BTC Goes on Face Melting Run, but the Best Is yet to Come

What a weekend!

What a weekend. We might be saying this many more times in the near future, but simply – whoa –. BTC didn’t just crack the much-feared $10K resistance, it vaporized it and charged all the way through to $11K.

While $10K+ BTC is something we can all cheer over, there’s been an awkward silence felt throughout most Telegram groups and subreddits. That’s probably because many people found themselves over-diversified into altcoins, and are now feeling the extreme effects of a 2017 style BTC bull run.

Altpocolypse

As the corn flies toward starry heights, altcoins are plummeting far beyond the lows many hoped were left in the past. While investors poured money into the BTC run, satoshis simultaneously exited alts in fire sale fashion, leaving some, like WTC, freefalling with no apparent bottom. The capitulation was something to behold – and may not be over yet.

Currently, BTC is undergoing a minor correction to the mid-$10,000s. During similar runs in the past, bitcoin gains were quite immediately distributed out to alts. This time, it’s a bit different.

As we noted in our last update, Facebook’s entrance into crypto with Libra and Binance’s new trading restrictions on Americans mean that alts are facing their toughest test in a long time.

The case for BTC has never been stronger, and now that the market (and public) has gotten a good look at Libra, an expertly marketed and publicly-oriented crypto, a period of soul-searching is underway. Which alts have longevity? Who has a real reason to thrive into the future? These are questions that the folks who pumped DENT last night are definitely overlooking.

Institutions Are Behind Bitcoin Rally

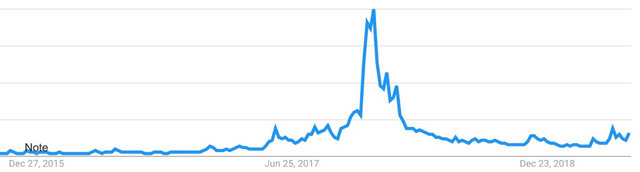

OK, institutions don’t proclaim their investments publicly, but there’s much to glean from the lack of retail involvement in the current move. Take a look at the Google Trend chart at the bottom of this post. The spike that looks like Mt. Everest was at the pinnacle of the crypto boom in late 2017 and early 2018.

See the tiny blip all the way to the right? The one that’s still eclipsed by a surge of interest in May of this year? That’s us right now. If searches for ‘bitcoin’ are still hovering just above all-time lows, then where is this pump coming from? Retail buyers have yet to jump in here, and mainstream media is still very far from the sort of coverage it produced two years ago.

The spike in BTC price has also been accompanied by an astounding increase in volume that can only be the result of heavy-handed buying power.

According to Diar.co:

Over 26% of circulating supply ($36Bn worth of Bitcoin) now sit in addresses that have a balance of 1000–10k BTC. In August 2018, when Bitcoin was also at $8000, these ‘Firm Size’ addresses held under 20% of the circulating supply, showing a sharp accumulation of nearly 7% in less than a year.

As expected, the bear market bottom which occurred around the holidays last year gave ‘Firm Size’ addresses the ability to accumulate and provide the firm ground upon which the current rally now stands. Retail holdings remain steady – so, considering that institutional demand has sharply risen, all of the ingredients are in place for BTC to continue its monumental run.

This is not financial advice. I don’t take into account of your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation. Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding accuracy or completeness of any information or analysis supplied.