Why the Futures Market Will Destroy B2X Before It Launches

With the Segwit2x hard fork approaching, I have been working on an article explaining the background to this fork, why I don’t support it and how I am going to trade it. The article is currently in draft and being reviewed by one of the resident miners in my Facebook group to check for accuracy as most of the topics covered are quite technical.

While I have been preparing the article, it is becoming evident that the futures market is going to kill off B2X before it launches so I wanted to get a post out about this as quickly as possible as this is going to affect trading.

A quick note: I am firmly in the NO2X camp, there will likely be big blockers able to attack my article with technical arguments as to why big blocks are better, so be it.

Background

Before I continue, let’s just be clear on a couple of terms:

- Segwit2x is the agreement made behind closed doors in New York, known as the New York Agreement (NYA) where a bunch of parties with a vested interest agreed to implement Segwit if it was followed by a 2mb hard fork. I don’t need to point out why a closed-door agreement for Bitcoin is suspicious.

- B2X is the proposed name of the new coin when it hits the exchanges.

I won’t get into the full details of this now but in summary, from my perspective:

- The Segwit side of the agreement is good for users as it increases block capacity while taking away an unfair advantage one set of miners has, Google ASICBOOST if you want to know more.

- 2mb is terrible as it centralises power. Just trust me on this for now.

Segwit was being blocked by some miners as it was not in their commercial interest, their hands were forced by BIP 148, a user activated soft fork. Nodes running BIP 148 would reject blocks not signalling for Segwit, potentially leading to a chain split; therefore miners not signalling Segwit could lose their mining rewards. As miners had to accept Segwit, the 2mb hard fork part of the agreement was the compromise and BIP 148 ultimately proved that users controlled Bitcoin and not the miners.

Separate to this we also had the Bitcoin Cash fork to keep ASICBOOST alive, did I suggest Googling this?

How the Upcoming Fork is Affecting Trading

I suspect that the current Bitcoin rally is a reaction to how Bitcoin Cash traded following its hard fork, where those who had been holding Bitcoin were essentially given ‘free coins’ to sell or hold as they choose. The ‘free coins’ potential was not so evident with Bitcoin Cash as the market had no idea what would happen following the 1st August UASF and some were exiting Bitcoin in anticipation of a crash. It was only when it all became a non-issue and Bitcoin held its price that those that were holding benefited from a bunch of new ‘free coins,’ thus free money.

I think that it is quite clear that the recent surge in Bitcoin and the crash in altcoins is investors liquidating their altcoin positions to increase their Bitcoin position in anticipation of more free coins. The problem is that the market tends to reward those who are one step ahead and the ‘free coins’ this time may be a red herring.

The trading of Bitcoin Cash has been a good barometer for how future forks may trade. Most coins tend to find their market price based on a combination of use case and speculation. With the Bitcoin Cash fork we had a new Bitcoin with a virtually same use case but a different approach, big block v small block. For most Bitcoin investors this is a non-issue right now as the majority of investment is speculation and not utility, as such Bitcoin Cash was free money and many sold which set off a chain reaction.

As you can see from the chart above, Bitcoin Cash has been under constant sell pressure from launch, where after initial support, likely from key players with a self-serving interest (cough ASICBOOST) and inexperienced traders, most have just been selling their ‘free coins.’ With Coinbase still to release Bitcoin Cash to their customers, they have confirmed they will make the coins available to withdraw from January 1st, 2018 but have no plans to allow for Bitcoin Cash trading; this will likely see more selling in the build-up and an even more significant sell-off come release.

The community does not want Bitcoin Cash at its current price because there are more sellers than buyers and arguably don’t want its use case. Have no doubt; the price will continue to fall through to early 2018 at a minimum.

As I mentioned previously, I believe investors are liquidating their altcoins into Bitcoin to get their free coins for when both forks happen and I even suggested doing the same with my Facebook group as a radical strategy. I ultimately didn’t go through with it, but I did increase my Bitcoin position by 50%. If I had of gone through with this radical strategy I would have increased the value of my portfolio by around 30% this week. Oh well, we live and learn. A hedged approach has worked for me in the past, and this is where I feel most comfortable.

A strategy of liquidating altcoins to BTC for free coins might not prove to be the perfect strategy anyway, as the market will likely price this in. Yes, Bitcoin may have gone up in price but the free coins could be worth little by launch and Bitcoin may prove to be overbought.

How Futures Will Destroy B2X

If you don’t know what a futures market is, this may help:

- “A contract to buy specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future.”

