years or so

http://www.zerohedge.com/article/history-worlds-reserve-currency-ancient-greece-today

http://www.zerohedge.com/article/history-worlds-reserve-currency-ancient-greece-today