Why you shouldn't wait for Bitcoin to pullback before buying

As we all know, Bitcoin has been on a tear recently, just spiking above $4,000 dollars yesterday for a new all time high. While it has pulled back slightly to $3986 while I'm writing this post, there are many who are probably still hesitant to invest right now, preferring to wait for a substantial pullback before investing in the cryptocurrency. I would advice against waiting for that, because Bitcoin has not acted like a normal stock or currency because the behavior of the price of cryptocurrencies are unlike anything traders or investors are accustomed to.

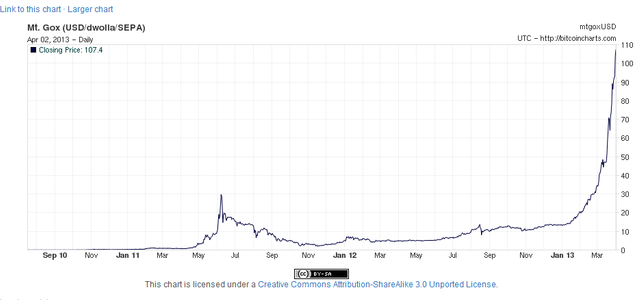

The chart above shows us how Bitcoin acted in 2012-13. As you can see, Bitcoin went from being worth $20 to being worth $100 in two months in a massive parabolic move that really kickstarted the popularity of cryptocurrency to the mainstream. Waiting for a pullback when the price was at $30 would have left investors in the dust as Bitcoin relentlessly rose to $100 and kept going.

The huge move we saw in the cryptocurrency yesterday was another indication that Institutional Investors are now jumping into Bitcoin, and these large investments will likely continue to push the cryptocurrency to at least $10,000 before a significant pullback. Most of these investors have been in stocks or bonds, but now that they see that Bitcoin is likely the cryptocurrency of choice, they will dump large sums of money as part of a diversification strategy. We must also consider that Janet Yellen and the monetary elites essentially green-lighted Bitcoin when someone behind Janet Yellen held up a sign directing the views to "buy Bitcoin." I've previously written an article about how Bitcoin is the preferred safe haven asset by the elites over gold and silver because gold and silver are illiquid and could be used to exchange goods and services. Click on the link below to read the article.

People still have to exchange Bitcoin for US dollars in order to buy most goods and services, therefore Bitcoin is not a real threat to the US dollars supremacy. The reality that's facing institutional investors is that gold and silver will not be allowed to be safe haven assets and that Bitcoin will be the preferred safe haven asset when there is a substantial sell off in the stock market, like we saw very recently with the North Korea escalation.

Don't wait for a pullback in Bitcoin to get in. The fear the Bitcoin will now be shutdown by the elites or will crash because it's not a real safe haven asset should be over now. Just jump on board and ride the wave.

Dollar cost averaging is the best plan for those looking to get in.

It's a lose-lose situation, investing in bitcoins, even when you make a profit! If the price drops after you buy, you feel awful. If the price rises and you didn't buy, you feel like crap! Even when you buy and the price goes up, you wish you had bought more! The market is impossible to predict, as it has no fixed pattern! The world of bitcoin is like a casino, and you need a strong heart to play the market! Too bad I chicken out every time... lol!