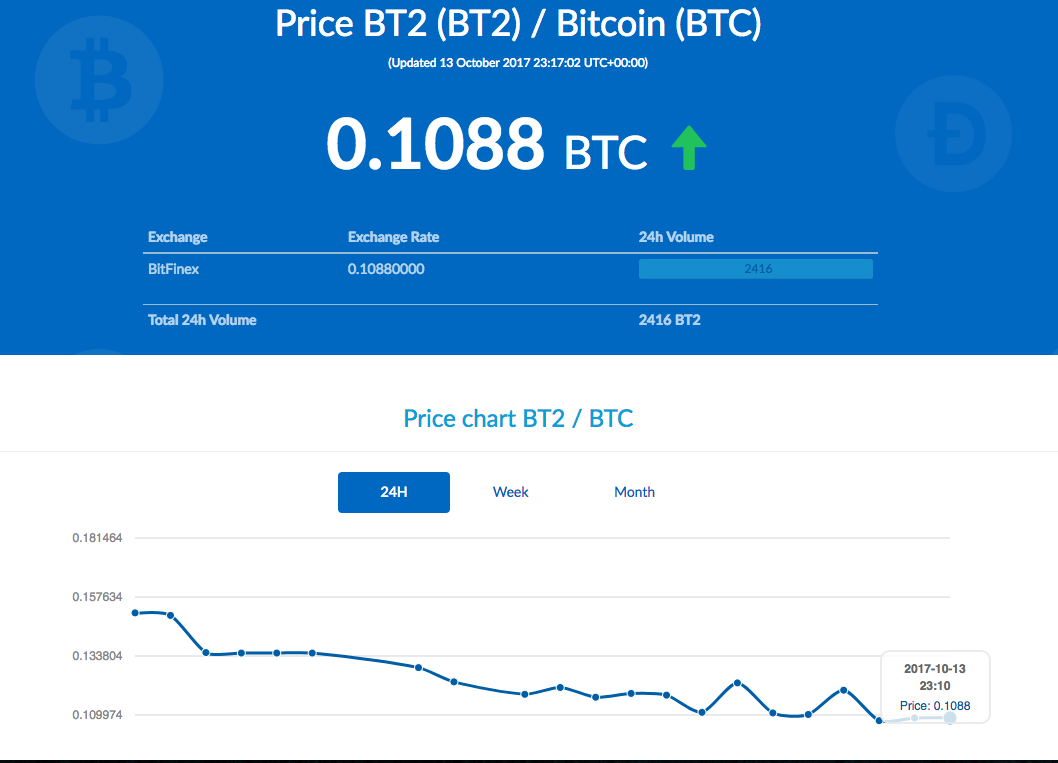

In advance of B2X, likely around November 17th, BitFinex is allowing for the trade of B2X futures (though they are calling it BT2), the price has already dropped to under 0.11BTC and is on a consistent downward trend. You can track the futures price of B2X here.

So, futures trading is trading based on the future price of an asset; therefore futures trading of B2X is based on the future price of B2X. Those who trade futures are trading to make a profit; thus, their trades are a prediction about what they think will happen with B2X.

You can see that in the above image the B2X futures price is falling and I put this down to two things:

- A fall in support for Segwit2x and the New York Agreement (increase in companies who signed up withdrawing support and a significant number of community members against it on Twitter and Reddit)

- A belief by the market that this will just be a huge market dump on release to the exchanges and thus the price will crash

Why would those trading futures buy something they expect to get dumped? Those buying the futures contracts do so in the belief that they will be on the right side of the trade when the coin starts trading.

Withdrawal of Support

Bitmex posted an excellent article on their blog identifying how they will handle the Segwit2x hard fork here. They rightly identify that anyone can create a fork of the Bitcoin chain at any point. They also identify that those people pushing for the Segwit2x fork want this coin to be called Bitcoin and that it is for the community to decide this and this is why strong replay protection is required. As this does not exist they have rightly distanced themselves from it:

- **"It is our understanding that the SegWit2x proposal does not include two-way transaction replay protection, enabled by default. Therefore BitMEX will not be able to support SegWit2x."

They are not the only ones, Seoul Bitcoin meetup has written an excellent post asking those who signed the agreement to reconsider support, the most compelling part being:

- **"Replay protection is being handled in an unacceptably irresponsible manner"

If you do not understand replay protection then please read this article. A lack of strong replay protection could cause havoc and is also evidence that this fork is a hostile act.

Others have also withdrawn support:

- F2pool

- Bitwala

- Vaultoro

- Wayniloans

- BitOasis

- CryptoFacilities

- surBTC

The opposition is growing and I expect more may look to withdraw support to be on the right side of the argument when the market rejects B2X, and their hands could be forced as futures trading makes it increasingly evident that B2X will be unprofitable to mine.

What I Think Will Happen

I believe the futures price of B2X will drop significantly further, already at 0.1088 BTC per B2X coin. How low it will go is hard to tell, but I think it will fall further, way below 0.1 BTC unless some party supporting the fork starts pumping the futures price. Whatever price it retains upon launch will get hammered as recipients dump their ‘free coins.’ Miners who support B2X will continue to mine Bitcoin as B2X will not be profitable, B2X will die a swift death, cast into a pointless oblivion alongside Bitcoin Cash. Okay, it won’t disappear, but it will be a meaningless coin traded on charts like DOGE and ETC rather than any fundamental practical use.

As such, the free coins may not prove to be much of a free bonus, and we will be back to trading Bitcoin and altcoins to some level of normality. The smart play here was to trade out the futures on BitFinex when the futures first started trading.

I think the market will settle back to regular trading pre-November 17th, where before the chain split the futures price of B2X will be so low that it will obviously be an embarrassing rejection of the coin. Those proponents of B2X may try and support it but similar to Bitcoin Cash this will be limited as they know they will be burning their own solid BTC to support something the market has little interested in. The ‘free coins’ bonus will become a red herring as it won’t have the expected value which may lead to sideways or down move in BTC. Altcoins will probably start coming back into play as investors look for higher returns.

One good outcome to all this is that Bitcoin will have demonstrated its strength and thus make future chain splits less likely if not supported by users. The futures market will price any attempt at a corporate/miner takeover or centralisation of power with resistance.

Now might prove to be an excellent time to trade altcoins, though I can’t be 100% sure. I have made the decision that I am going to hold everything I have for now and assess on a week by week basis. I don’t feel that we will enter normal trading conditions again until November, either when the futures market finds a stable B2X price or post fork when the market has dumped. I believe the former is more likely as the market is pretty good at pricing in advance.

Note: we do also have the Bitcoin Gold fork coming on October 25th which is attempting to change the proof of work algorithm. There is enough to concern me that this is just a scam primarily due to the pre-mined element of the fork. Still, this Reddit post should tell you enough you need to know about this. No interest, if I can transfer and dump these coins, I will, and that is if any exchange lists it.

Very interesting article on the btc upcoming fork.

Thank you