Investor Who Predicted Two Great Crashes, Bitcoin Flame of "Bubble"

Jeremy Grantham, co-founder of investment management firm GMO, wrote in a letter to investors that he believes Bitcoin, along with the stock market in general, is in a bubble. Famous for predicting the market crashes of 2000 and 2007, Grantham maintains that "[the] burst or final phase of the [bubble] within the next 6 months to 2 years is likely."

For Grantham, a bubble different from the others

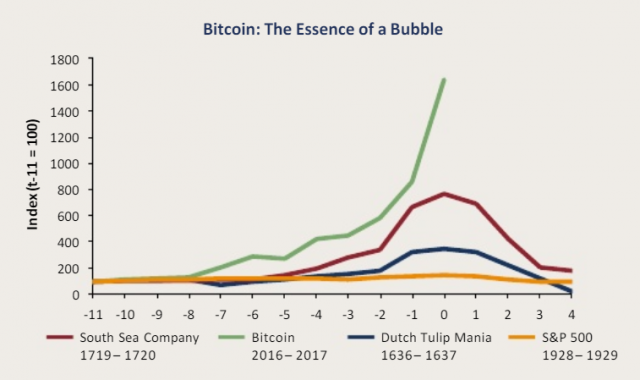

In its usual report on market trends, Grantham devoted a section to addressing Bitcoin's meteoric rise.

"Not having a clear fundamental value and largely unregulated markets, along with a plot conducive to delusions of grandeur," writes Grantham, "makes [Bitcoin] more than anything we can find in history books, the very essence of a bubble ".

He goes on to add that "[anyone] in 1999 and early 2000 had a classic foreboding of these signs," arguing that the historical precedent would have led the bubble "to explode and burn even before the peak of the broader market."

Part of a larger trend

For Grantham, Bitcoin's speculative increase coincides with the stock market's own bubble.

"I acknowledge, on the one hand, that this is one of the highest priced markets in US history," Grantham said in the report. "On the other hand, as a historian of the big bubbles, we also recognize that we are showing signs of entering the blasting or melting stage of this bull market."

Throughout his report, he continues to list examples of historical market recessions, complementing his analysis with charts that illustrate these trends.

"We know we're not there yet, but maybe we can anticipate this move."

Grantham believes that the fact that bitcoin has hit the mainstream media and only talking about it in recent months can be a great indication that the time is coming.

"Good luck. We all need it, "he concludes.