Bitcoin Chart Analysis 8 July 2017 - A Beautiful Correction

Hello Fellow Steemers.

Summary

- a beautiful correction scenario is appearing

- but playing this out could take up to a couple of months

- risk of bearish pressure remains; there are not certainties

Introduction

Once in a while, I look at the Bitcoin charts and think of what they are telling me. I leave Bitcoin day trading to others and tend to look at the long(er) view. Below, I share my thoughts on the price developments and the directions that the charts may give. I note that charts and technical indicators do not predict the future; they only show the past. However, they may signal the probability of the next move.

Please note that all charts are logarithmic, meaning that any doubling - for example from $1,000 to $2,000 or from $3,000 to $6,000 - would be shown on a similar scale (i.e. a straight line). This filters away extreme price spikes as appearing from normal charts.

For the previous chart analysis article, see: https://steemit.com/bitcoin/@wekkel/bitcoin-chart-analysis-30june-2017

Let's start with the first chart.

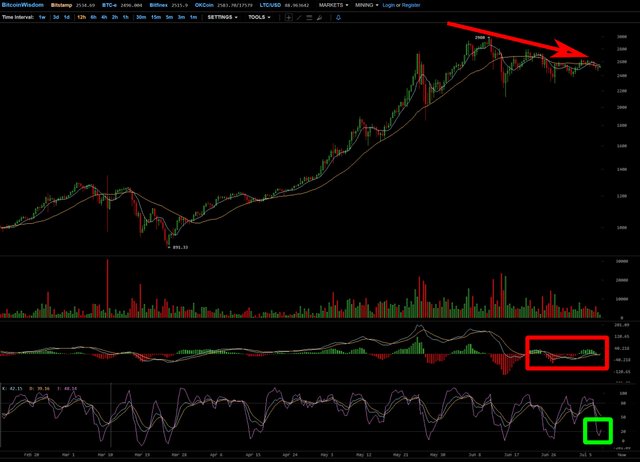

1. 12Hrs Chart

12hrs chart (Bitcoinwisdom) - direct link

The Bitcoin 12 hrs chart continues to show deterioration. Price is moving sideways and MACD lingers around the midline, not showing a clear direction up or down. The chart has improved compared to the chart in the previous article. The downwards sloping short term trend line was broken upwards, but without a meaningful push higher. This points to sideways action for now while the chart KDJ indicator (measuring oscillation) has hit a bottom. Bases on this, I expect some further downward movement followed by a small movement higher (all within a bigger sideways movement).

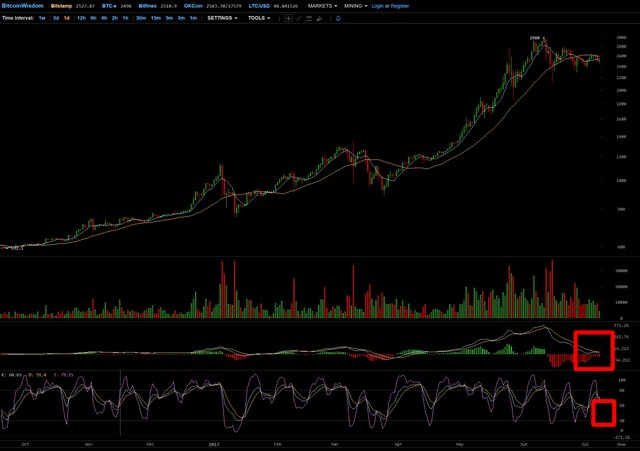

2. Daily Chart

Daily chart (Bitcoinwisdom) - direct link

The Bitcoin daily chart presents a better view of this 'sideways movement' idea. Since June, price moves up and down within a certain band, slowing losing amplitude but keeping up with a certain base above $2,400. A sideways movement.

Prices kept up in the $2,500 zone and despite a generally 'red' week, no meaningful drop in Bitcoin price occurred. This makes be confident that the correction may play out largely sideways and perhaps not with a big drop. MACD is almost turning green again, but is also hovering just above the neutral line. KDJ indicator is halfway, not indicating a meaningful bottom right now. This also points to a lack of direction at this time. Not a bad thing but not very exciting for day traders.

3. Three Day Chart

3 day chart (Bitcoinwisdom) - direct link

The 3 day chart shows the KDJ indicator having it something of a bottom, but not with a clear spike below 20 close to 0. Because price has not shown an equal move downwards towards the $1,800-2,200 range, I think the change of such larger drop are becoming increasingly unlikely and that the 'correction' will play out sideways. The Moving Average (yellow line) is at around $2,200 (see green arrow) and could act as psychological support point should price do encounter a drop. This would fit a narrative of increased uncertainty in the Bitcoin scene now that the 1 August 2017 deadline is rapidly approaching. MACD has crossed indicating further weakness which could take a couple of weeks to play out. It makes no sense to me to go long now with a new position.

Given the fact that price holds up so well in view of the deterioration technical indicators, the 'correction' could take a similar form of the corrections from the recent past. The first two green lines (from the left) below the bottoms in the KDJ indicator indicate moments of sideways movement with no determined direction, leading to a 'beautiful correction'. The best indicator we can hope for at the end of such correction is a spike downwards in KDJ as encircled in purple, which would the the buy moment.

4. Weekly Chart

Weekly chart ((Long View) (Bitcoinwisdom) - direct link

The weekly chart provides a clear view of the impact of the two 2013 bubbles and how far we are still away from a real 2017 bubble. For a real bubble, think of at least $10k-15k.

The MACD indicator is slowly moving towards a cross. However, since this is the weekly chart, there is no reason to be fearful right away. It would only become more scary if we have a MACD cross and a crossing (downwards) of the yellow moving average, which currently rests at about $1,500.

KDJ has not bottomed yet; similar to the 3 day chart, a clear bottom in the KDJ may not appear just yet, aligning with the scenario of a slow and steady sideways pattern while Bitcoin builds another base for a jump upwards.

For a comparison of earlier events, see the purple encircled parts of price and KDJ reflecting a relatively sideways movement with relatively mild downward spikes in KDJ. For the moment, this is what I am expecting and thus a period of up to a couple of months without a clear direction in the market.

However, price determines action so I can change my views should price action warrant this.

And that brings me to the last chart.

5. Bullish Long View - Chart

Bullish as Hell (Masterluc's) (Tradingview) - direct link

This chart shows the most bullish projections for a 2017-2019 price spike up to $110k. It is my understanding that the person who made this chart (and maintains it over at Tradingview is the same as masterluc in the infamous 'Analysis never ends' thread over at Bitcointalk. He has been right numerous times in 2013 and he may be right this time.. But this will take a strong HODL attitude.

This is it for now. Happy trading (and HODL-ing).

DISCLAIMER: just sharing ideas, no trading advice. I am long Bitcoin.

Excellent TA analysis.

Let's hope fundamentals goes well too

Day trading does not look like a good proposition these days. Looking at it long term and adding to your positions when you see a dip looks like a better deal. A chart can only say so much and sometimes you just gotta go with your gut feeling. Good analysis btw!

Great comprehensive analysis glad that there are still people who trade with skill and take their time analyzing.

Looking forward to exchange ideas.

Thanks. Followed and looking forward to your articles.